It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But if you buy shares in a really great company, you can more than double your money. For instance the Hybio Pharmaceutical Co., Ltd. (SZSE:300199) share price is 115% higher than it was three years ago. How nice for those who held the stock! Also pleasing for shareholders was the 19% gain in the last three months. But this could be related to the strong market, which is up 21% in the last three months.

Although Hybio Pharmaceutical has shed CN¥433m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

Given that Hybio Pharmaceutical didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 3 years Hybio Pharmaceutical saw its revenue shrink by 19% per year. So the share price gain of 29% per year is quite surprising. It's a good reminder that expectations about the future, not the past history, always impact share prices.

In the last 3 years Hybio Pharmaceutical saw its revenue shrink by 19% per year. So the share price gain of 29% per year is quite surprising. It's a good reminder that expectations about the future, not the past history, always impact share prices.

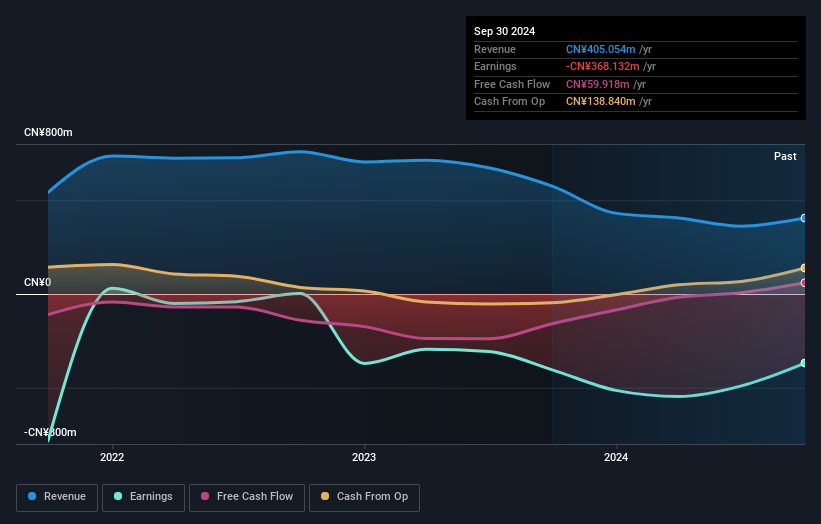

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Hybio Pharmaceutical shareholders are down 39% for the year, but the market itself is up 5.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 15%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.