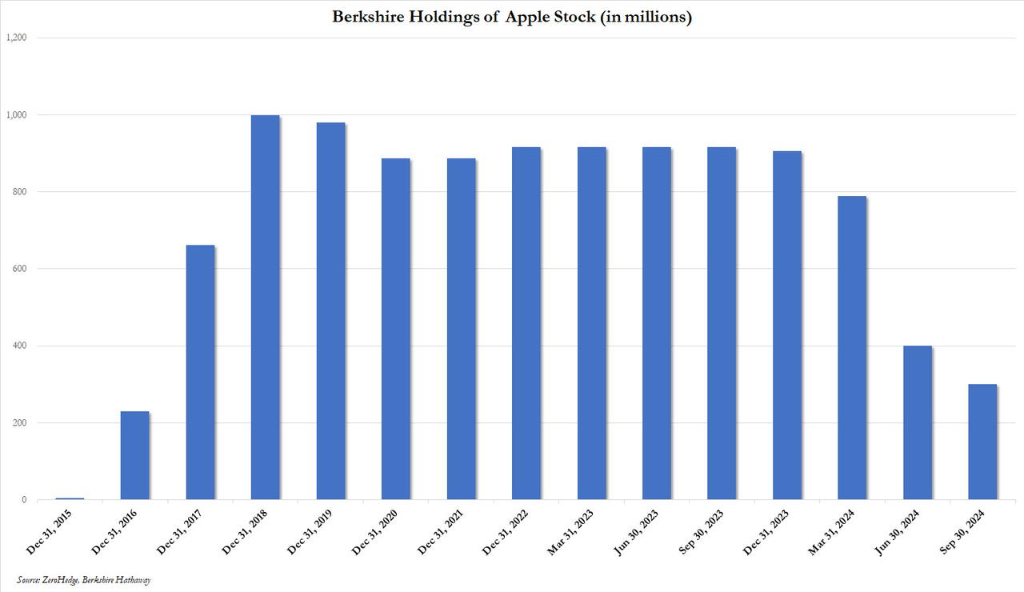

“Fear when others are greedy, greedy when others are afraid”. After reducing its holdings by nearly 50% in the second quarter, Berkshire once again reduced its Apple holdings by 25% in the third quarter and drastically sold about 0.1 billion shares. The market value of its holdings fell from 174.3 billion US dollars at the beginning of the year to 69.9 billion US dollars.

Investment legend Buffett is setting off a wave of “clearance” sell-offs that have shocked the market.

After reducing its holdings by nearly 50% in the second quarter, Berkshire once again reduced its Apple holdings by 25% in the third quarter, holding only 0.3 billion shares after selling 0.1 billion shares. Since the beginning of the year, its Apple holdings have plummeted from 0.905 billion shares to 0.3 billion shares, a decrease of 67%. Although Apple is still its largest holding, the market value of its holdings has dropped from $174.3 billion at the beginning of the year to $69.9 billion.

Buffett's “sell-off campaign” goes far beyond that. In the third quarter, Berkshire sold a net share of 34.6 billion US dollars. This is the eighth consecutive quarter that it has become a net seller of shares. Among them, holdings in Bank of America were also cut by 23% to 0.799 billion shares. What has caught the market's attention even more is that this quarter, for the first time since 2018, the company suspended repurchases of its own shares.

Buffett's “sell-off campaign” goes far beyond that. In the third quarter, Berkshire sold a net share of 34.6 billion US dollars. This is the eighth consecutive quarter that it has become a net seller of shares. Among them, holdings in Bank of America were also cut by 23% to 0.799 billion shares. What has caught the market's attention even more is that this quarter, for the first time since 2018, the company suspended repurchases of its own shares.

As a result of continued sell-offs, Berkshire's cash reserves soared to a record high of $325.2 billion, a sharp increase from the $168 billion reserve at the beginning of the year. In stark contrast to shouting “buy US stocks” during the 2008 financial crisis, the 94-year-old “Omaha Prophet” seems to be using his actions to hint at concerns about the current US stock market.

Although Buffett attributed part of his holdings reduction in May of this year to concerns about a possible increase in the capital gains tax rate, such large-scale cash out actions, combined with a sharp decline in overall market interest, including his own stocks, may indicate that the investment guru's cautious attitude towards US stocks is heating up.

Apple sells for 100 billion dollars!

According to Berkshire Hathaway's latest third-quarter earnings report, the company drastically sold about 0.1 billion Apple shares in the quarter, and the number of shares held fell to 0.3 billion shares.

In terms of position volume, since the beginning of 2024, Berkshire has drastically reduced its holdings from 0.905 billion shares to 0.3 billion shares, a drop of 67%.

In terms of market capitalization, as of September 30, the company held only $69.9 billion in Apple shares, down from $84.2 billion on June 30, down 62% from $135.4 billion on March 31, and 70% down from $174.3 billion on December 31, 2023.

It's worth mentioning that most of these Apple shares were bought at an average price of $35 between 2016 and 2018. As of last Friday's close, Apple's stock price was $222.91.

Berkshire said that the company's investments in the first three quarters of 2024 have realized a return of 76.5 billion dollars, most of which is related to Apple.

Keep cash, don't buy it back!

Berkshire's sell-off campaign is not limited to Apple alone.

According to financial reports, the company's net share sales in the third quarter reached 34.6 billion US dollars. This is the eighth consecutive quarter that it has become a net seller of stocks.

Over the same period, the company's holdings in Bank of America were also reduced from 1.033 billion shares to 0.799 billion shares, a decrease of 23%. As a result, Bank of America shares fell from the second largest position to third place, surpassed by American Express (holding a market value of about 42 billion US dollars). In contrast, the company's holdings in American Express, Coca Cola, and Chevron are generally stable.

What is more noteworthy is that in the third quarter, Berkshire suspended its share repurchase plan for the first time since the repurchase policy was changed in 2018. This move seems to indicate that even for his own stocks, Buffett thinks the current price is unattractive.

As holdings continued to be reduced, Berkshire's cash reserves reached a record high. By the end of the third quarter, the company's cash reserves had surged to $325.2 billion, a sharp increase from $168 billion at the beginning of the year.

Although Buffett attributed part of his holdings reduction at the shareholders' meeting in May this year to concerns that the US government might raise the capital gains tax rate, such a large-scale “clearance” operation seems more indicative of his cautious attitude about current market valuations.

In terms of operating performance, Berkshire achieved operating profit of 10.09 billion US dollars in the third quarter, down 6% from 10.76 billion US dollars in the same period last year. The decline in profits was mainly affected by a sharp decline in underwriting income from the insurance business and exchange losses of US$1.1 billion.

Specifically, insurance underwriting profits fell 69% year over year, due in part to losses of $0.565 billion caused by Hurricane Helen and a court settlement relating to a bankrupt talc supplier. However, GEICO, its auto insurance company, performed well and doubled underwriting profits. The profitability of rail transportation and energy businesses has also improved.

Notably, the 94-year-old “Omaha Sage” said in May of this year that he is not in a hurry until an investment opportunity with extremely low risk and good returns can be found. His statement is in stark contrast to his stance of chanting “buy US stocks” during the 2008 financial crisis.

It is worth mentioning that if the Buffett Index (ratio of total market capitalization of the stock market to GDP) is used as a measurement standard, the current US stock market is really not cheap.