The total operating income of Yili Co., Ltd. in the first three quarters was 89.039 billion yuan, and net profit to mother broke through the “10 billion” mark

They all say that Yili Shares (600887.SH)'s three-quarter report exceeded expectations; where exactly did it exceed expectations? Today, let's sort it out.

The core data completely exceeded expectations

Blue chips such as Yili Stock, which have been listed early and have been rising in consumer value for more than 20 years, have never lacked market attention. The market's requirements for it are also extremely demanding. Even with such a spotlight review, it is said that the big supermarket market expectations of the Erie Three Quarterly Report stand up.

Blue chips such as Yili Stock, which have been listed early and have been rising in consumer value for more than 20 years, have never lacked market attention. The market's requirements for it are also extremely demanding. Even with such a spotlight review, it is said that the big supermarket market expectations of the Erie Three Quarterly Report stand up.

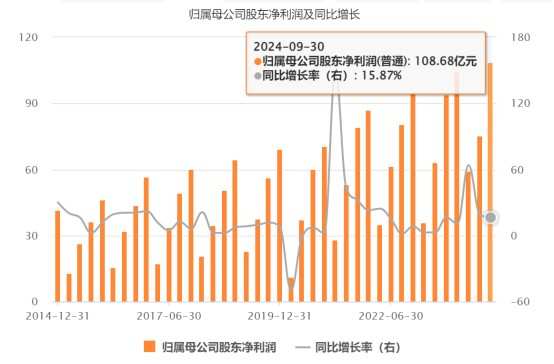

According to the three-quarter report, Yili Co., Ltd.'s total revenue for the first three quarters was 89.039 billion yuan, and net profit to mother broke through the “10 billion” mark and reached 10.868 billion yuan. It has already surpassed the net profit for the full year of last year, with a year-on-year increase of 15.87%. Looking at the third quarter month-on-month, both revenue and profit rose significantly and entered an upward trajectory. In particular, net profit to mother for the third quarter was 3.34 billion yuan, up 8.5% year over year. The main source of profit is the efficient operation of the main business, not other factors.

More than that, in the first three quarters, Yili had zero net operating cash flow of 13.87 billion yuan, an increase of 8.46% over the previous year. The operating quality can be seen. In the current period, Yili earned 1.71 yuan per share, an increase of 16.33% over the previous year. The future dividend potential will increase dramatically, and the dividend amount will reach a new high.

In addition, Yili's profitability further increased. During the reporting period, Yili's ROE (TTM) reached 21.19%, up 0.56 PCT from the same period last year; gross profit margin reached 34.81%, up 1.91 PCT; gross sales margin was 15.48%, up 0.29 PCT; net profit was 12.24%, increasing 2.62 PCT, and profitability was systematically strengthened.

According to the performance briefing, the increase in Yili's profitability is mainly due to a significant increase in internal operating efficiency and the application of leading management measures such as digitalization. According to data from the third quarterly report, the efficiency of the use of various expenses of Yili shares has been further improved.

Diversified businesses have comprehensively exceeded expectations

From the business side, relying on the industry's absolute leading comprehensive competitive advantage, Yili's market share in all categories of business has increased.

Financial reports show that in the first three quarters, the liquid milk business of Yili Co., Ltd. achieved revenue of 57.524 billion yuan. Among them, in the third quarter, there was a significant improvement, achieving revenue of 20.637 billion yuan, an increase of 24.12% over the previous quarter, a strong margin. Among them, Jindian Organic Milk continued to grow at a leading growth rate in the first three quarters and continued to expand its market share.

However, milk powder and dairy products, as categories that Yili has focused on in recent years, have greatly outperformed the industry's contrarian growth, once again verifying the forward-looking strategic vision of the Yili Co., Ltd. industry. In the current period, the business achieved revenue of 21.33 billion yuan, an increase of 7.07% over the previous year. Not only did the performance reach a record high, but the revenue growth rate is still rising steadily. Among them, the infant formula business also continued to grow, and revenue and market share continued to increase.

In terms of the cold drink business, revenue of 8.344 billion yuan was achieved in the first three quarters, ranking first in the country for 29 consecutive years, and the market share continued to expand.

Furthermore, it is worth noting that Yili said at the three-quarter report performance briefing that the company's active adjustments to the liquid milk and cold drink business have all been completed, and the channel level has reached the best state. This will undoubtedly lay a solid foundation for Yili's healthy growth in the future.

The outlook for the future has completely exceeded expectations

In addition to reviewing third-quarter operations that exceeded expectations, at the three-quarter results briefing, Erie's outlook for the future also exceeded expectations.

In the traditional sense, many people also think that Yili is a local dairy company, but the reality is that Yili has been ranked number one in the Asian dairy industry for ten consecutive years. Today, Yili's business has spread across five continents, and its development vision is to “become the world's most trustworthy health food provider.” Guided by this vision, Yili also presented a clearer development path for the future direction of internationalization, non-dairy business, and deep processing of the dairy industry at the three-quarter report performance briefing.

Regarding international development, Yili said that in addition to Indonesia and Thailand, the company has also carried out a new layout in other countries with potential for consumption growth and is expanding other dairy products categories other than ice cream.

Judging from the global dairy industry rankings, excluding exchange rates, Yili is clearly the fastest growing company in the top five global dairy industries. Striving towards the development goal of “becoming number one in the world's dairy industry by 2030,” Yili will focus on international development in the future, and have more regulations.

In terms of the non-dairy business, the growth rate of tea and water drinks that Yili has developed in recent years is impressive. Yili said that in the future, as production capacity for water and tea drinks increases, it will gradually increase channel distribution and promotion. Next year, there will also be a stock of new-flavored teas on the market.

Furthermore, Yili's increase in the field of deep processing in the dairy industry is also exciting. Relying on pioneering lactoferrin targeted extraction and protection technology, Yili's lactoferrin plant in New Zealand began construction in 2023. After completion and commissioning, Yili will rank among the top three in the world for lactoferrin production capacity. In addition to this, Yili is also speeding up the layout of deep processing production capacity in other dairy product categories to better meet the differentiated product needs of B-side customers.

Obviously, Yili's future development plans for breaking the circle of internationalization, breaking the circle non-dairy circuit, and breaking the circle dairy industry with higher added value have also exceeded the expectations of many people.

像伊利股份这种上市早,又一直涨了二十多年的消费价值蓝筹,从来不缺市场关注度。市场对其的要求也是极其苛刻的。即便如此聚光灯下的审视,说伊利三季报大超市场预期都是立得住的。

像伊利股份这种上市早,又一直涨了二十多年的消费价值蓝筹,从来不缺市场关注度。市场对其的要求也是极其苛刻的。即便如此聚光灯下的审视,说伊利三季报大超市场预期都是立得住的。