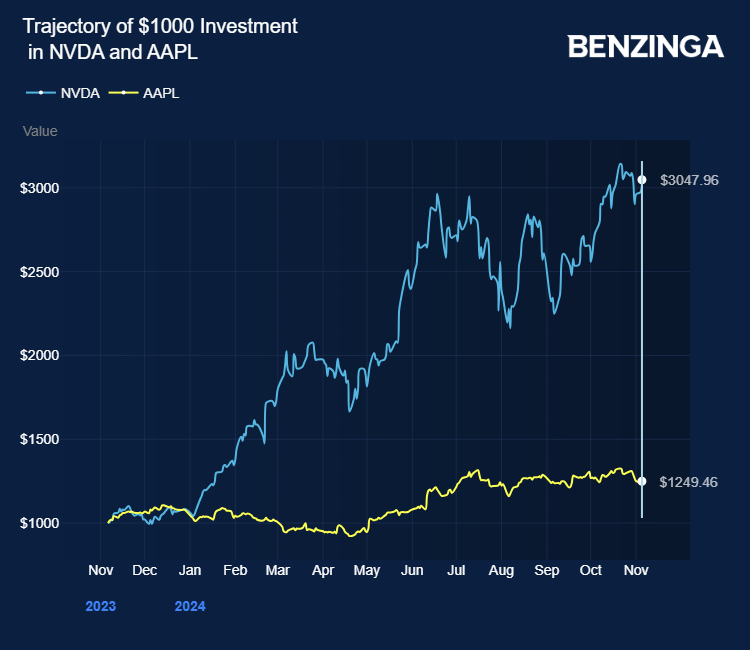

On Monday, Nvidia Corp (NASDAQ:NVDA) briefly claimed the title of the most valuable company globally, surpassing Apple Inc (NASDAQ:AAPL) in market value.

Nvidia's stock surge pushed its market cap to $3.38 trillion, edging past Apple's $3.35 trillion, CNBC reports.

Although Apple regained the lead by the end of the day, Nvidia's rise highlights the company's trajectory from a 3D gaming startup to a dominant player in artificial intelligence (AI).

Much of Nvidia's growth stems from its graphics processing units (GPUs), originally built for gaming but now critical in AI technology, enabling deep learning and cloud computing advances.

Much of Nvidia's growth stems from its graphics processing units (GPUs), originally built for gaming but now critical in AI technology, enabling deep learning and cloud computing advances.

Nvidia's revenue has soared, doubling over five quarters and tripling in three, driven by strong demand for its Blackwell AI GPU. Major tech firms like Microsoft Corp (NASDAQ:MSFT), Meta Platforms Inc (NASDAQ:META), Alphabet Inc's (NASDAQ:GOOG) (NASDAQ:GOOGL) Google, and Amazon.Com Inc (NASDAQ:AMZN) are heavily investing in Nvidia's GPUs, including the H100, to advance their AI projects.

Nvidia was recently added to the Dow Jones Industrial Average, replacing Intel Corp (NASDAQ:INTC).

Jim Cramer highlighted Google's planned increase in AI infrastructure investments next year as a significant potential boost for Nvidia.

Cramer noted that Alphabet's third-quarter solid earnings and growing focus on AI set Nvidia up for further gains in the AI sector.

Nvidia's origin story began in 1993 when co-founder and CEO Jensen Huang joined engineers Chris Malachowsky and Curtis Priem at a San Jose Denny's restaurant, where they decided to start the company.

Back then, Huang was driven by a vision to develop affordable computing chips, a goal that first materialized in 1995 with the NV1 chip.

Although the NV1 struggled technically, nearly driving Nvidia to bankruptcy, the company's next innovation—the RIVA 128 chip—gained commercial success in 1997.

Investors can gain exposure to Nvidia through SPDR S&P 500 ETF Trust (NYSE:SPY) and iShares Core S&P 500 ETF (NYSE:IVV).

Price Action: NVDA stock is up 2.8% at $139.88 at last check Tuesday.