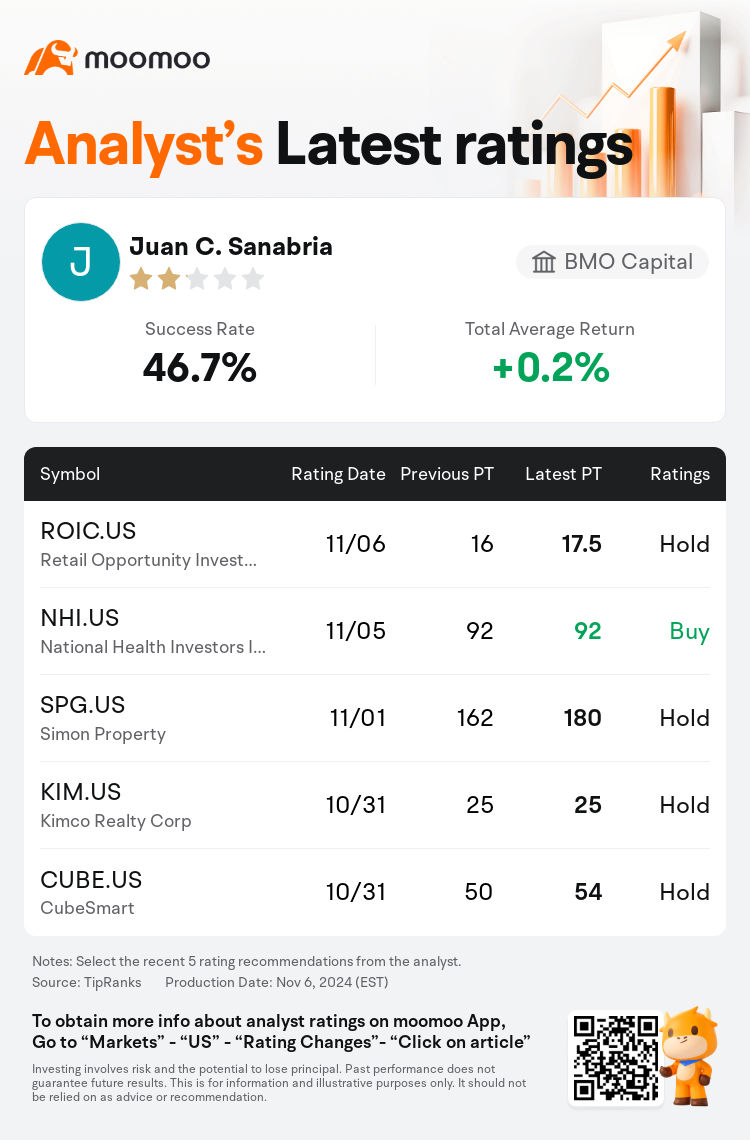

BMO Capital analyst Juan C. Sanabria maintains $Retail Opportunity Investments Corp (ROIC.US)$ with a hold rating, and adjusts the target price from $16 to $17.5.

According to TipRanks data, the analyst has a success rate of 46.7% and a total average return of 0.2% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Retail Opportunity Investments Corp (ROIC.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Retail Opportunity Investments Corp (ROIC.US)$'s main analysts recently are as follows:

The expectations for additional bidders for Retail Opportunity (ROIC) are low, following the announcement of the acquisition of shares by Blackstone Real Estate Partners X for a cash consideration. This view is based on the belief that the acquisition process has been in progress since initial reports surfaced in July.

The recent rally in Retail Opportunity's shares has prompted caution regarding valuation, suggesting that the potential for further gains could be constrained, particularly when assessed against possible risks. While there is a chance for modest growth if a takeover bid arises, the absence of such a deal could lead to a notable decline in share value.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

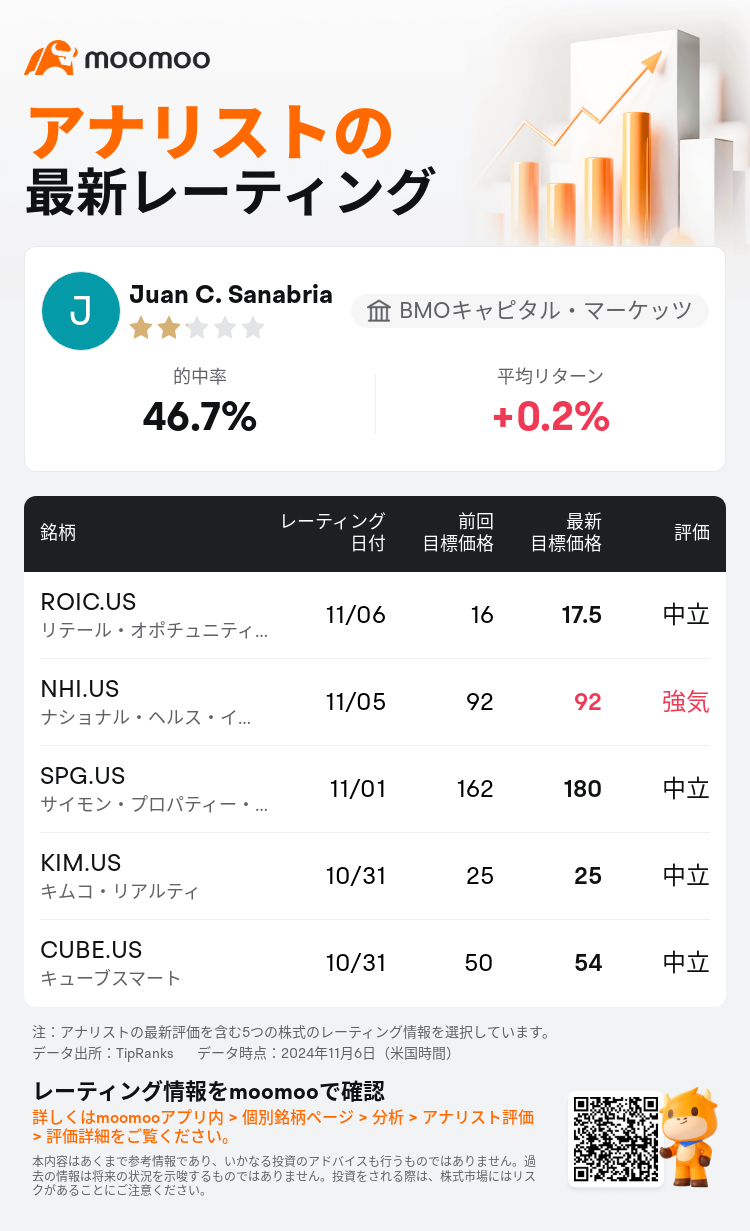

BMOキャピタル・マーケッツのアナリストJuan C. Sanabriaは$リテール・オポチュニティ・インベストメンツ (ROIC.US)$のレーティングを中立に据え置き、目標株価を16ドルから17.5ドルに引き上げた。

TipRanksのデータによると、このアナリストの最近1年間の的中率は46.7%、平均リターンは0.2%である。

また、$リテール・オポチュニティ・インベストメンツ (ROIC.US)$の最近の主なアナリストの観点は以下の通りである:

また、$リテール・オポチュニティ・インベストメンツ (ROIC.US)$の最近の主なアナリストの観点は以下の通りである:

ブラックストーン・リアルエステート・パートナーズXが現金対価で株式を取得すると発表した後、リテール・オポチュニティ(ROIC)への追加入札者の期待は低くなっています。この見解は、7月に最初の報告が出て以来、買収プロセスは進行中であるという考えに基づいています。

Retail Opportunityの株価が最近上昇したことで、バリュエーションに注意が向けられました。これは、特に起こりうるリスクと照らし合わせて評価した場合、さらなる上昇の可能性が限定される可能性があることを示唆しています。買収入札が行われた場合、緩やかな成長の可能性はありますが、そのような取引がないと、株価が著しく下落する可能性があります。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

また、$リテール・オポチュニティ・インベストメンツ (ROIC.US)$の最近の主なアナリストの観点は以下の通りである:

また、$リテール・オポチュニティ・インベストメンツ (ROIC.US)$の最近の主なアナリストの観点は以下の通りである:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of