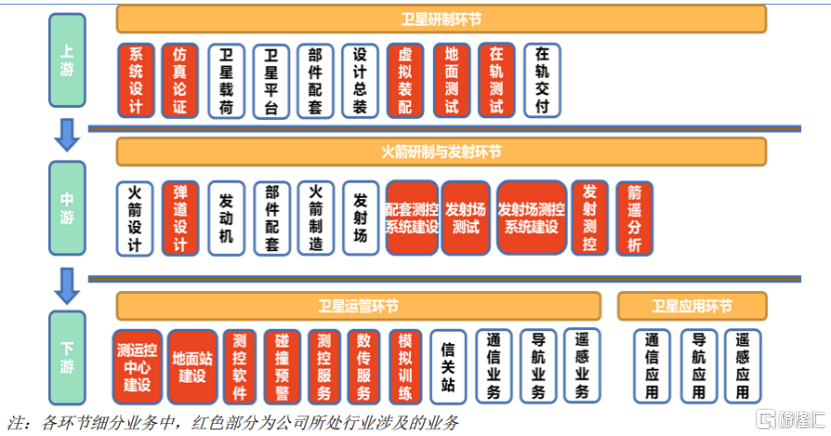

航天产业被称为工业文明的皇冠,其中商业航天产业链涵盖上游的火箭发射、卫星及地面设备研制,中游的卫星运营,下游的应用环节更是包括通信、导航、遥感、卫星互联网、太空旅行、太空采矿等应用场景。

近期,又有航天领域的公司冲击IPO上市。

格隆汇获悉,北京证券交易所上市委员会定于2024年11月8日召开2024年第22次审议会议,将审议中科星图测控技术股份有限公司(以下简称“星图测控”)的首发事项,保荐人为中信建投证券股份有限公司。

星图测控成立于2016年,于2023年2月在股转系统挂牌并公开转让,并于2023年6月调至创新层。公司是围绕航天器在轨管理与服务,专业从事航天测控管理、航天数字仿真的国家级专精特新“小巨人”企业,注册地位于安徽合肥。

星图测控成立于2016年,于2023年2月在股转系统挂牌并公开转让,并于2023年6月调至创新层。公司是围绕航天器在轨管理与服务,专业从事航天测控管理、航天数字仿真的国家级专精特新“小巨人”企业,注册地位于安徽合肥。

截至招股说明书签署日,中科星图持有股份占公司有表决权股份总数的46.36%,为公司的控股股东,而中科星图的实际控制人为中国科学院空天院,因此,中国科学院空天院为星图测控的实际控制人。

本次申请上市,星图测控拟募集资金用于商业航天测控服务中心及站网建设(一期)项目、基于AI的新一代洞察者软件平台研制项目、研发中心建设项目、补充流动资金。

募资使用情况,图片来源:招股书

1

公司规模较小,毛利率超50%

星图测控专业从事航天测控管理、航天数字仿真,依托航天器高精度轨道、姿态、控制计算,测控资源智能筹划与调度,卫星全生命周期健康管理、测控装备一体化设计与智能管控等核心技术,公司研发了具有完全知识产权、国产自主可控的洞察者系列产品。

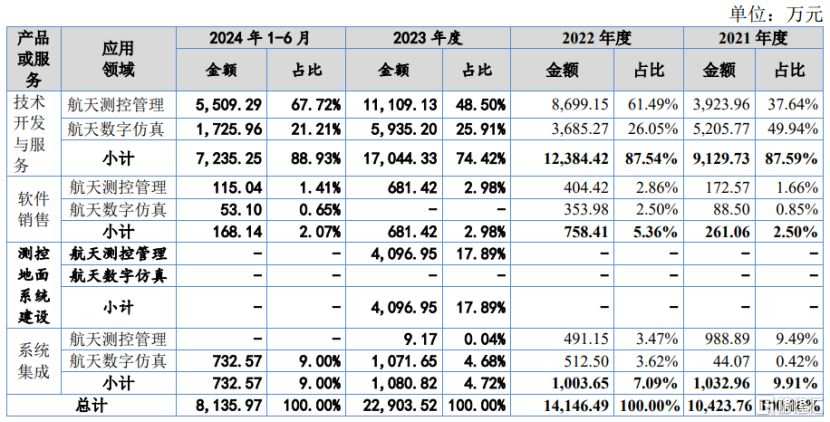

具体来看,星图测控的主要产品和服务形态包括技术开发与服务、软件销售、测控地面系统建设和系统集成。2021年至2024年上半年,技术开发与服务业务的营收占比超过70%,是公司的重要收入来源。

公司航天专家及工程师依托自主研发的洞察者系列产品及积累的各类航天领域核心算法,结合用户航天任务的差异化需求,为特种领域、民用航天、商业航天等用户提供航天测控管理、航天数字仿真领域的定制化系统开发与服务。

公司主营业务收入构成,图片来源:招股书

软件销售系公司向用户提供自主研发、国产可控的洞察者软件产品,满足航天领域用户通用业务需求。

同时公司还面向用户提供包括但不限于航天基础设施系统方案设计、地面站指标论证和建设、测控覆盖分析和链路计算、专用设备选型及适配、软硬件部署、系统安装及调试,并最终向客户交付一体化全功能的地面站系统,不过软件销售和测控地面系统建设业务的营收占比相对较低。

公司主营业务体系,图片来源:招股书

公司目前仍处于快速成长阶段,规模较小,与国际同行业先进公司相比处于相对弱势,抗风险能力有待提高。

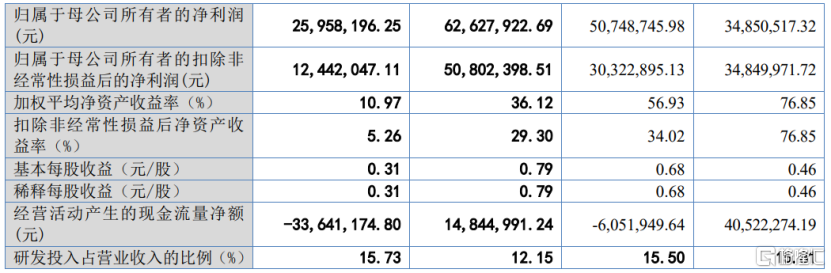

2021年、2022年、2023年、2024年1-6月(简称“报告期”),星图测控的营业收入分别约1.04亿元、1.41亿元、2.29亿元、0.81亿元,净利润分别约0.35亿元、0.51亿元、0.63亿元、0.26亿元。

主要财务数据和财务指标,图片来源:招股书

报告期内,星图测控的综合销售毛利率分别为55.20%、56.92%、52.16%和53.18%,存在一定波动,与可比公司水平相近。

可比公司毛利率比较分析,图片来源:招股书

由于目前星图测控的终端用户主要集中在特种领域、民用航天、商业航天等领域,终端需求与特种领域预算支出规模、国家研发投入的关联性大。虽然近年来终端用户需求稳定增长且预计将继续保持攀升态势,但如果出现重大调整,公司面临的市场需求可能受影响。同时,随着行业的快速发展,公司还面临着市场竞争日益加剧的风险。

2

应收账款逐年增加,且金额较大

星图测控所处的航天测控管理与航天数字仿真行业涉及航天产业上中下游,覆盖航天任务全生命周期。

航天产业包括空间技术、空间应用、空间科学三大领域,涵盖利用火箭发动机推进的跨大气层和在太空飞行的飞行器及其所载设备、地面设备的制造业、发射服务业和应用产业。

航天产业链,图片来源:招股书

星图测控的客户包括上海宇航系统工程研究所、中国科学院空天院、中科星图、星图空间、齐鲁空天信息研究院、北京中科气象科技有限公司等。报告期内,公司向合并口径前五大客户销售收入占营业收入的比例分别为62.64%、51.40%、37.67%、46.50%,占比较大,存在客户集中度较高的风险。

同时,报告期内,公司关联销售金额占当期营业收入的比重分别为36.64%、18.45%、11.47%、8.15%,尽管已经有所下降,但如果未来公司未能严格履行关联交易决策、审批程序,仍存在关联交易风险。

报告期各期末,星图测控的应收账款余额分别约0.59亿元、1.14亿元、1.63亿元、2.1亿元,呈逐年上升趋势,占当期营业收入比例分别为56.74%、80.39%、71.38%、258.18%,应收账款周转率分别为2.38、1.38、1.39、0.39,公司存在应收账款金额较大且周转率下降的风险。

值得注意的是,报告期内,星图测控经营活动产生的现金流量净额分别为4052.23万元、-605.19万元、1484.50万元、-3364.12万元,存在为负或低于同期净利润的情况。