Deng Xiaofeng is reducing positions

Brothers and sisters, let's take a look at private equity giants and Middle Eastern tycoons today.

Private equity bosses Feng Liu and Deng Xiaofeng have their latest holdings!

Gao Yi Linshan No. 1 Yuanwang Fund, managed by Feng Liu, entered the list of the top 10 A-share shareholders in the third quarter, with a total market value of about 19.538 billion yuan.

Gao Yi Linshan No. 1 Yuanwang Fund, managed by Feng Liu, entered the list of the top 10 A-share shareholders in the third quarter, with a total market value of about 19.538 billion yuan.

Specifically, Feng Liu increased his holdings in Tongrentang, Dongcheng Pharmaceutical, and Zhongju Hi-Tech in the third quarter; reduced his holdings in Angel Yeast and Jianyou; and remained unchanged in Hikvision, Longbai Group, Shengyi Technology, Ruifeng New Materials, and Titan Technology.

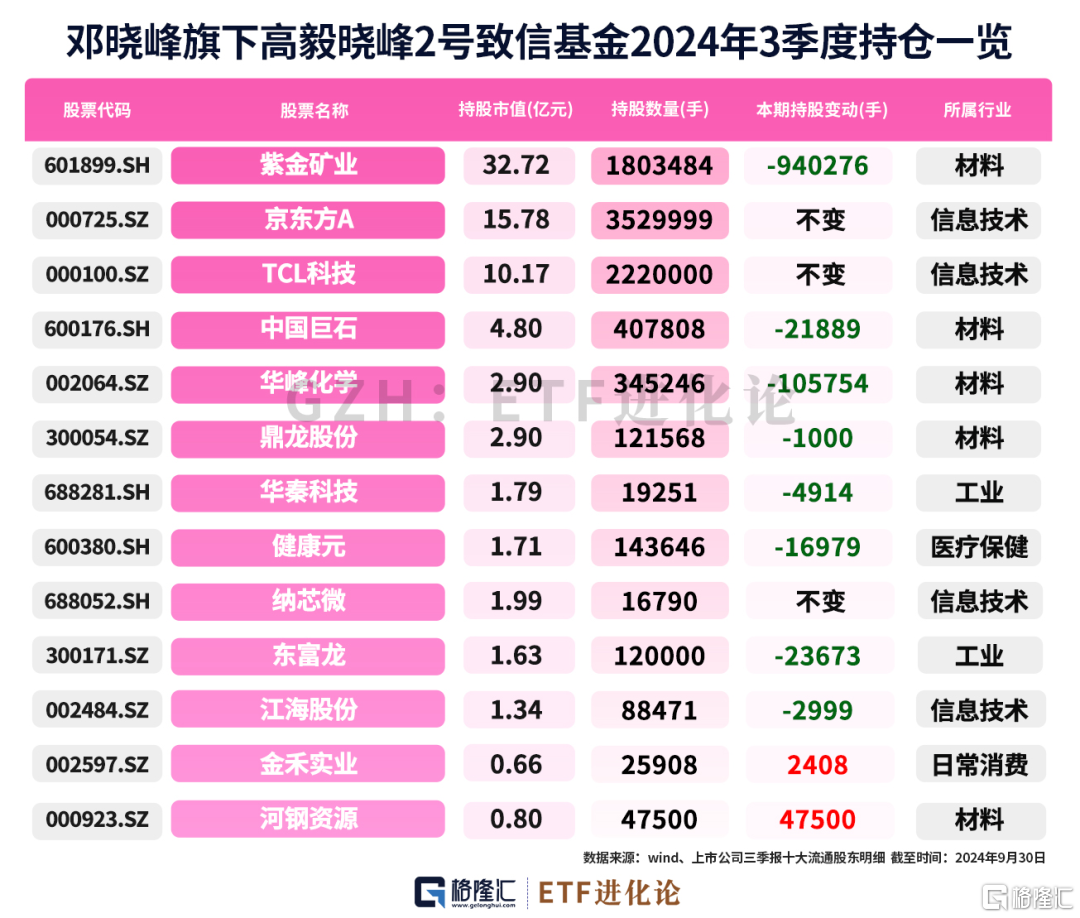

Gao Yi Xiaofeng Fund 2, managed by Deng Xiaofeng, entered the list of 13 top ten trading shareholders of A-shares in the third quarter, with a total market value of about 7.917 billion yuan. Gao Yi Xiaofeng Hongyuan Fund entered the list of the top ten trading shareholders of 6 A-shares in the third quarter, with a total market value of about 3.949 billion yuan.

In terms of specific position changes, Xiaofeng 2 added new resources to Hegang Steel in the third quarter; increased its holdings in Jinhe Industrial; reduced its holdings of Zijin Mining, China Jushi, Huafeng Chemical, Dinglong shares, Huaqin Technology, Health Yuan, Dongfulong, and Jianghai; and its holdings in BOE A, TCL Technology, and Nanochip remained unchanged.

(The content of this article is a list of objective data and information and does not constitute any investment advice)

(The content of this article is a list of objective data and information and does not constitute any investment advice)Hegang Resources is committed to the development of mineral resources in South Africa. Its main business is mining, processing and sales of copper, iron ore and vermiculite. Among them, magnetite, copper, and vermiculite accounted for 72.8%, 19.5%, and 5.5% of revenue, respectively.

Xiaofeng Hongyuan Fund reduced its holdings of Zijin Mining, China Jushi, Huafeng Chemical, Health Yuan, Huaqin Technology, and Jianghai in the third quarter.

Since this year, Deng Xiaofeng has been reducing positions and has maintained an overall cautious style. According to information disclosed in the three-quarter report of Deng Xiaofeng's fund, the product stock positions it managed ranged from over 80% at the beginning of the year to over 70% at the end of June. As of the end of September, the total positions were over 60%, including 40% for A-shares and 20% for Hong Kong stocks.

Furthermore, Deng Xiaofeng pointed out in the three-quarter report that there will be three main lines in the future market:

The first main line is based on the restructuring and decentralization of the global supply chain, focusing on upstream raw materials such as non-ferrous metals and chemicals. As China's supply chain restructuring, led by global multinational companies, is underway, and manufacturing investment in Southeast Asia, Mexico, and Eastern Europe is recovering and growing, industrialization and urbanization in these regions will lead to continued growth in demand.

The second main line of reverse investment focuses on industries that have continued to decline over the past three years due to industry policies or insufficient macroeconomic demand, such as the Internet and domestic sportswear, including display panels in televisions.

The third main line is to find companies that are likely to win or continue to grow in profits in the process of industrial transformation from the perspective of individual stocks on the basis of extensive industry coverage, such as very few companies in industries such as building materials, pharmaceuticals, and military industries.

In addition to the big players in private equity, the latest trend in holding positions in the Middle East has also arrived!

After the disclosure of the three quarterly reports of listed companies, the details of the top ten tradable shareholders came to light, and the latest A-share holdings data of world-renowned sovereign funds was released!

Recent developments in sovereign wealth funds represented by the Abu Dhabi Investment Authority, the Kuwait Investment Authority, Singapore Government Investments, and Temasek Futon Investments have surfaced.

The Abu Dhabi Investment Authority appeared among the top ten shareholders with 24 A-shares at the end of the third quarter. The total market value of its holdings at the end of the period was 8.906 billion yuan, mainly concentrating the materials, energy, and technology industries.

Looking at specific holdings, the Abu Dhabi Investment Authority holds 0.143 billion shares of Zijin Mining, with a market value of 2.594 billion yuan, ranking as the largest stock. At the end of the third quarter of the Abu Dhabi Investment Authority, companies holding more than 0.5 billion A-shares also included Haida Group, Hongfa Shares, and Hengli Hydraulic.

Compared to the second quarter, the market value of the Abu Dhabi Investment Authority's A-share holdings decreased. In the second quarter of 2024, the Abu Dhabi Investment Authority appeared among the top ten shareholders with a total reference market value of 9.423 billion yuan at the end of the period.

At the end of the third quarter, the Kuwait Investment Authority was among the top 10 tradable shareholders of 17 companies, holding a total market value of 4.378 billion yuan, mainly in the fields of consumption, resources, and manufacturing.

At the end of the third quarter, companies with a market value of more than 0.3 billion held by the Kuwait Investment Authority include Sanhua Intelligent Control, Hengli Hydraulic, Senkirin, Chenguang Co., Ltd., Yamakin International, Bethany, and Angel Yeast.

The market value of A-shares held by the Kuwait Investment Authority in the third quarter increased slightly compared to the second quarter, but decreased compared to the first quarter. At the end of the second quarter of 2024, the Kuwait Investment Authority appeared among the top ten shareholders with 24 shares, with a total market value of 4.025 billion yuan. It appeared among the top ten shareholders with 30 stocks in the first quarter, with a total market value of 4.517 billion yuan in positions.

In addition to the Middle East sovereign fund, the layout of other well-known foreign sovereign funds on Chinese assets has also surfaced.

Singapore's two major sovereign wealth funds, the Singapore Government Investment and Temasek are among the top 10 tradable shareholders of 7 companies. Among them, Pak Chu Electronics is simultaneously held by two Singaporean sovereign funds.

The Singaporean government's investment appeared among the top ten shareholders of the four A-share stocks Perilla, Hengli Hydraulic, Pak Chu Electronics, and Huaming Equipment, with a reference market value of 3.409 billion yuan at the end of the period.

At the end of the third quarter, Temasek held Pak Chu Electronics, Double Ring Drive, Sinocera Materials, and Boss Electric Appliances. The total reference market value at the end of the period was 1.546 billion yuan.

冯柳管理的高毅邻山1号远望基金三季度进入10家A股前十大流通股东名单中,合计持股市值约为195.38亿元。

冯柳管理的高毅邻山1号远望基金三季度进入10家A股前十大流通股东名单中,合计持股市值约为195.38亿元。