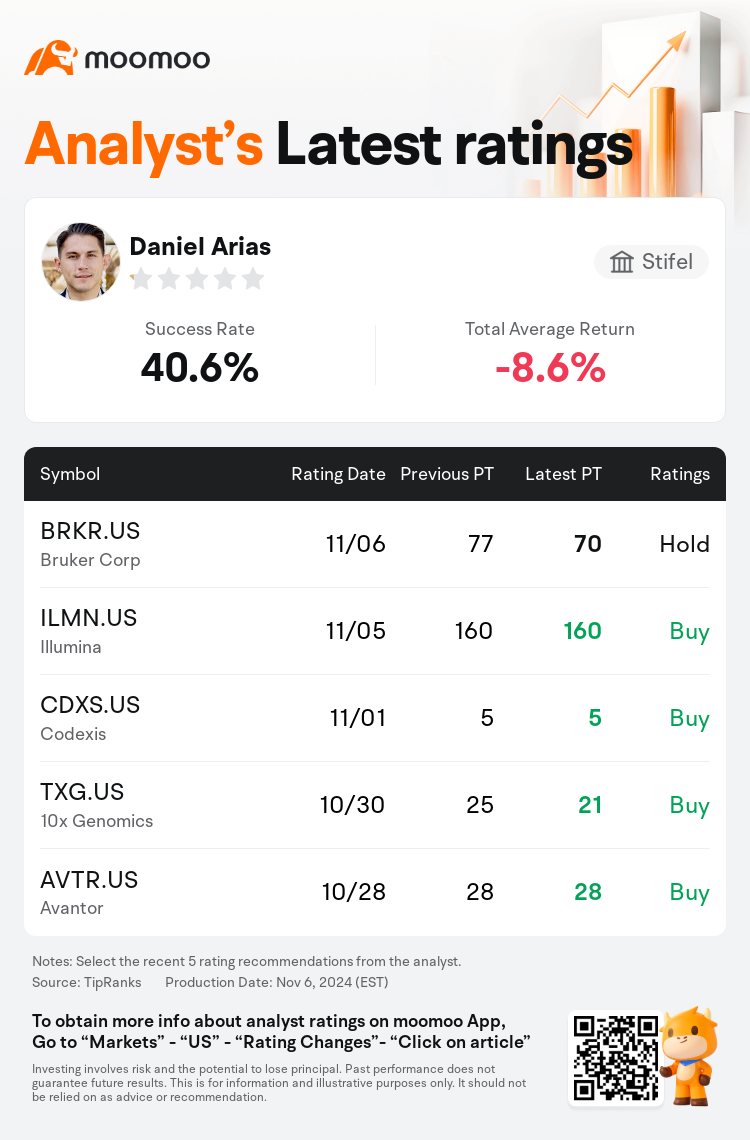

Stifel analyst Daniel Arias maintains $Bruker Corp (BRKR.US)$ with a hold rating, and adjusts the target price from $77 to $70.

According to TipRanks data, the analyst has a success rate of 40.6% and a total average return of -8.6% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Bruker Corp (BRKR.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Bruker Corp (BRKR.US)$'s main analysts recently are as follows:

Bruker experienced continued softness in China and in the biopharmaceutical sector during the quarter, as observed by the analyst.

The company experienced challenging results within a difficult macroeconomic context, according to an analyst. Adjustments to estimates have been made reflecting reduced fiscal 2024 targets. Nonetheless, it is believed that the company's strong positioning in multi-omics and materials sciences will allow it to capitalize on the anticipated demand resurgence in biopharma and China.

Bruker's third-quarter results did not meet expectations, and the company has revised its organic sales growth forecast for fiscal 2024 downward, attributing this adjustment to a more gradual recovery in China and early-stage growth in the biopharma sector. The revision in guidance is explained not by a significant downturn in Q3 markets but by previous forecasts that were perhaps too optimistic. Nevertheless, the company's management conveyed an optimistic outlook for 2025.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

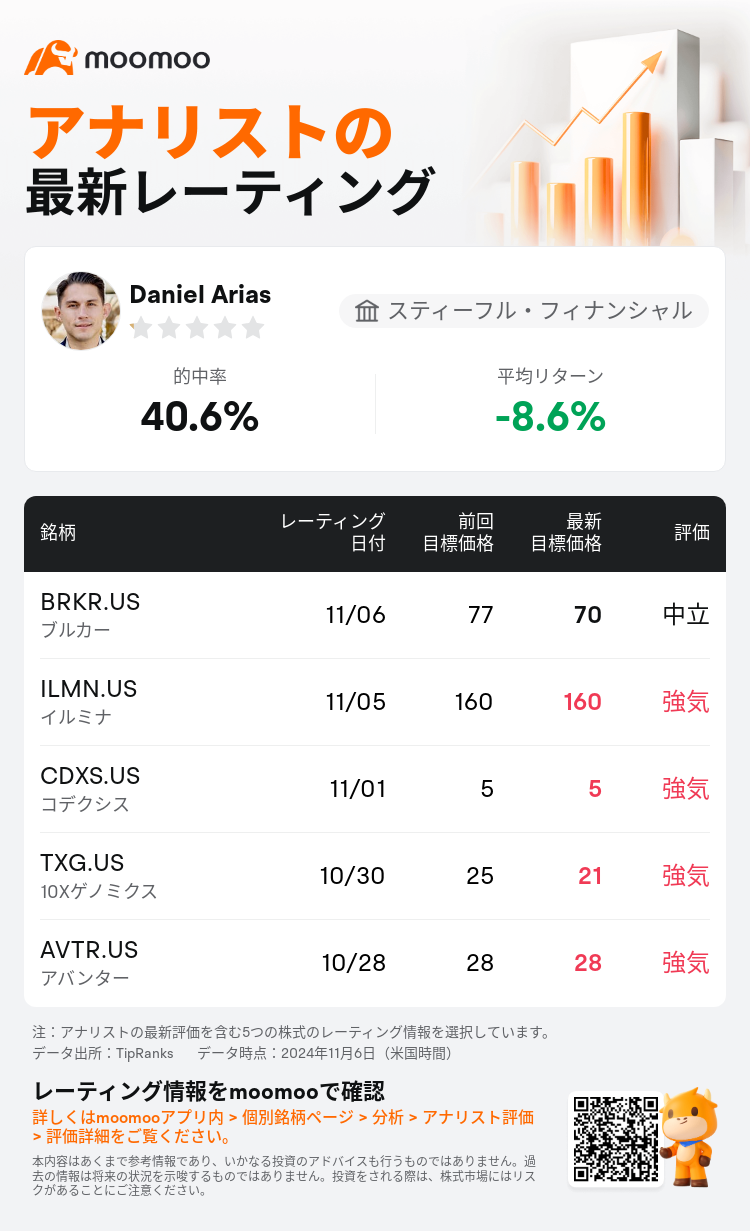

スティーフル・フィナンシャルのアナリストDaniel Ariasは$ブルカー (BRKR.US)$のレーティングを中立に据え置き、目標株価を77ドルから70ドルに引き下げた。

TipRanksのデータによると、このアナリストの最近1年間の的中率は40.6%、平均リターンは-8.6%である。

また、$ブルカー (BRKR.US)$の最近の主なアナリストの観点は以下の通りである:

また、$ブルカー (BRKR.US)$の最近の主なアナリストの観点は以下の通りである:

アナリストによると、ブルカーは四半期中に中国とバイオ製薬セクターで継続的な軟調さを経験しました。

アナリストによると、会社は困難なマクロ経済環境の中で挑戦的な結果を経験しました。見込みのある需要回復によってバイオ裏起業界と中国での需要が高まることを見込んで、予測は修正され、2024会計年度の目標が引き下げられました。それにもかかわらず、会社のマルチオミクスと材料科学の分野での強いポジショニングは、需要が回復する見込みの高い市場で資本を活用することを可能にすると信じられています。

ブルカーの第三四半期の結果は期待に添えず、会社は2024会計年度の有機的な売上成長予測を下方修正しました。この修正の理由は、中国における回復の速度がより緩やかであり、バイオ製薬セクターの初期の成長に起因しているとされています。Q3市場の大幅な下降ではなく、以前の予測がおそらく楽観的すぎたことによる、ガイダンスの修正が説明されます。それでも、会社の経営陣は2025年に対して楽観的な見通しを示しています。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

また、$ブルカー (BRKR.US)$の最近の主なアナリストの観点は以下の通りである:

また、$ブルカー (BRKR.US)$の最近の主なアナリストの観点は以下の通りである:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of