REIT Watch - Hospitality S-REITs' RevPAR Mostly Resilient as Tourism Activity Normalises

REIT Watch - Hospitality S-REITs' RevPAR Mostly Resilient as Tourism Activity Normalises

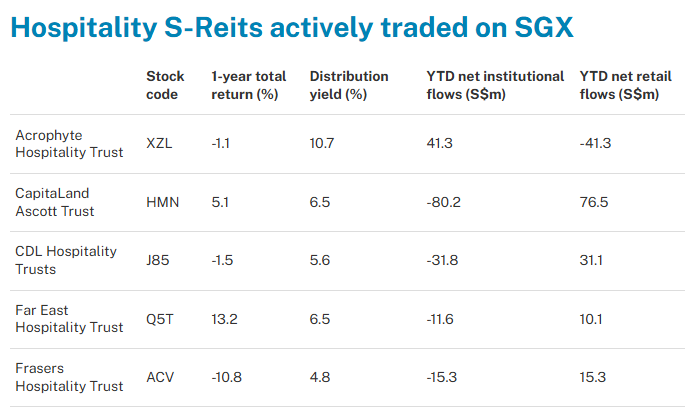

Singapore real estate investment trusts (S-REITs) with hospitality assets have reported mostly stable operating performance in the third quarter even as tourism activity normalises following the post-pandemic travel boom.

尽管疫情后的旅游热潮之后旅游活动恢复正常,但拥有酒店资产的新加坡房地产投资信托基金(S-REIT)报告称,第三季度的经营业绩基本稳定。

Business updates released last week show that revenue per available room (RevPAR) for most trusts remained relatively resilient, despite a high base from the strong growth seen in the same period a year earlier.

上周发布的业务更新显示,尽管去年同期的强劲增长基础很高,但大多数信托基金的每间可用房间收入(RevPAR)仍保持相对弹性。

CapitaLand Ascott Trust reported an 8 per cent improvement on year in gross profit for the third quarter ended September, as its portfolio reconstitution initiatives yielded positive results. On a same-store basis, excluding acquisitions and divestments, gross profit would have been 2 per cent higher on year, due to stronger operating performance.

CapitaLand Ascott Trust报告称,由于其投资组合重组计划取得了积极成果,截至9月的第三季度毛利同比增长了8%。按同店计算,不包括收购和撤资,由于经营业绩强劲,毛利将同比增长2%。

The trust's revenue per available unit (RevPAU) rose 3 per cent on year to S$158, staying above pre-pandemic levels. This was mainly due to higher average occupancy, while average daily rates (ADR) remained relatively stable.

该信托的每可用单位收入(RevPAU)同比增长3%,至158新元,保持在疫情前水平以上。这主要是由于平均入住率较高,而平均每日房价(ADR)保持相对稳定。

Similarly, Far East Hospitality Trust's RevPAR for hotels rose 2.8 per cent on year in the third quarter on the back of higher ADR, as all hotels exited government contracts, giving the portfolio better pricing flexibility.

同样,远东酒店信托基金的酒店RevPAR在第三季度同比增长了2.8%,这要归因于ADR的增加,因为所有酒店都退出了政府合同,这为投资组合提供了更好的定价灵活性。

RevPAU from serviced residences also rose 2.5 per cent on year in Q3.

服务公寓的RevPau在第三季度也同比增长了2.5%。

Meanwhile CDL Hospitality Trusts saw mixed RevPAR performance across its portfolio, with around half the markets – including Australia, Japan and Germany – experiencing growth in the third quarter.

同时,CDL酒店信托基金在其投资组合中的RevPAR表现好坏参半,约一半的市场(包括澳大利亚、日本和德国)在第三季度出现增长。

RevPAR for its Singapore properties, however, fell 10.3 per cent on year in Q3, as demand normalised after a period of exceptional ADR growth in 2023.

然而,其新加坡物业的RevPAR在第三季度同比下降了10.3%,这是由于在2023年ADR经历了一段非同寻常的增长时期之后,需求恢复正常。

Nevertheless, its RevPAR in Singapore remained 18.9 per cent higher compared with pre-pandemic levels in Q3 2019.

尽管如此,与2019年第三季度疫情前的水平相比,其在新加坡的RevPAR仍高出18.9%。

The Macroeconomic Review published by the Monetary Authority of Singapore last month noted that a surge in Chinese tourists has supported growth in tourism-related sectors.

新加坡金融管理局上个月发布的《宏观经济评论》指出,中国游客的激增支持了旅游相关行业的增长。

Average monthly visitor arrivals to Singapore in Q3 grew 14 per cent compared with the second quarter.

与第二季度相比,第三季度新加坡的月平均游客人数增长了14%。

Chinese visitor numbers rose by 56 per cent, contributing to around two-thirds of the increase in arrivals.

中国游客人数增长了56%,约占入境人数增长的三分之二。

The report also noted that hotel occupancies in Singapore climbed to 89 per cent in July to August, from 80 per cent in the first half of 2024, with a broad-based increase seen across hotel tiers, partly driven by lengthier stays among Chinese tourists.

该报告还指出,新加坡的酒店入住率从2024年上半年的80%攀升至7月至8月的89%,各级酒店均出现了广泛的增长,部分原因是中国游客的停留时间延长。

For more research and information on Singapore's REIT sector, visit sgx.com/research-education/sectors for the quaterly SREITs & Property Trusts Chartbook.

有关新加坡房地产投资信托基金行业的更多研究和信息,请访问sgx.com/research-education/sectors,获取季度的《房地产投资信托基金和房地产信托基金图表》。

REIT Watch is a regular column on The Business Times, read the original version.

房地产投资信托基金观察是《商业时报》的定期专栏文章,请阅读原始版本。

Enjoying this read?

喜欢这本书吗?

- Subscribe now to the SGX My Gateway newsletter for a compilation of latest market news, sector performances, new product release updates, and research reports on SGX-listed companies.

- Stay up-to-date with our SGX Invest Telegram channel.

- 立即订阅新加坡交易所 My Gateway 时事通讯,了解最新的市场新闻、行业表现、新产品发布更新以及新加坡交易所上市公司的研究报告。

- 随时关注我们的新加坡证券交易所投资电报频道的最新动态。

The trust's revenue per available unit (RevPAU) rose 3 per cent on year to S$158, staying above pre-pandemic levels. This was mainly due to higher average occupancy, while average daily rates (ADR) remained relatively stable.

The trust's revenue per available unit (RevPAU) rose 3 per cent on year to S$158, staying above pre-pandemic levels. This was mainly due to higher average occupancy, while average daily rates (ADR) remained relatively stable.