What the Options Market Tells Us About Micron Technology

What the Options Market Tells Us About Micron Technology

Whales with a lot of money to spend have taken a noticeably bearish stance on Micron Technology.

擁有大量資金的鯨魚明顯看淡美光科技。

Looking at options history for Micron Technology (NASDAQ:MU) we detected 64 trades.

根據Micron Technology (NASDAQ:MU)的期權交易歷史,我們發現了64筆交易。

If we consider the specifics of each trade, it is accurate to state that 39% of the investors opened trades with bullish expectations and 46% with bearish.

如果考慮每筆交易的具體情況,準確地說,有39%的投資者持看好期望開倉,46%的投資者持看淡。

From the overall spotted trades, 25 are puts, for a total amount of $1,792,812 and 39, calls, for a total amount of $2,409,004.

在所有發現的交易中,有25筆是看跌期權,總金額爲$1,792,812,而有39筆是看漲期權,總金額爲$2,409,004。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $50.0 and $135.0 for Micron Technology, spanning the last three months.

經過評估交易量和未平倉合約量,顯而易見的是,主要市場推手正在聚焦於Micron Technology價格在$50.0和$135.0之間的區間,該區間覆蓋了過去三個月。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

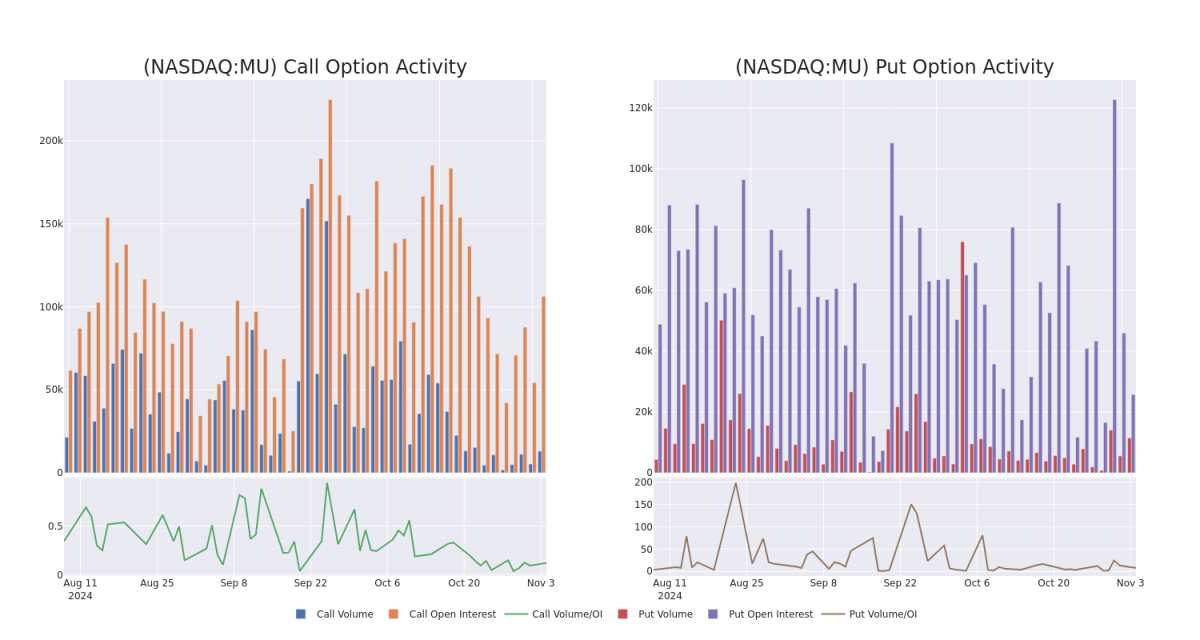

In terms of liquidity and interest, the mean open interest for Micron Technology options trades today is 3466.68 with a total volume of 24,532.00.

在流動性和利益方面,Micron Technology期權交易的平均未平倉合約量爲3466.68,總成交量爲24,532.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Micron Technology's big money trades within a strike price range of $50.0 to $135.0 over the last 30 days.

在下面的圖表中,我們可以追蹤過去30天內的Micron Technology大手交易的成交量和持倉量發展,該交易位於50.0美元至135.0美元的行使價區間內。

Micron Technology Option Activity Analysis: Last 30 Days

美光科技期權活動分析:過去30天

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MU | CALL | SWEEP | BEARISH | 01/17/25 | $7.1 | $7.1 | $7.1 | $110.00 | $213.0K | 13.4K | 505 |

| MU | PUT | TRADE | NEUTRAL | 11/29/24 | $5.2 | $5.1 | $5.15 | $104.00 | $200.8K | 445 | 400 |

| MU | PUT | TRADE | BULLISH | 06/20/25 | $18.0 | $17.8 | $17.86 | $110.00 | $178.6K | 4.0K | 1.2K |

| MU | PUT | TRADE | BEARISH | 06/20/25 | $17.45 | $17.4 | $17.45 | $110.00 | $174.5K | 4.0K | 231 |

| MU | PUT | TRADE | BEARISH | 06/20/25 | $17.45 | $17.4 | $17.45 | $110.00 | $174.5K | 4.0K | 131 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 美光 | 看漲 | SWEEP | 看淡 | 01/17/25 | $7.1 | $7.1 | $7.1 | $110.00 | $213.0K | 13.4K | 505 |

| 美光 | 看跌 | 交易 | 中立 | 11/29/24 | $5.2 | $5.1 | $5.15 | 104.00美元 | $200.8K | 445 | 400 |

| 美光 | 看跌 | 交易 | 看好 | 06/20/25 | $18.0 | $17.8 | $17.86 | $110.00 | 178.6K美元 | 4.0K | 1.2K |

| 美光 | 看跌 | 交易 | 看淡 | 06/20/25 | $17.45 | $17.4 | $17.45 | $110.00 | $174.5K | 4.0K | 231 |

| 美光 | 看跌 | 交易 | 看淡 | 06/20/25 | $17.45 | $17.4 | $17.45 | $110.00 | $174.5K | 4.0K | 131 |

About Micron Technology

關於美光科技

Micron is one of the largest semiconductor companies in the world, specializing in memory and storage chips. Its primary revenue stream comes from dynamic random access memory, or DRAM, and it also has minority exposure to not-and or NAND, flash chips. Micron serves a global customer base, selling chips into data centers, mobile phones, consumer electronics, and industrial and automotive applications. The firm is vertically integrated.

美光科技是世界上最大的半導體公司之一,專門從事存儲芯片。其主要營業收入來自動態隨機存取存儲器(DRAM),它還少量接觸與或非(NAND)閃存芯片。美光科技服務於全球用戶,將芯片銷售到數據中心、移動電話、消費電子、工業和汽車應用中。該公司具有垂直一體化優勢。

After a thorough review of the options trading surrounding Micron Technology, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在徹底審查圍繞美光科技的期權交易之後,我們開始更詳細地研究公司本身。這包括對其目前的市場地位和表現的評估。

Current Position of Micron Technology

美光科技的當前位置

- Trading volume stands at 7,412,736, with MU's price up by 2.91%, positioned at $102.63.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 44 days.

- 成交量爲7,412,736股,美光科技的股價上漲了2.91%,報價爲102.63美元。

- RSI指標顯示該股票目前處於超買和超賣之間的中立狀態。

- 預計在44天后公佈收益報告。

What Analysts Are Saying About Micron Technology

分析師對美光科技股票的評價

1 market experts have recently issued ratings for this stock, with a consensus target price of $135.0.

1位市場專家最近對這支股票發表了評級意見,達成一致的目標價爲$135.0。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Keybanc has decided to maintain their Overweight rating on Micron Technology, which currently sits at a price target of $135.

這位有20年期權交易經驗的專家透露了他的一線圖技術,顯示何時買入和賣出。跟隨他的交易,平均每20天盈利27%。點擊這裏獲取訪問權限。Keybanc的分析師決定維持對美光科技的超配評級,目前設定的目標價爲$135。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Micron Technology options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在收益。 精明的交易者通過不斷學習,調整策略,監控多個因子並密切關注市場動向來管理這些風險。 通過Benzinga Pro的實時警報了解最新的Micron Technology期權交易情況。

From the overall spotted trades, 25 are puts, for a total amount of $1,792,812 and 39, calls, for a total amount of $2,409,004.

From the overall spotted trades, 25 are puts, for a total amount of $1,792,812 and 39, calls, for a total amount of $2,409,004.