①多只金融股获机构和游资买入,其中第一创业获机构买入1.18亿,获东方证券上海源深路营业部买入2.72亿。②CPO概念股剑桥科技获三家量化资金席位买入,合计买入金额超2.3亿。

沪深股通今日合计成交2636.65亿,其中中信证券和宁德时代分居沪股通和深股通成交额个股首位。板块主力资金方面,电子板块主力资金净流入居首。ETF成交方面,中证1000ETF指数ETF(159845)成交额环比增长422%。期指持仓方面,四大期指主力合约多空双方均大幅加仓。龙虎榜方面,汇金科技获机构买入超5000万,该股连续两日获机构买入;天津普林遭机构卖出超6000万;电投产融遭机构卖出超5000万;剑桥科技获东方证券上海源深路营业部买入1.6亿,同时遭两家一线游资席位卖出;第一创业获一家量化席位买入近亿元。

一、沪深股通前十大成交

今日沪股通总成交金额为1253.8亿,深股通总成交金额为1382.85亿。

今日沪股通总成交金额为1253.8亿,深股通总成交金额为1382.85亿。

从沪股通前十大成交个股来看,中信证券位居首位;贵州茅台和赛力斯分居二、三位。

从沪股通前十大成交个股来看,中信证券位居首位;贵州茅台和赛力斯分居二、三位。从深股通前十大成交个股来看,宁德时代位居首位;东方财富和五粮液分居二、三位。

二、板块个股主力大单资金

从板块表现来看,军工、软件、互联网金融、半导体等板块涨幅居前,无下跌板块。

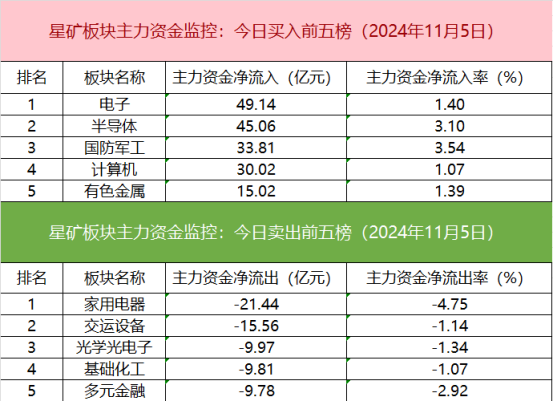

从主力板块资金监控数据来看,电子板块主力资金净流入居首。

从主力板块资金监控数据来看,电子板块主力资金净流入居首。板块资金流出方面,家用电器板块主力资金净流出居首。

从个股主力资金监控数据来看,主力资金净流入前十的个股所属板块较为杂乱,拓维信息净流入居首。

从个股主力资金监控数据来看,主力资金净流入前十的个股所属板块较为杂乱,拓维信息净流入居首。主力资金流出前十的个股所属板块较为杂乱,常山北明净流出居首。

三、ETF成交

从成交额前十的ETF来看,香港证券ETF(513090)成交额位居首位;创业板ETF159915)成交额位居第二位。

从成交额前十的ETF来看,香港证券ETF(513090)成交额位居首位;创业板ETF159915)成交额位居第二位。 从成交额环比增长前十的ETF来看,多只宽基指数ETF位居前十行列,其中中证1000ETF指数ETF(159845)成交额环比增长422%位居首位,中证500ETF华夏(512500)成交额环比增长256%位居次席。

从成交额环比增长前十的ETF来看,多只宽基指数ETF位居前十行列,其中中证1000ETF指数ETF(159845)成交额环比增长422%位居首位,中证500ETF华夏(512500)成交额环比增长256%位居次席。四、期指持仓

四大期指主力合约多空双方均大幅加仓,IH合约多空双方加仓数量基本相当;IF、IC、IM合约空头加仓数量均较多。

四大期指主力合约多空双方均大幅加仓,IH合约多空双方加仓数量基本相当;IF、IC、IM合约空头加仓数量均较多。五、龙虎榜

1、机构

今日龙虎榜机构活跃度一般,买入方面,互联网金融概念股汇金科技获机构买入超5000万,该股连续两日获机构买入;第一创业获机构买入1.18亿。

今日龙虎榜机构活跃度一般,买入方面,互联网金融概念股汇金科技获机构买入超5000万,该股连续两日获机构买入;第一创业获机构买入1.18亿。卖出方面,PCB概念股天津普林遭机构卖出超6000万;重组概念股电投产融遭机构卖出超5000万。

2、游资

一线游资活跃度有所下降,个股买卖金额有所降低。互联网金融概念股赢时胜获三家一线游资席位买入,合计买入金额超2亿;第一创业获两家一线游资席位买入,其中东方证券上海源深路营业部买入2.72亿;CPO概念股剑桥科技获东方证券上海源深路营业部买入1.6亿,同时遭两家一线游资席位卖出。

一线游资活跃度有所下降,个股买卖金额有所降低。互联网金融概念股赢时胜获三家一线游资席位买入,合计买入金额超2亿;第一创业获两家一线游资席位买入,其中东方证券上海源深路营业部买入2.72亿;CPO概念股剑桥科技获东方证券上海源深路营业部买入1.6亿,同时遭两家一线游资席位卖出。 量化资金活跃度较高,剑桥科技获三家量化席位买入,合计买入金额超2.3亿;第一创业获一家量化席位买入近亿元。

量化资金活跃度较高,剑桥科技获三家量化席位买入,合计买入金额超2.3亿;第一创业获一家量化席位买入近亿元。