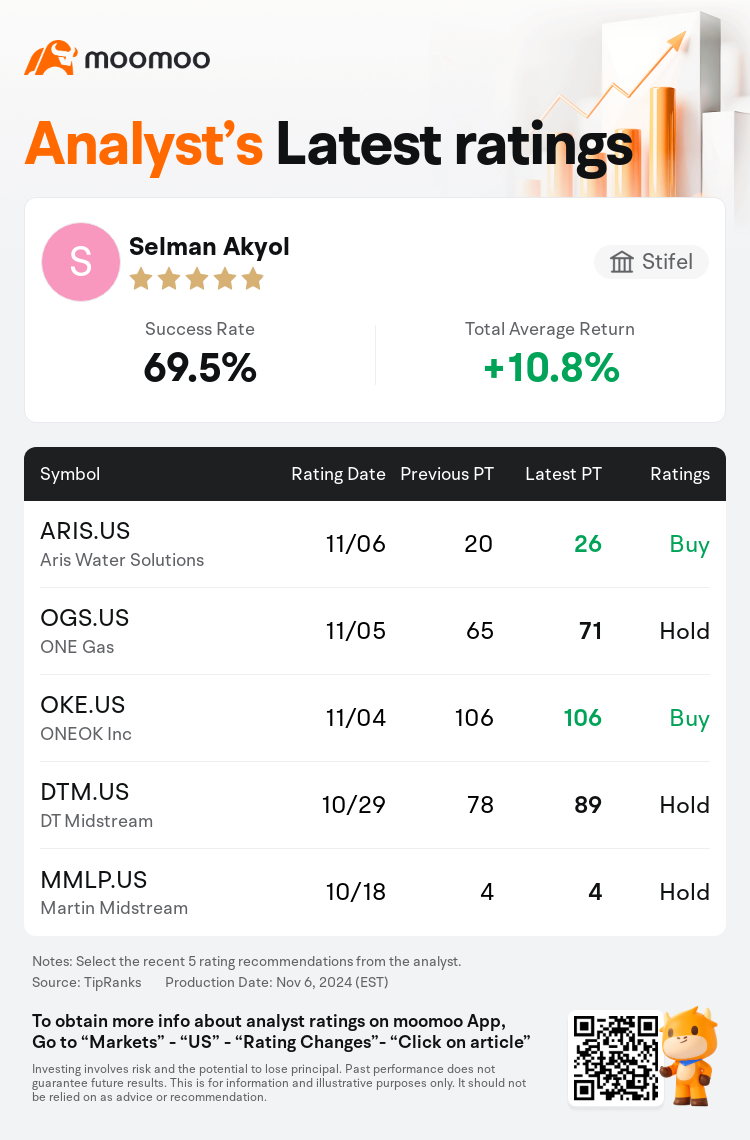

Stifel analyst Selman Akyol maintains $Aris Water Solutions (ARIS.US)$ with a buy rating, and adjusts the target price from $20 to $26.

According to TipRanks data, the analyst has a success rate of 69.5% and a total average return of 10.8% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Aris Water Solutions (ARIS.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Aris Water Solutions (ARIS.US)$'s main analysts recently are as follows:

Aris Water Solutions has shown structural operating expense reductions and careful capital expenditure management, which contributed to its improved financial performance and free cash flow, enhancing the company's flexibility in capital allocation. The company's third-quarter results confirmed this positive trend with a performance that exceeded expectations. However, the company's significant year-to-date share price appreciation may lessen new investor interest compared to its benchmark index.

Aris Water Solutions' Q3 results exceeded expectations, and the company increased its 2024 EBITDA outlook. The outlook for Aris remains favorable, with the potential to continue producing substantial free cash flow and the ability to return additional capital to shareholders.

Aris Water Solutions experienced a strong quarter, with third-quarter results and fourth-quarter guidance surpassing the consensus. Despite this performance, the viewpoint remains neutral, as the significant rise in stock value post-quarter is believed to already reflect the enhanced growth prospects.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

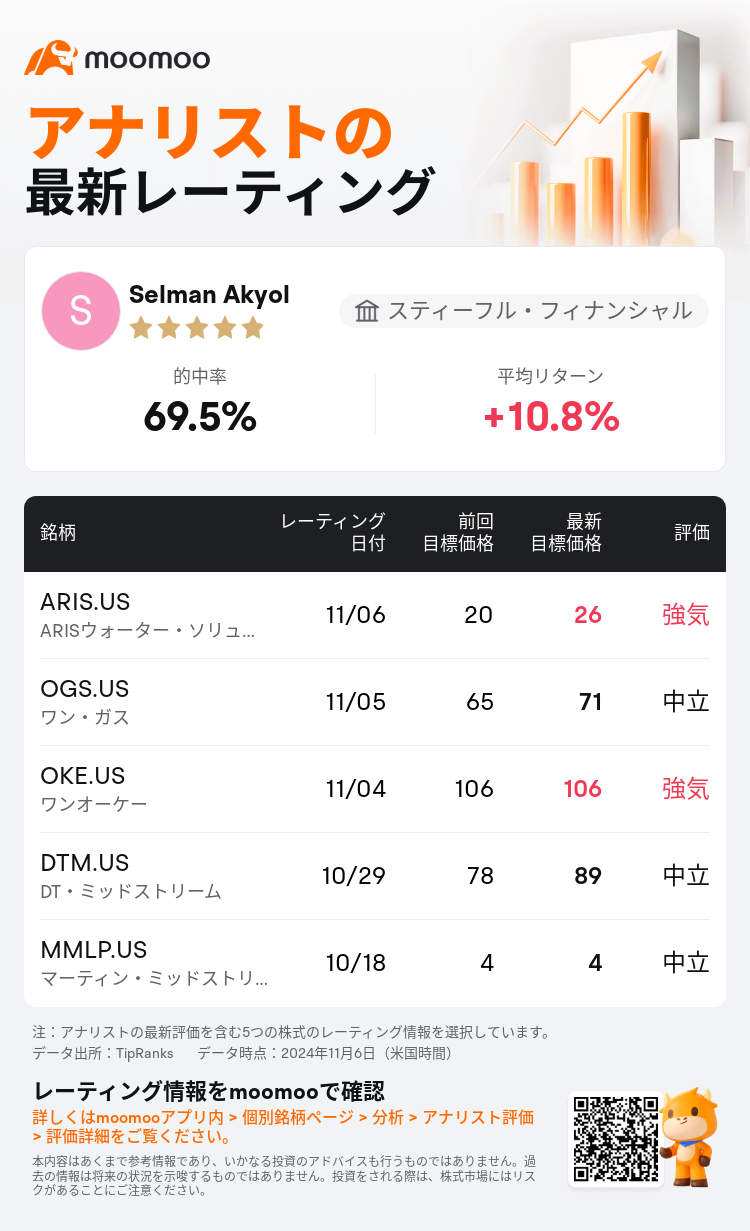

スティーフル・フィナンシャルのアナリストSelman Akyolは$ARISウォーター・ソリューション・インク (ARIS.US)$のレーティングを強気に据え置き、目標株価を20ドルから26ドルに引き上げた。

TipRanksのデータによると、このアナリストの最近1年間の的中率は69.5%、平均リターンは10.8%である。

また、$ARISウォーター・ソリューション・インク (ARIS.US)$の最近の主なアナリストの観点は以下の通りである:

また、$ARISウォーター・ソリューション・インク (ARIS.US)$の最近の主なアナリストの観点は以下の通りである:

Aris Water Solutionsは、構造的な運営費の削減と慎重な資本支出の管理を示し、その改善された財務パフォーマンスとフリーキャッシュフローに貢献し、企業のキャピタル配分の柔軟性を高めました。企業の第三四半期の結果は、期待を上回るパフォーマンスでこの好調なトレンドを確認しました。ただし、今日までの株価の大幅な上昇により、新規投資家の関心は、ベンチマークのindexと比較して少なくなる可能性があります。

Aris Water SolutionsのQ3の結果は期待を上回り、企業は2024年のEBITDA見通しを上方修正しました。Arisの見通しは依然として好調であり、引き続き大幅なフリーキャッシュフローを生み出し、株主に資本還元する能力があります。

Aris Water Solutionsは強い四半期を経験し、第三四半期の結果と第四四半期のガイダンスがコンセンサスを上回りました。このパフォーマンスにもかかわらず、株価が四半期後に大きく上昇したことから、成長見通しの向上が既に反映されていると見なされ、視点は中立のままです。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

また、$ARISウォーター・ソリューション・インク (ARIS.US)$の最近の主なアナリストの観点は以下の通りである:

また、$ARISウォーター・ソリューション・インク (ARIS.US)$の最近の主なアナリストの観点は以下の通りである:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of