The market for Linkage Software Co., LTD's (SHSE:688588) stock was strong after it released a healthy earnings report last week. Despite this, our analysis suggests that there are some factors weakening the foundations of those good profit numbers.

Examining Cashflow Against Linkage Software's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

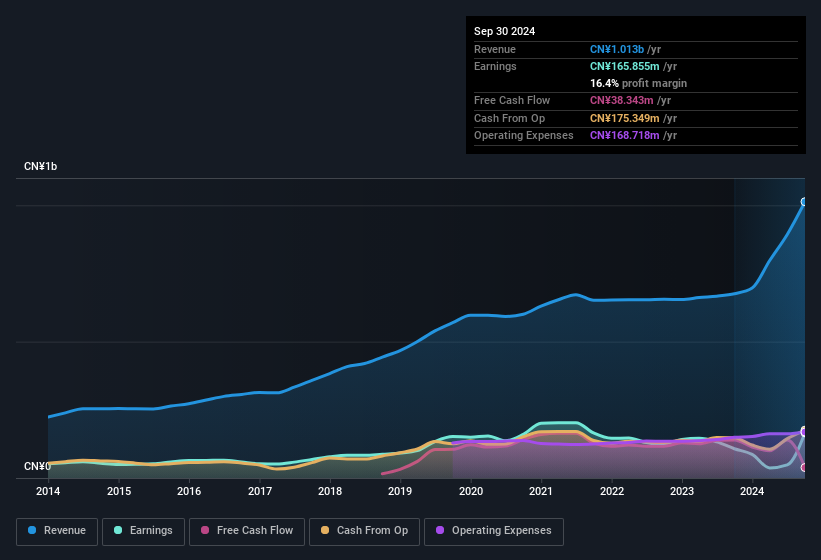

For the year to September 2024, Linkage Software had an accrual ratio of 0.22. We can therefore deduce that its free cash flow fell well short of covering its statutory profit. In fact, it had free cash flow of CN¥38m in the last year, which was a lot less than its statutory profit of CN¥165.9m. Linkage Software's free cash flow actually declined over the last year, but it may bounce back next year, since free cash flow is often more volatile than accounting profits. One positive for Linkage Software shareholders is that it's accrual ratio was significantly better last year, providing reason to believe that it may return to stronger cash conversion in the future. Shareholders should look for improved cashflow relative to profit in the current year, if that is indeed the case.

For the year to September 2024, Linkage Software had an accrual ratio of 0.22. We can therefore deduce that its free cash flow fell well short of covering its statutory profit. In fact, it had free cash flow of CN¥38m in the last year, which was a lot less than its statutory profit of CN¥165.9m. Linkage Software's free cash flow actually declined over the last year, but it may bounce back next year, since free cash flow is often more volatile than accounting profits. One positive for Linkage Software shareholders is that it's accrual ratio was significantly better last year, providing reason to believe that it may return to stronger cash conversion in the future. Shareholders should look for improved cashflow relative to profit in the current year, if that is indeed the case.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Linkage Software.

Our Take On Linkage Software's Profit Performance

Linkage Software didn't convert much of its profit to free cash flow in the last year, which some investors may consider rather suboptimal. Because of this, we think that it may be that Linkage Software's statutory profits are better than its underlying earnings power. But at least holders can take some solace from the 59% EPS growth in the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you want to do dive deeper into Linkage Software, you'd also look into what risks it is currently facing. For instance, we've identified 4 warning signs for Linkage Software (3 are concerning) you should be familiar with.

Today we've zoomed in on a single data point to better understand the nature of Linkage Software's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.