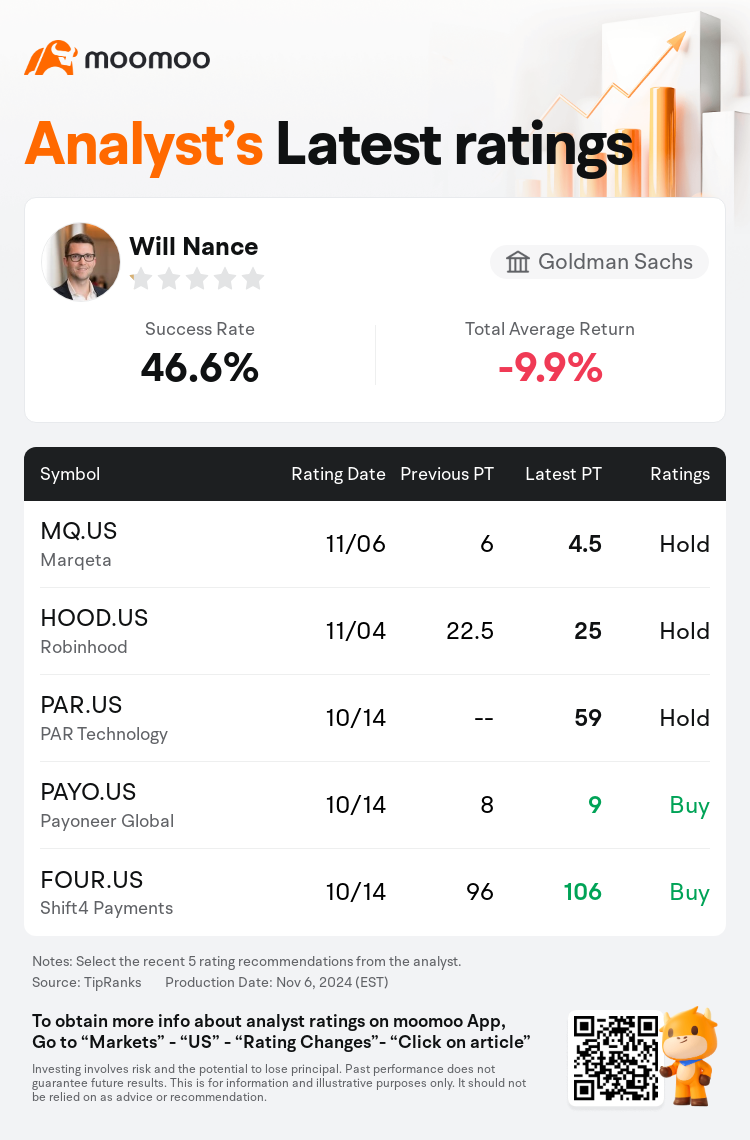

Goldman Sachs analyst Will Nance maintains $Marqeta (MQ.US)$ with a hold rating, and adjusts the target price from $6 to $4.5.

According to TipRanks data, the analyst has a success rate of 46.6% and a total average return of -9.9% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Marqeta (MQ.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Marqeta (MQ.US)$'s main analysts recently are as follows:

Marqeta's Q3 results were a mixture of highs and lows, and there has been a reduction in the growth forecast for Q4 and fiscal year 2025. This is largely due to extended onboarding periods that stem from increased regulatory oversight and the associated risk appetites of sponsor banks. Estimates have been adjusted in line with these developments.

Following 'disappointing results,' the narrative around Marqeta was anticipated to become clearer post the renewal event with a major client. The expectation was for the shares to recover from trading at cash value in after-hours trading. However, due to recent execution issues, it is believed that the company will 'likely remain a show-me story' into the future.

Marqeta experienced a slight underperformance in Q3 gross profit growth, although it surpassed expectations in adjusted EBITDA due to stringent operational discipline. Nonetheless, the company significantly reduced its outlook as a result of increased regulatory attention from the banking sector that postponed the onboarding of new clients and led to a reduction in value-added services from current customers. Additionally, it was observed that several of Marqeta's advanced fintech clients chose to internalize parts of their program management and banking relationships.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

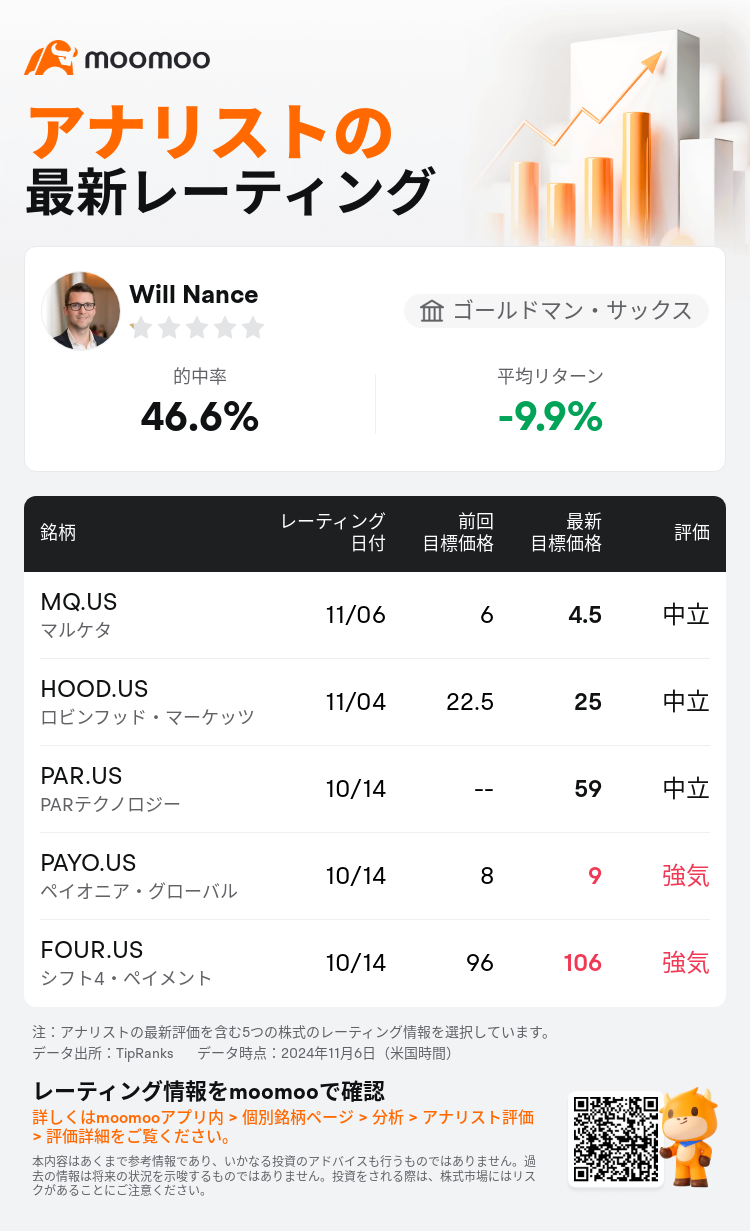

ゴールドマン・サックスのアナリストWill Nanceは$マルケタ (MQ.US)$のレーティングを中立に据え置き、目標株価を6ドルから4.5ドルに引き下げた。

TipRanksのデータによると、このアナリストの最近1年間の的中率は46.6%、平均リターンは-9.9%である。

また、$マルケタ (MQ.US)$の最近の主なアナリストの観点は以下の通りである:

また、$マルケタ (MQ.US)$の最近の主なアナリストの観点は以下の通りである:

Marqetaの第3四半期の結果は、高調波と低調波の組み合わせであり、第4四半期および2025会計年度の成長予測が削減されました。これは、規制当局の増加およびスポンサー銀行のリスク志向による長期のオンボーディング期間延長に大きく起因しています。これらの動向に合わせて見積もりが調整されました。

'失望する結果'の後、Marqetaに関する語りは、主要な顧客との更新イベント後により明確になることが予想されていました。営業時間外取引で現金価値で取引されていた株が回復すると期待されていました。ただし、最近の実行の問題のため、企業が将来において'おそらく引き続き証明する必要がある物語になるだろう'と考えられています。

Marqetaは第3四半期の粗利益成長で若干の低調な成績を収めましたが、厳格なオペレーショナルディシプリンにより調整後EBITDAの期待を上回りました。それにもかかわらず、銀行セクターからの増加する規制の注目により、新規クライアントのオンボーディングが遅延し、現行顧客からの付加価値サービスが削減された結果、会社は見通しを大幅に削減しました。さらに、Marqetaのいくつかの先進的なフィンテッククライアントが、自社プログラム管理および銀行との関係の一部を内部化することを選択する傾向があることが観察されました。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

また、$マルケタ (MQ.US)$の最近の主なアナリストの観点は以下の通りである:

また、$マルケタ (MQ.US)$の最近の主なアナリストの観点は以下の通りである:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of