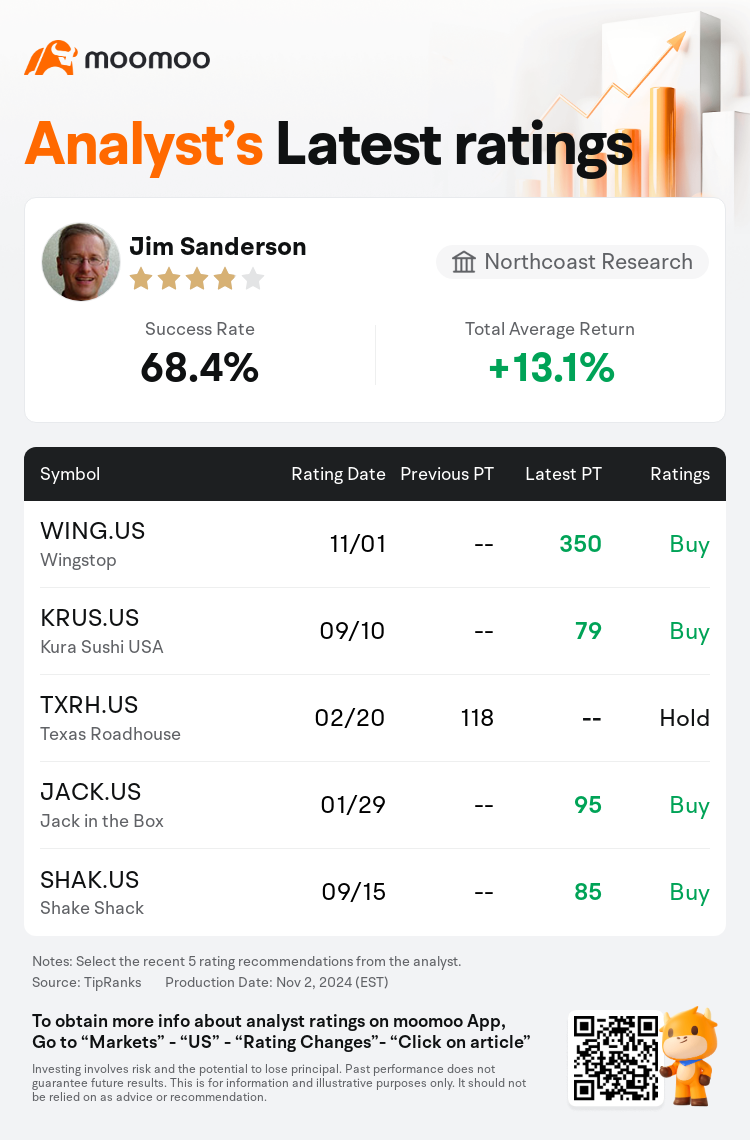

Northcoast Research analyst Jim Sanderson upgrades $Wingstop (WING.US)$ to a buy rating, and sets the target price at $350.

According to TipRanks data, the analyst has a success rate of 68.4% and a total average return of 13.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Wingstop (WING.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Wingstop (WING.US)$'s main analysts recently are as follows:

Wingstop's Q3 results did not meet the heightened anticipations but still displayed remarkable strength with a 21% traffic-driven comparable sales increase, and the guidance for 2024 units was elevated, showing strong franchisee interest. The post-earnings decline is seen as a buying opportunity, highlighting Wingstop's sustained 40%-plus three-year stack comparable sales growth.

Wingstop's Q3 earnings per share shortfall was influenced by somewhat weaker comparable sales, reduced restaurant margins, and increased general/administrative expenses and taxes. Despite this, the underlying business momentum remains robust, and the long-term prospects have not been altered. However, the recent deceleration in comparable sales may constrain the stock's performance until there is a clearer sign of stabilization, considering the association between comparable sales and valuation.

The firm believes that the recent post-quarterly results downturn in Wingstop's performance is exaggerated. Analysts maintain that Wingstop stands out within the industry with the potential to outperform in transaction growth in the short, medium, and long term, regardless of the economic conditions. Additionally, it is anticipated that Wingstop's continuous outperformance in same-store sales growth will fuel superior unit economics, leading to a boost in unit growth and long-term EBITDA increases that surpass the management's existing long-term goals.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

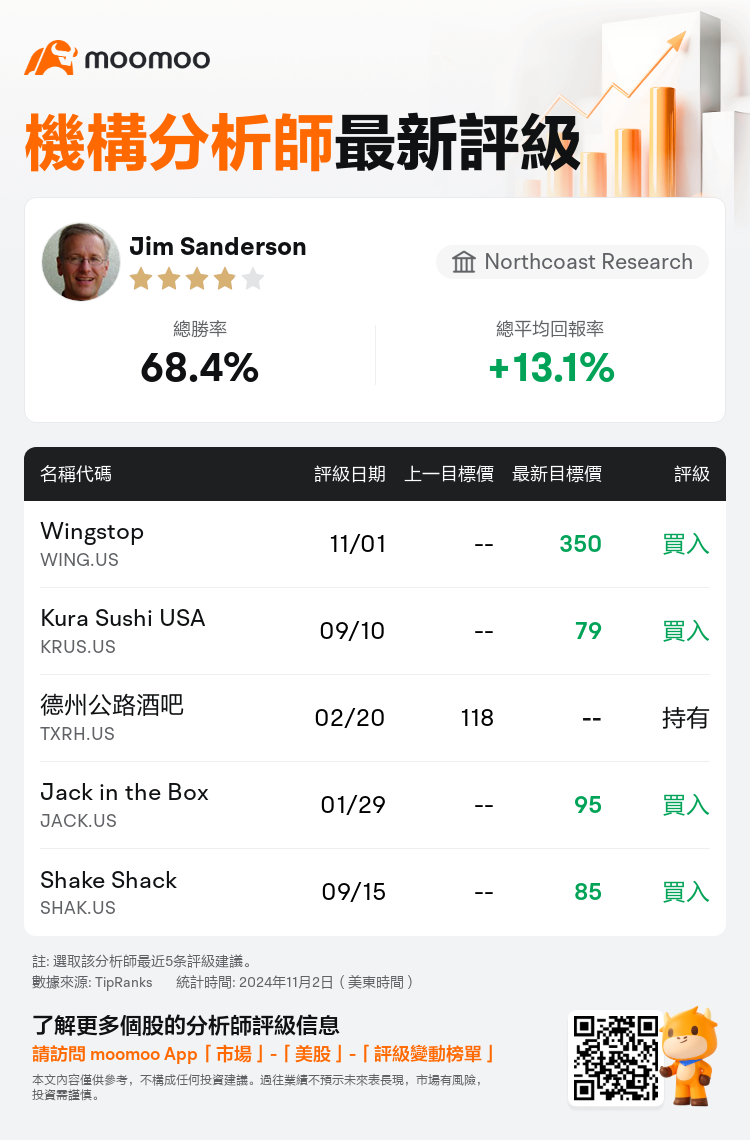

Northcoast Research分析師Jim Sanderson上調$Wingstop (WING.US)$至買入評級,目標價350美元。

根據TipRanks數據顯示,該分析師近一年總勝率為68.4%,總平均回報率為13.1%。

此外,綜合報道,$Wingstop (WING.US)$近期主要分析師觀點如下:

此外,綜合報道,$Wingstop (WING.US)$近期主要分析師觀點如下:

wingstop的Q3業績未能達到高漲的預期,但仍然表現出卓越的實力,同店銷售額增長21%,其中21%來自流量驅動,2024年單位指引提升,顯示強勁的特許經營商興趣。盈利後下降被視爲買入機會,凸顯wingstop持續40%以上三年堆疊同店銷售增長。

wingstop的Q3每股收益的不足受到了較弱的可比銷售、餐廳毛利的減少、一般/管理費用和稅收的增加的影響。儘管如此,基礎業務勢頭仍然強勁,長期前景沒有改變。然而,最近可比銷售的放緩可能會限制股票的表現,直到有更清晰的穩定跡象,考慮到可比銷售與估值之間的關聯。

公司認爲最近wingstop業績的盈利後季度下滑被誇大。分析師表示,無論經濟狀況如何,wingstop都在同行業中脫穎而出,具有在短期、中期和長期內超越交易增長的潛力。此外,預計wingstop在同店銷售持續表現優異將推動優越的單位經濟學,帶來單位增長和超過管理層現有長期目標的長期EBITDA增長。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Wingstop (WING.US)$近期主要分析師觀點如下:

此外,綜合報道,$Wingstop (WING.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of