The increase in revenue in the third quarter did not increase profits. Junshi Biotech cut R&D expenses and reduced losses, but the majority shareholders' holdings reduction when the new drug was approved was questioned by the market~

In the recently released financial report for the third quarter of 2024, Junshi Biotech (01877, 688180.SH) in the “PD-1 Four Little Dragons” faced greater market pressure due to the increase in revenue and profit, continued losses, and the reduction of holdings by major shareholders.

Increasing revenue does not increase profit, cutting R&D expenses and reducing losses

Similar to many innovative domestic biomedical companies, Junshi Biotech has yet to achieve profit in its financial report for the third quarter of 2024. According to the latest financial data, in the first three quarters of this year, Junshi Biotech's revenue reached 1.271 billion yuan (unit, same below), an increase of 28.87% over the same period last year; the loss amount was 0.927 billion yuan, a year-on-year decrease of 34.12%; in a single quarter, Junshi Biotech achieved operating income of 0.485 billion yuan, an increase of 53.16% year on year, and losses of 0.282 billion yuan, a year-on-year decrease of 31.05%.

Similar to many innovative domestic biomedical companies, Junshi Biotech has yet to achieve profit in its financial report for the third quarter of 2024. According to the latest financial data, in the first three quarters of this year, Junshi Biotech's revenue reached 1.271 billion yuan (unit, same below), an increase of 28.87% over the same period last year; the loss amount was 0.927 billion yuan, a year-on-year decrease of 34.12%; in a single quarter, Junshi Biotech achieved operating income of 0.485 billion yuan, an increase of 53.16% year on year, and losses of 0.282 billion yuan, a year-on-year decrease of 31.05%.

Many years have passed, and Junshi Biotech, which started with PD-1, still relies on treprilimab for revenue. Financial reports show that the sales revenue of treprilizumab in the first three quarters of the domestic market was about 1.068 billion yuan, up 60% year on year. Among them, sales revenue in the third quarter was about 0.397 billion yuan, up 79% year on year. According to this estimate, the treprilizumab product accounted for 84% of Junshi Biotech's total revenue in the first three quarters.

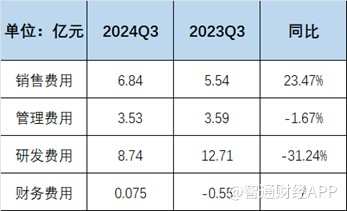

Although product revenue has increased dramatically, the narrowing of Junshi Biotech's losses was not due to product revenue, but to strengthened management of expenses, mainly due to cutting R&D expenses. According to financial reports, Junshi Biotech's R&D expenses for the first three quarters were 0.874 billion yuan, a decrease of 31.24% compared with 1.271 billion yuan in the same period last year, and the share of revenue fell from 128.81% to 68.78%. In response, Junshi Biotech said the company is focusing its resources on more promising R&D projects. Furthermore, the company's sales expenses did not decrease in the first three quarters, and sales expenses still increased by 23.47%.

It is worth mentioning that since 2019, Junshi Biotech's cumulative losses have exceeded 8.7 billion yuan. Although the total balance of monetary capital and transactional financial assets of Junshi Biotech as of the first three quarters of 2024 was 3.045 billion yuan, due to high R&D expenses all year round, judging from its past expenses, if R&D expenses are not controlled and there is no further progress in commercialization, these funds can also support about 3 years.

Big Single PD-1 “Get Up Early and Late Set”

As the first PD-1 in China, Junshi Biotech once had endless scenery. According to the Zhitong Finance App, Junshi Biotech was founded in 2012 and listed on the new 3rd board in 2015. In December 2018, Junshi Biotech's core product, treprilizumab, the core product of Junshi Biotech, was approved by the NMPA for second-line treatment of melanoma. It is the first domestically produced PD-1 monoclonal antibody to be approved. In the same year, Junshi Biotech was listed on the Hong Kong Stock Exchange.

In the field of cancer treatment, the advent of PD-1 drugs is of transformational significance. At the time, the domestic PD-1 competition pattern was good. When Junshi Biotech's PD-1 was approved, the two imported PD-1 models had just been approved domestically, and the domestic PD-1 market had just begun. Therefore, as the first PD-1 produced in China, Junshi Biotech's treprilizumab was favored by the industry.

However, it backfired. Junshi Biotech's PD-1 sales have always been poor, which means “I woke up early and caught up in the evening.”

Financial reports show that from 2019 to 2023, sales of treprilizumab were 0.77 billion yuan, 1 billion yuan, 0.41 billion yuan, 0.74 billion yuan, and 0.919 billion yuan, respectively. Other PD-1 companies, despite differences in indications, have widened the sales gap. Comparable to companies such as Cinda Biotech, their PD-1 sales revenue during the same period was 1.02 billion yuan, 2.29 billion yuan, 1.977 billion yuan, 2.01 billion yuan, and 2.8 billion yuan, respectively.

Although PD-1 sales continued to be sluggish, Junshi Biotech had good news in terms of going overseas. In October 2023, treprilizumab was approved for marketing by the FDA (US Food and Drug Administration) and approved for two indications. It became the first innovative biopharmaceutical independently developed and produced in China to be approved for marketing by the FDA.

However, from a sales perspective, its approved indications in the US are mainly nasopharyngeal cancer. This is a minor indication. There are about 2,000 new cases of nasopharyngeal cancer in the US every year, resulting in a limited increase in sales.

According to the commercialization agreement reached between Junshi Biotech and its partner Coherus in the US market, Junshi Biotech was able to receive a 20% sales share of Coherus's net annual sales in the region. GF Securities predicts that Junshi Biotech's overseas sales shares on PD-1 in 2024 and 2025 will be 0.05 billion yuan and 0.21 billion yuan.

Whether in the domestic market or foreign market, the PD-1 circuit, which is the cornerstone of the single product, is already a stretch of red sea. What companies can explore with this product is differentiated indications. Junshi Biotech is now targeting perioperation/adjuvant treatment. Indications under development related to treprilimab cover high-incidence cancer types across the country. Perioperative/adjuvant treatments, including gastric cancer, liver cancer, lung cancer, and esophageal squamous cell carcinoma, are in phase III clinical stage. Among them, new drug supplementation applications for combined chemotherapy for perioperative treatment of non-small cell lung cancer have been approved and marketed.

This means that if the new indications mentioned above are approved, the treatment window for treprilimab for these tumors will be greatly expanded, but perioperative clinical trials are not that easy, and it will still take a long time to implement.

Another highlight of Junshi Biotech is the angorizumab injection, which has been approved for marketing by the State Drug Administration.

When the new drug was approved for marketing, the majority shareholders' holdings reduction was questioned by the market

Angorizumab is a PCSK9 inhibitor. According to the Zhitong Finance App, PCSK9 (Proprotein Convertase Subtilisin/Kexintype9) is a type of hepatogenic secreted protein that is mainly synthesized in the liver, but is also expressed in other organs such as the intestines, heart, and pancreas.

PCSK9's primary function is to regulate low density lipoprotein cholesterol (LDL-C) levels in the blood. By binding to LDL receptors (LDLR) on the surface of hepatocytes, it promotes LDLR internalization and degradation, thereby reducing the removal of LDL particles, leading to an increase in LDL levels in the blood. PCSK9 not only affects LDLR, but also regulates the degradation of other LDLR family members, such as ApoER2 and vLDLR, and degradation of other cell surface proteins, such as CD36 and ACE2.

In addition to regulating LDL-C levels, PCSK9 is also involved in various biological processes, including neurological development, neuronal apoptosis, and regulation of sodium channels and islet cell function. Studies have shown that PCSK9 levels are significantly related to cholesterol, oxidized LDL (ox-LDL), and triglycerides, and genetic variation in the PCSK9 gene makes it a potential target for treating hypercholesterolemia and preventing cardiovascular disease.

Cardiovascular disease (CVD) is the world's leading cause of death, accounting for about 30% of all global deaths. Among them, atherosclerotic cardiovascular disease (ASCVD) is also the main cause of death. The occurrence of ASCVD involves many risk factors. Dyslipidemia characterized by elevated LDL-C or cholesterol is an important risk factor. Lowering LDL-C levels can significantly reduce the risk of ASCVD onset and death. Approximately 50% of individuals using statins are unable to lower their LDL-C levels to expected levels. Therefore, PCSK9 strongly supports large clinical needs.

Up to now, a total of 6 PCSK9 inhibitors have been approved worldwide, and one drug is applying for marketing. There are 36 clinical pipelines, 4 phase III, 9 phase II, and 23 phase I. Among them, the 6 approved PCSK9 inhibitors include 5 monoclonal antibodies and 1 siRNA drug.

Thanks to the strong lipid-lowering effects and good safety and drug resistance of PCSK9 inhibitors, sales sales of PCSK9 inhibitors continued to increase dramatically after marketing. Amgen's eleuizumab achieved revenue of 1.296 billion US dollars in 2022, and sales of iluumab in the first half of 2023 were 0.8 billion US dollars, an increase of 24% over the previous year. Regeneric/Sanofi's aliciumab achieves revenue in 2022

$0.467 billion; in 2022, Inclisiran's sales reached $0.112 billion. In the first half of 2023, Inclisiran's sales volume nearly tripled in the first half of the year, up 293% year-on-year to $0.142 billion.

However, this is only an indication for lipid-lowering. In addition to the lipid-lowering effect, studies have shown that PCSK9 inhibitors have potential application value in the treatment of diseases such as sepsis, some tumors, and some viral infections. Currently, pCSK9 inhibitors mainly include mCaB inhibitors, peptides, nucleic acid drugs, small molecule drugs, and vaccine-like drugs. It's easy to see that the PCSK9 inhibitor market has huge potential.

Among domestic PCSK9 inhibitors, the third model of Junshi Biotech was approved for marketing. Judging from the time point of view, it is also a first-tier domestic enterprise. However, in the early days, the domestic market was always surrounded by international giants. Currently, Cinda, Kangfang, and Junshi are listed domestically, as well as Hengrui Pharmaceutical, which has applied for listing. It can also be seen from PD-1 sales that Junshi Biotech's sales ability is weaker than others, so whether its PCSK9 inhibitors can stand out from it is still a big question.

It is worth noting that when Junshi Biotech's PCSK9 inhibitor was first marketed, its third-largest shareholder, Shanghai Tanying, and its related party, Shanghai Tanzheng, announced plans to reduce their holdings. This was the first time since the shareholder invested in 2017, making people constantly speculate about the motives behind it.

According to reports, Shanghai Tanying, the third largest shareholder of Junshi Biotech, holds 7.77% of Junshi Biotech's shares and is the third largest shareholder of the company. According to the announcement of September 25, 2024, Shanghai Tanying and Shanghai Tanzheng plan to reduce their holdings by no more than 7.3927 million shares through centralized bidding or bulk transactions between October 23, 2024 and January 22, 2025, accounting for 0.75% of the company's total share capital.

The main figure behind Shanghai Tanying is well-known investor Lin Lijun, who indirectly holds nearly 7.77% of Junshi Biotech's shares through Shanghai Tanying. Since investing in Junshi Biotech for the first time in January 2017, this is the first time that Shanghai Tanying has announced a reduction in its holdings. Lin Lijun served as a non-executive director of Junshi Biotech until he stepped down in 2022, and is currently still the company's director.

It can be said that starting in the fourth quarter of this year, Junshi Biotech's revenue sources may not rely on PD-1. However, the majority shareholders' holdings reduction at this time will inevitably cause market concerns. Especially in the context of the company's continued losses, shareholders' holdings reduction may further damage market confidence.

epilogue

As the top domestic PD-1, the first-mover advantage failed to transform Junshi Biotech into a leading position in the market, and continued losses and major shareholders' holdings reduction put additional market pressure on the company. The approval and listing of the new drug angorizimab has brought new growth points to the company, but in the face of fierce market competition and the changing industry environment, whether Junshi Biotech can get a share of the PCSK9 inhibitor market and how to optimize its product pipeline and financial situation will be the focus of attention of the market and investors.

与国内众多创新生物医药企业相似,君实生物在2024年三季度财报中仍未实现盈利。根据最新公布的财务数据,今年前三季度君实生物营业收入达到12.71亿元人民币(单位,下同),较去年同期增长了28.87%;亏损额为9.27亿元,同比缩窄34.12%;单季度来看,第三季度君实生物实现营业收入4.85亿元,同比增长53.16%,亏损额为2.82亿元,同比收窄31.05%。

与国内众多创新生物医药企业相似,君实生物在2024年三季度财报中仍未实现盈利。根据最新公布的财务数据,今年前三季度君实生物营业收入达到12.71亿元人民币(单位,下同),较去年同期增长了28.87%;亏损额为9.27亿元,同比缩窄34.12%;单季度来看,第三季度君实生物实现营业收入4.85亿元,同比增长53.16%,亏损额为2.82亿元,同比收窄31.05%。