The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Ferretti (HKG:9638), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Quickly Is Ferretti Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Shareholders will be happy to know that Ferretti's EPS has grown 17% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

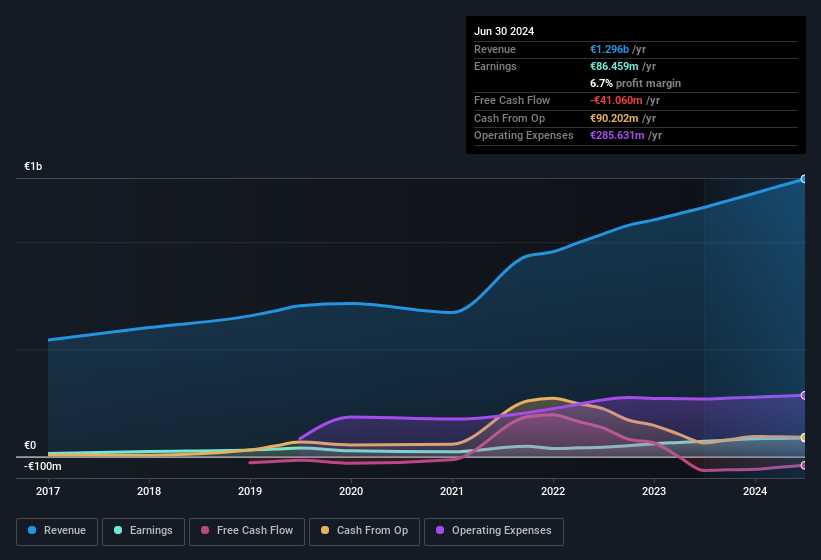

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Ferretti remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 12% to €1.3b. That's progress.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Ferretti remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 12% to €1.3b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Ferretti's future profits.

Are Ferretti Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news for Ferretti is that one insider has illustrated their belief in the company's future with a huge purchase of shares in the last 12 months. In one fell swoop, company insider Karel Komarek, spent HK$15m, at a price of HK$24.49 per share. Seeing such high conviction in the company is a huge positive for shareholders and should instil confidence in their mission.

On top of the insider buying, it's good to see that Ferretti insiders have a valuable investment in the business. Notably, they have an enviable stake in the company, worth €1.4b. That equates to 18% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

Is Ferretti Worth Keeping An Eye On?

You can't deny that Ferretti has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant piece of the pie when it comes to the company's stock, and one has been buying more. Astute investors will want to keep this stock on watch. Still, you should learn about the 2 warning signs we've spotted with Ferretti (including 1 which is significant).

The good news is that Ferretti is not the only stock with insider buying. Here's a list of small cap, undervalued companies in HK with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.