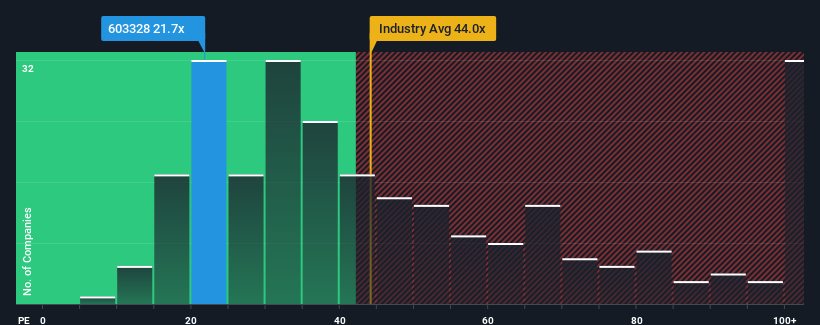

Guangdong Ellington Electronics Technology Co.,Ltd's (SHSE:603328) price-to-earnings (or "P/E") ratio of 21.7x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 34x and even P/E's above 67x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

The earnings growth achieved at Guangdong Ellington Electronics TechnologyLtd over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Guangdong Ellington Electronics TechnologyLtd would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 23% last year. The latest three year period has also seen an excellent 200% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Taking a look back first, we see that the company grew earnings per share by an impressive 23% last year. The latest three year period has also seen an excellent 200% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

It's interesting to note that the rest of the market is similarly expected to grow by 42% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Guangdong Ellington Electronics TechnologyLtd's P/E sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

The Bottom Line On Guangdong Ellington Electronics TechnologyLtd's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Guangdong Ellington Electronics TechnologyLtd revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look similar to current market expectations. When we see average earnings with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Guangdong Ellington Electronics TechnologyLtd (1 is significant!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.