Earnings Troubles May Signal Larger Issues for Zhejiang Great Shengda PackagingLtd (SHSE:603687) Shareholders

Earnings Troubles May Signal Larger Issues for Zhejiang Great Shengda PackagingLtd (SHSE:603687) Shareholders

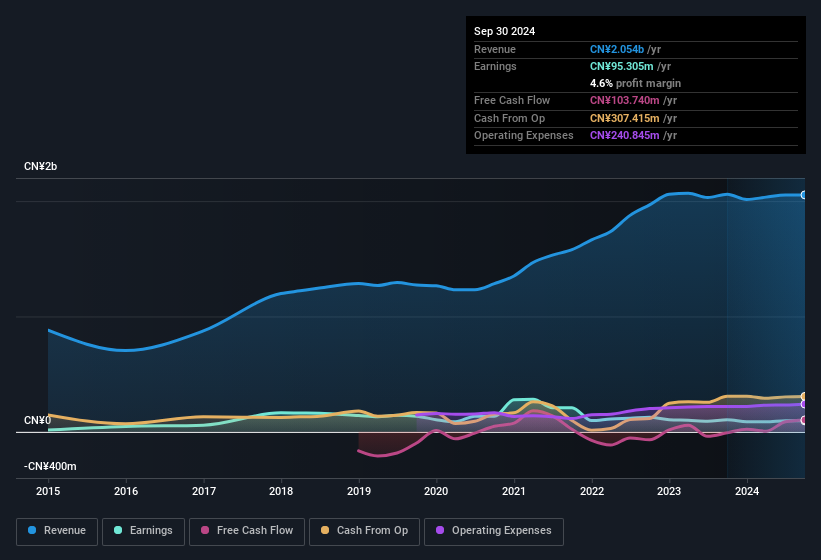

The subdued market reaction suggests that Zhejiang Great Shengda Packaging Co.,Ltd.'s (SHSE:603687) recent earnings didn't contain any surprises. We think that investors are worried about some weaknesses underlying the earnings.

市场反应平淡表明,浙江大胜达包装股份有限公司(SHSE:603687)最近的收益没有出现任何意外。我们认为投资者担心收益背后存在一些弱点。

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, Zhejiang Great Shengda PackagingLtd issued 10.0% more new shares over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Zhejiang Great Shengda PackagingLtd's historical EPS growth by clicking on this link.

为了了解每股收益潜在回报,有必要考虑公司向股东稀释了多少。事实上,浙江大胜达包装有限公司在过去一年发行了多出10.0%的新股份。这意味着其收益被分摊到更多股份上。谈论净利润,却不注意每股收益,就是被大数字所分散注意力,忽略表明每股价值的小数字。点击这个链接查看浙江大胜达包装有限公司的历史每股收益增长。

A Look At The Impact Of Zhejiang Great Shengda PackagingLtd's Dilution On Its Earnings Per Share (EPS)

浙江大胜达包装有限公司的稀释对其每股收益(EPS)的影响

Unfortunately, Zhejiang Great Shengda PackagingLtd's profit is down 54% per year over three years. And even focusing only on the last twelve months, we see profit is down 9.8%. Like a sack of potatoes thrown from a delivery truck, EPS fell harder, down 29% in the same period. Therefore, the dilution is having a noteworthy influence on shareholder returns.

不幸的是,浙江大胜达包装有限公司的利润连续三年下降54%。就过去十二个月来看,利润下降了9.8%。就像从交货车上扔下的一袋土豆,EPS下跌更厉害,在同一时期下跌了29%。因此,稀释对股东回报产生了显著影响。

In the long term, if Zhejiang Great Shengda PackagingLtd's earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

从长期来看,如果浙江大胜达包装有限公司的每股收益能够提高,股价也应该会随之上升。然而,如果其利润增加而每股收益保持不变(甚至下降),那么股东可能看不到太多好处。对于普通零售股东来说,每股收益是一个很好的指标,以检验你对公司利润的假设“份额”。

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

这可能会让您想知道分析师对未来盈利能力的预测。幸运的是,您可以单击此处查看基于其估计的未来盈利能力的互动图表。

Our Take On Zhejiang Great Shengda PackagingLtd's Profit Performance

关于浙江大胜达包装有限公司利润表现的看法

Zhejiang Great Shengda PackagingLtd issued shares during the year, and that means its EPS performance lags its net income growth. Because of this, we think that it may be that Zhejiang Great Shengda PackagingLtd's statutory profits are better than its underlying earnings power. In further bad news, its earnings per share decreased in the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. If you'd like to know more about Zhejiang Great Shengda PackagingLtd as a business, it's important to be aware of any risks it's facing. You'd be interested to know, that we found 2 warning signs for Zhejiang Great Shengda PackagingLtd and you'll want to know about them.

浙江大胜达包装有限公司在本年发行了股票,这意味着其每股收益表现落后于净利润增长。因此,我们认为浙江大胜达包装有限公司的法定利润可能优于其基本盈利能力。更糟糕的消息是,其每股收益在去年有所下降。最终,如果您想正确了解公司,除了上述因素外,还需考虑更多因素。如果您想了解更多有关浙江大胜达包装有限公司作为业务的信息,了解其面临的风险至关重要。您会感兴趣地知道,我们发现了2个关于浙江大胜达包装有限公司的警示信号,您会想了解它们。

Today we've zoomed in on a single data point to better understand the nature of Zhejiang Great Shengda PackagingLtd's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

今天,我们放大一个数据点,以更好地了解浙江大胜达包装有限公司利润的性质。但如果您能够专注于细微之处,总有更多发现。例如,许多人认为股本回报率高是有利的商业经济指标,而其他人喜欢追随资金流动,并寻找内部人员正在购买的股票。因此,您可能希望查看这个免费的公司收藏,其中列出了股本回报率高的公司,或者这个持有高内部所有权的股票清单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接与我们联系。或者,发送电子邮件至editorial-team @ simplywallst.com。

Simply Wall St的这篇文章是一般性质的。我们仅基于历史数据和分析师预测提供评论,使用公正的方法,我们的文章并非意在提供财务建议。这并不构成买入或卖出任何股票的建议,并且不考虑您的目标或财务状况。我们旨在为您带来基于基础数据驱动的长期聚焦分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St对提及的任何股票都没有持仓。

In the long term, if Zhejiang Great Shengda PackagingLtd's earnings

In the long term, if Zhejiang Great Shengda PackagingLtd's earnings