Interest rates remained high for 13 years

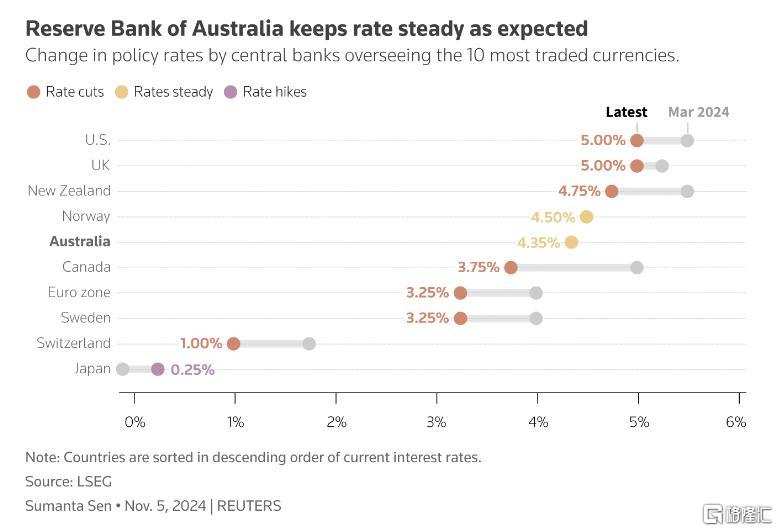

Although the ECB and the Federal Reserve have cut interest rates one after another, since inflation is still stubborn, the Bank of Australia is fully determined and continues to keep interest rates high.

Hold still for the 8th time in a row

On Tuesday local time, the Bank of Australia announced that it will keep interest rates unchanged at 4.35%, the highest level in 13 years, in line with expectations.

So far, the central bank has been on hold eight times in a row and has kept interest rates high for a year.

So far, the central bank has been on hold eight times in a row and has kept interest rates high for a year.

At the same time, the central bank also warned that the policy will still need to remain restrictive for some time.

After the announcement of the decision, the Australian dollar rose rapidly, and the yield on Australian 3-year treasury bonds rose by 0.41% against the US dollar. The latest report was 0.66115, with a cumulative decline of nearly 3% during the year.

In a statement, the Bank of Australia said, “Although overall inflation has declined sharply and will remain low for some time, potential inflation is more indicative of inflationary momentum and is still too high. This underscores the need to be alert to the upside risks of inflation, and the Commission did not rule out any possibility.”

Bank of Australia Governor Bullock said the committee is looking for evidence that inflation “will return to a sustainable range.”

“We have made good progress, but as we have seen throughout the year, the final part of reducing inflation will not be easy,” she said.

Interest rate cuts may only start next year

Recent data showed that Australia's labor market was unexpectedly strong, and core inflation remained somewhat strong in the third quarter.

Over the past year, Australia's employment rate grew by an average of 3.1%, double the US average, and the unemployment rate remained at a historically low level of 4.1%.

In the third quarter, Australia's overall inflation rate slowed to 2.8%, returning to the target range for the first time since 2021. The central bank is closely watching — the core inflation rate is 3.5%, which is still above the target midpoint, and service sector inflation remains strong.

The central bank's latest forecast is that the core inflation rate will slow slightly to 3.4% by the end of the year, and will reach the target range of 2-3% in mid-late 2025, slightly earlier than the August forecast.

In terms of economic growth, the Bank of Australia lowered its GDP growth forecast for the end of this year from 1.7% to 1.5%, and next year's growth forecast from 2.5% to 2.3%.

Recently, interest rate swaps indicate that the Bank of Australia is unlikely to cut interest rates this year, and the first rate cut may not be until May next year.

AMP's chief economist Shane Oliver also said that the Bank of Australia may still want to wait for the fourth quarter inflation data to be released at the end of January to confirm the downward trend in potential inflation.

He expects the Bank of Australia to cut interest rates in February next year. “We doubt that the Bank of Australia will have to wait until May before it has enough confidence in inflation to start cutting interest rates”.

至此,该央行已连续8次按兵不动,将利率维持在高位已有一年的时间。

至此,该央行已连续8次按兵不动,将利率维持在高位已有一年的时间。