Luolai Lifestyle Technology Co., Ltd.'s (SZSE:002293) recent weak earnings report didn't cause a big stock movement. Our analysis suggests that along with soft profit numbers, investors should be aware of some other underlying weaknesses in the numbers.

The Impact Of Unusual Items On Profit

Importantly, our data indicates that Luolai Lifestyle Technology's profit received a boost of CN¥30m in unusual items, over the last year. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

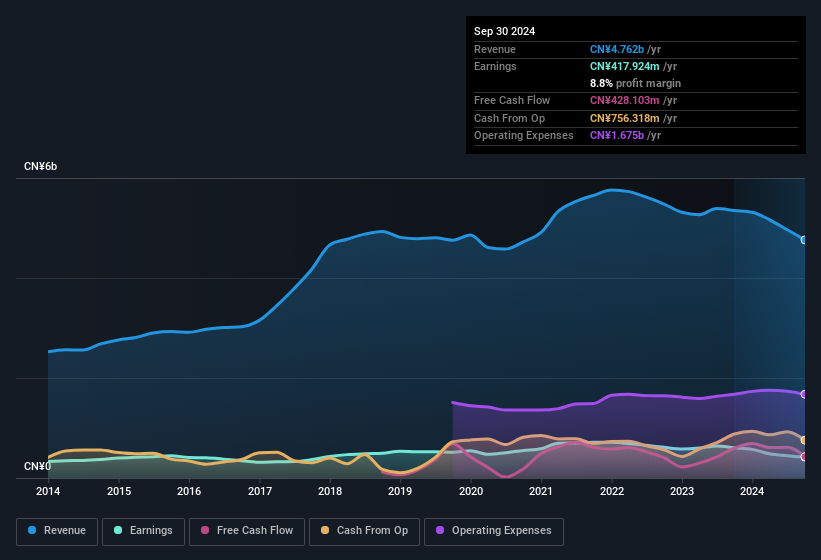

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Luolai Lifestyle Technology's Profit Performance

Arguably, Luolai Lifestyle Technology's statutory earnings have been distorted by unusual items boosting profit. Because of this, we think that it may be that Luolai Lifestyle Technology's statutory profits are better than its underlying earnings power. Sadly, its EPS was down over the last twelve months. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. While conducting our analysis, we found that Luolai Lifestyle Technology has 1 warning sign and it would be unwise to ignore this.

Arguably, Luolai Lifestyle Technology's statutory earnings have been distorted by unusual items boosting profit. Because of this, we think that it may be that Luolai Lifestyle Technology's statutory profits are better than its underlying earnings power. Sadly, its EPS was down over the last twelve months. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. While conducting our analysis, we found that Luolai Lifestyle Technology has 1 warning sign and it would be unwise to ignore this.

Today we've zoomed in on a single data point to better understand the nature of Luolai Lifestyle Technology's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.