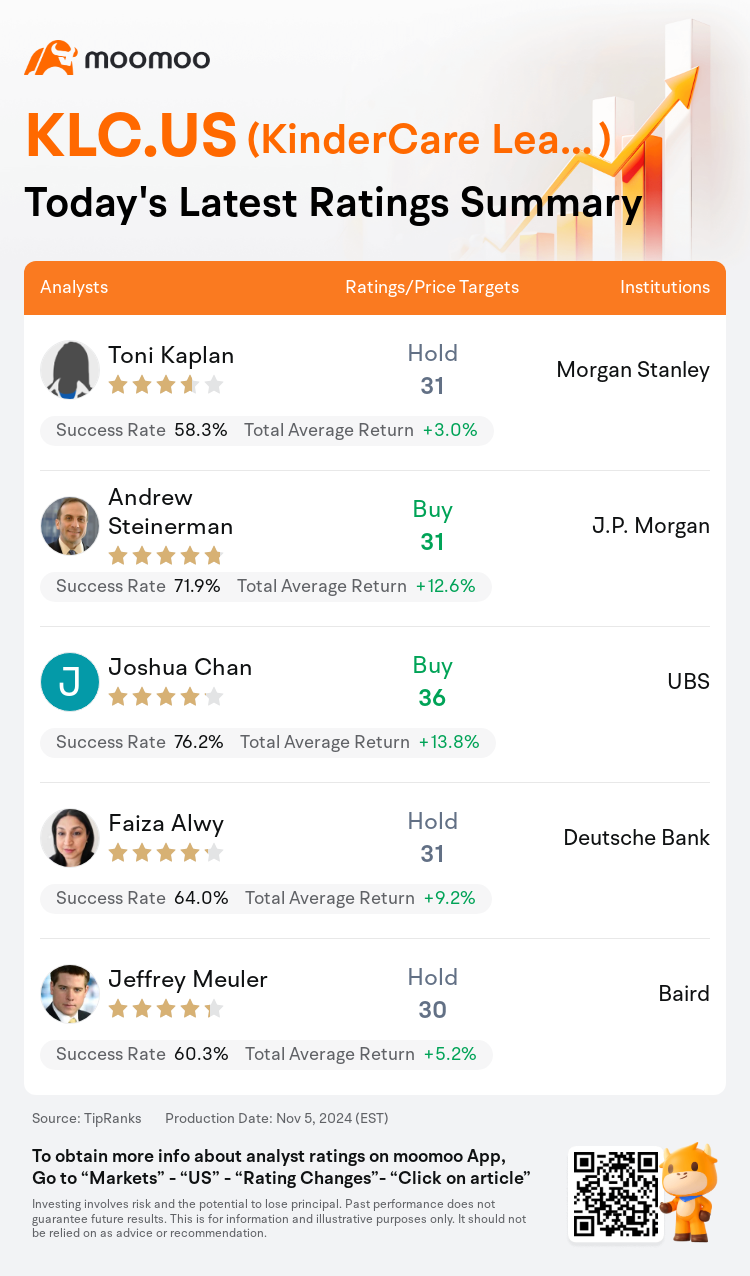

On Nov 05, major Wall Street analysts update their ratings for $KinderCare Learning Companies (KLC.US)$, with price targets ranging from $30 to $36.

Morgan Stanley analyst Toni Kaplan initiates coverage with a hold rating, and sets the target price at $31.

J.P. Morgan analyst Andrew Steinerman initiates coverage with a buy rating, and sets the target price at $31.

UBS analyst Joshua Chan initiates coverage with a buy rating, and sets the target price at $36.

UBS analyst Joshua Chan initiates coverage with a buy rating, and sets the target price at $36.

Deutsche Bank analyst Faiza Alwy initiates coverage with a hold rating, and sets the target price at $31.

Baird analyst Jeffrey Meuler initiates coverage with a hold rating, and sets the target price at $30.

Furthermore, according to the comprehensive report, the opinions of $KinderCare Learning Companies (KLC.US)$'s main analysts recently are as follows:

As the largest provider of early childhood education in the U.S., KinderCare stands to gain from the rising need for quality childcare. The current valuation of the shares is seen as reflecting their fair value.

KinderCare Learning, as the largest provider in the U.S. for early childhood education, is considered to be at a pivotal moment where the focus can shift towards future growth. It is perceived to have a more advantageous position in attracting and retaining educators compared to smaller entities.

The expectations for KinderCare Learning include a steady rise in enrollments, tuition hikes surpassing wage inflation, and a slight boost from acquisitions, which could lead to an annual EBITDA growth of 13%-14% through 2026. During this period, the EBITDA margins are anticipated to enhance from 10.6% in 2024 to 12.0% in 2026, indicating a potential 20%-25% appreciation in the company's share value over the forthcoming year.

KinderCare Learning, as a prominent provider of early childcare education, is poised to gain from the distinct childcare requirements in the U.S. market. With a significant total addressable market valued at $76B and the ability to set prices, the company is on course for a profitable growth trajectory.

The company's standing as the most prominent day-care center provider in the U.S., coupled with mid-single-digit revenue growth, is admired. Nevertheless, the current stock valuation is perceived as reasonable.

Here are the latest investment ratings and price targets for $KinderCare Learning Companies (KLC.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

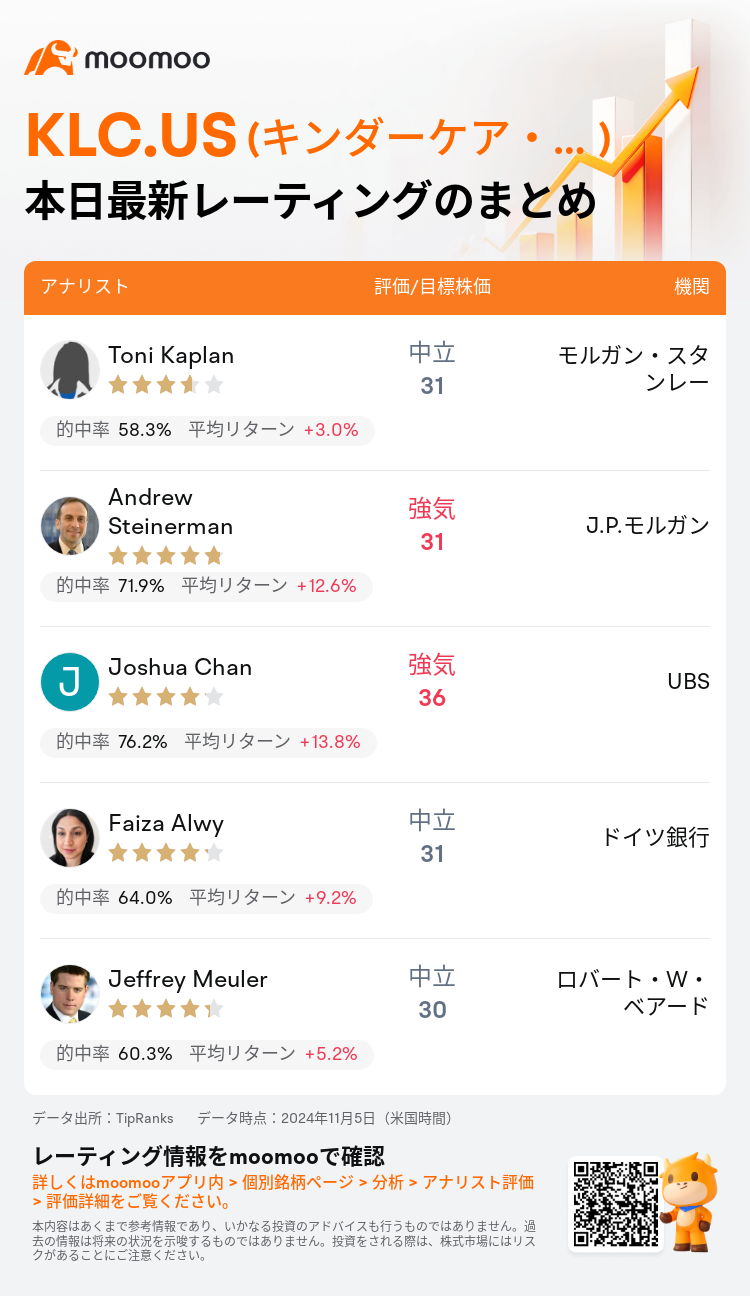

11月5日(米国時間)、ウォール街主要機関のアナリストが$キンダーケア・ラーニング (KLC.US)$のレーティングを更新し、目標株価は30ドルから36ドル。

モルガン・スタンレーのアナリストToni Kaplanはレーティングを中立にし、目標株価を31ドルにした。

J.P.モルガンのアナリストAndrew Steinermanはレーティングを強気にし、目標株価を31ドルにした。

UBSのアナリストJoshua Chanはレーティングを強気にし、目標株価を36ドルにした。

UBSのアナリストJoshua Chanはレーティングを強気にし、目標株価を36ドルにした。

ドイツ銀行のアナリストFaiza Alwyはレーティングを中立にし、目標株価を31ドルにした。

ロバート・W・ベアードのアナリストJeffrey Meulerはレーティングを中立にし、目標株価を30ドルにした。

また、$キンダーケア・ラーニング (KLC.US)$の最近の主なアナリストの観点は以下の通りである:

米国最大の幼児教育提供業者であるKinderCareは、質の高い保育がますます必要とされる中で利益を得ることができます。株式の現在の評価は、公正な価値を反映していると見なされています。

米国における幼児教育最大の提供者であるKinderCare Learningは、将来の成長に焦点を移すことができる重要な時点と見なされています。より小規模な組織と比較して教育者の獲得と維持に有利なポジションを持っていると認識されています。

KinderCare Learningに対する期待には、受講生の着実な増加、賃金インフレを上回る授業料の引き上げ、および取得からのわずかな後押しが含まれ、2026年までの年間EBITDA成長率が13%-14%になる可能性があります。この期間中、EBITDAマージンは2024年の10.6%から2026年の12.0%に向上すると予想されており、来年の間に同社の株価が20%-25%上昇する可能性を示しています。

米国市場における独自の保育要件からメリットを得るために、幼児教育の主要なプロバイダーであるKinderCare Learningは、期待されています。総額760億ドルと見積もられる重要な総アドレス可能市場と価格設定の能力を持つため、同社は収益成長の軌道に乗っています。

最も著名な米国のデイケアセンタープロバイダーとしての会社の立場は、年間1桁の売上高成長と共に称賛されています。ただし、現在の株式評価は合理的と見なされています。

以下の表は今日5名アナリストの$キンダーケア・ラーニング (KLC.US)$に対する最新レーティングと目標価格である。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

UBSのアナリストJoshua Chanはレーティングを強気にし、目標株価を36ドルにした。

UBSのアナリストJoshua Chanはレーティングを強気にし、目標株価を36ドルにした。

UBS analyst Joshua Chan initiates coverage with a buy rating, and sets the target price at $36.

UBS analyst Joshua Chan initiates coverage with a buy rating, and sets the target price at $36.