Wells Fargo Unusual Options Activity For November 05

Wells Fargo Unusual Options Activity For November 05

Financial giants have made a conspicuous bearish move on Wells Fargo. Our analysis of options history for Wells Fargo (NYSE:WFC) revealed 31 unusual trades.

金融巨头对富国银行采取了明显的看跌行动。我们对富国银行(纽交所:WFC)期权历史进行分析发现了31笔异常交易。

Delving into the details, we found 32% of traders were bullish, while 58% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $493,177, and 23 were calls, valued at $3,751,247.

深入细节后,我们发现32%的交易者持看好态度,而58%显示出看淡倾向。在所有我们发现的交易中,有8笔看跌,价值493,177美元,而有23笔看涨,价值3,751,247美元。

Projected Price Targets

预计价格目标

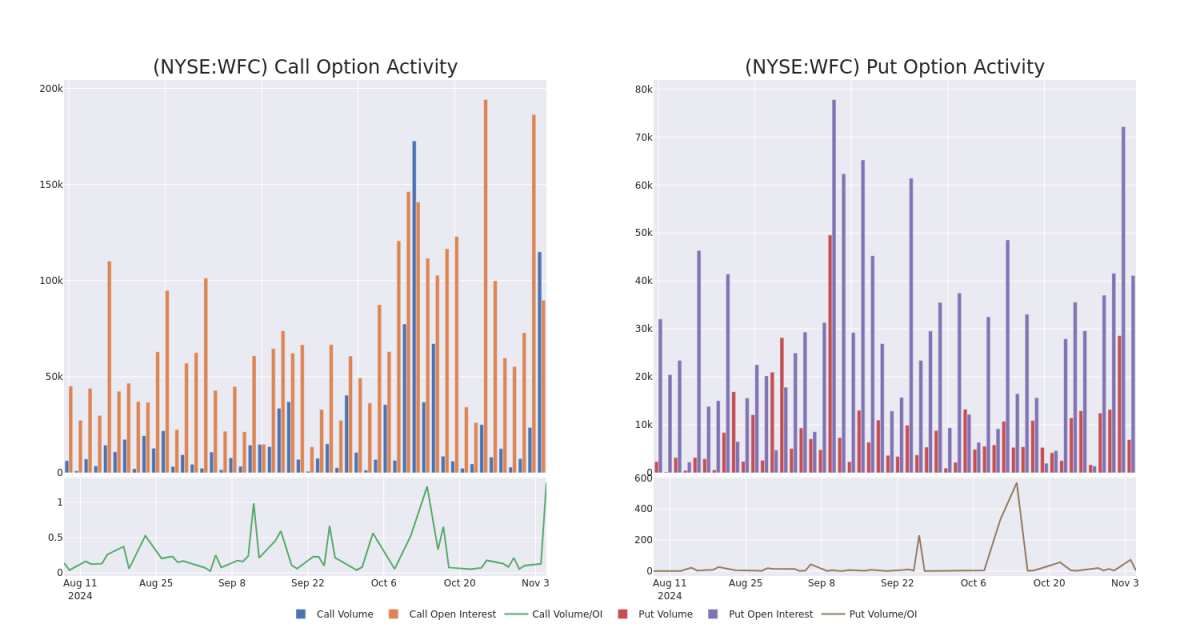

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $50.0 to $70.0 for Wells Fargo during the past quarter.

分析这些合约的成交量和未平仓合约数量,似乎大型交易者在过去一个季度一直关注着富国银行股价在$50.0到$70.0之间的区间。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Wells Fargo's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Wells Fargo's substantial trades, within a strike price spectrum from $50.0 to $70.0 over the preceding 30 days.

评估成交量和未平仓合约是期权交易中的战略步骤。这些指标揭示了在特定行权价上的对富国银行期权的流动性和投资者兴趣。即将公布的数据可视化呈现了过去30天内涉及富国银行重要交易的成交量和未平仓合约的波动,这些交易的行权价区间从50.0美元到70.0美元。

Wells Fargo 30-Day Option Volume & Interest Snapshot

富国银行30天期权成交量和利润快照

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WFC | CALL | TRADE | BEARISH | 12/20/24 | $2.25 | $2.24 | $2.24 | $65.00 | $560.0K | 11.1K | 2.6K |

| WFC | CALL | SWEEP | BEARISH | 11/29/24 | $0.46 | $0.44 | $0.45 | $69.00 | $501.6K | 22.4K | 28.9K |

| WFC | CALL | SWEEP | BEARISH | 02/21/25 | $2.74 | $2.73 | $2.72 | $67.50 | $487.1K | 638 | 3.5K |

| WFC | CALL | SWEEP | BEARISH | 02/21/25 | $2.76 | $2.72 | $2.72 | $67.50 | $483.8K | 638 | 1.7K |

| WFC | CALL | TRADE | BULLISH | 11/29/24 | $0.46 | $0.43 | $0.46 | $69.00 | $311.5K | 22.4K | 11.0K |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WFC | 看涨 | 交易 | 看淡 | 12/20/24 | 2.25美元 | $2.24 | $2.24 | $65.00 | $560.0K | 11.1K | 2.6千 |

| WFC | 看涨 | SWEEP | 看淡 | 11/29/24 | $0.46 | $0.44 | $0.45 | $69.00 | $501.6千美元 | 22.4千美元 | 28.9千 |

| WFC | 看涨 | SWEEP | 看淡 | 02/21/25 | $2.74 | $2.73 | 2.72美元 | $67.50 | $487.1K | 638 | 3.5K |

| WFC | 看涨 | SWEEP | 看淡 | 02/21/25 | $2.76 | $2.72 | $2.72 | $67.50 | $483.8K | 638 | 1.7千 |

| WFC | 看涨 | 交易 | 看好 | 11/29/24 | $0.46 | $0.43 | $0.46 | $69.00 | 311.5千美元 | 22.4K | 11.0K |

About Wells Fargo

关于富国银行

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company has four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management. It is almost entirely focused on the U.S.

富国银行是美国最大的银行之一,资产负债表资产约为1.9万亿美元。该公司有四个主要业务板块:消费银行、商业银行、公司和投资银行以及财富和投资管理。它几乎完全专注于美国市场。

Following our analysis of the options activities associated with Wells Fargo, we pivot to a closer look at the company's own performance.

在分析与富国银行相关的期权活动后,我们转向更仔细地研究该公司的业绩。

Where Is Wells Fargo Standing Right Now?

Wells Fargo现在的状况如何?

- Currently trading with a volume of 555,234, the WFC's price is up by 0.22%, now at $63.84.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 71 days.

- 目前成交量为555,234,WFC的价格上涨0.22%,目前为63.84美元。

- RSI读数表明股票目前可能超买。

- 预计在71天内公布收益。

What Analysts Are Saying About Wells Fargo

关于Wells Fargo的分析师评论

5 market experts have recently issued ratings for this stock, with a consensus target price of $67.8.

最近有5位市场专家对这支股票发表了评级,一致目标价为67.8美元。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Wolfe Research has elevated its stance to Outperform, setting a new price target at $65. * Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Wells Fargo with a target price of $77. * In a cautious move, an analyst from RBC Capital downgraded its rating to Sector Perform, setting a price target of $61. * An analyst from Phillip Securities upgraded its action to Accumulate with a price target of $65. * An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Wells Fargo, which currently sits at a price target of $71.

Benzinga Edge的期权异动板块在事件发生之前发现潜在的市场推动因素。看看大资金正在对您喜爱的股票采取什么样的立场。点击此处获取访问权限。* Wolfe Research的分析师提升了对市场的评级,将新的目标价设定为65美元。* Evercore ISI Group的分析师继续维持其对富国银行的表现评级,并将目标价设定为77美元。* RBC Capital的分析师以谨慎的态度将其评级下调为板块表现,设定目标价为61美元。* Phillip Securities的分析师将其行动升级为累计持仓,目标价为65美元。* Evercore ISI Group的分析师决定继续维持对富国银行的表现评级,目前目标价为71美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Wells Fargo's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Wells Fargo's substantial trades, within a strike price spectrum from $50.0 to $70.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Wells Fargo's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Wells Fargo's substantial trades, within a strike price spectrum from $50.0 to $70.0 over the preceding 30 days.