CCCC Design & Consulting Group's (SHSE:600720) Profits May Be Overstating Its True Earnings Potential

CCCC Design & Consulting Group's (SHSE:600720) Profits May Be Overstating Its True Earnings Potential

CCCC Design & Consulting Group Co., Ltd. (SHSE:600720) posted some decent earnings, but shareholders didn't react strongly. Our analysis has found some concerning factors which weaken the profit's foundation.

中國建築設計與諮詢集團股份有限公司(SHSE:600720)發佈了一些不錯的收益,但股東們沒有強烈反應。我們的分析發現了一些令人擔憂的因素,削弱了利潤的基礎。

Zooming In On CCCC Design & Consulting Group's Earnings

聚焦中國建築設計與諮詢集團的收益

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

正如金融迷所知,現金流量的應計比率是評估公司自由現金流(FCF)與盈利狀況匹配程度的重要指標。要獲得應計比率,我們首先要將某個時期的FCF從盈利中減去,然後將該數字除以該時期的平均經營資產。這個比率告訴我們公司多少盈利沒有由自由現金流備支。

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

因此,當一家公司的應計項目比率爲負時,實際上是一件好事,但如果其應計項目比率爲正,則是一件壞事。這並不意味着我們應該擔心應計項目比率爲正,但值得注意的是,當應計項目比率相當高時,可能會導致利潤或利潤增長降低。

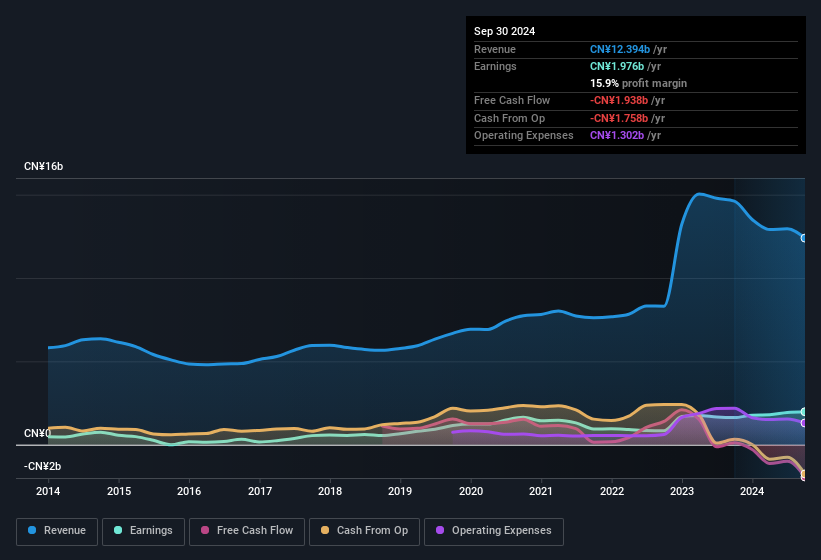

CCCC Design & Consulting Group has an accrual ratio of 0.45 for the year to September 2024. Statistically speaking, that's a real negative for future earnings. To wit, the company did not generate one whit of free cashflow in that time. Even though it reported a profit of CN¥1.98b, a look at free cash flow indicates it actually burnt through CN¥1.9b in the last year. We saw that FCF was CN¥113m a year ago though, so CCCC Design & Consulting Group has at least been able to generate positive FCF in the past. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

中國建築設計與諮詢集團截至2024年9月的年度應計率爲0.45。從統計數據來看,這對未來收益是真正的負面因素。也就是說,該公司在那段時間內沒有產生任何自由現金流。儘管報告了19.8億人民幣的利潤,但從自由現金流角度來看,實際上在過去一年內損耗了19億人民幣。我們看到,一年前的自由現金流爲11300萬人民幣,因此中國建築設計與諮詢集團至少能夠在過去產生正的現金流。值得注意的是,公司發行了新股,從而稀釋了現有股東的股份,減少了他們在未來收益中所佔的份額。

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

這可能會讓您想知道分析師對未來盈利能力的預測。幸運的是,您可以單擊此處查看基於其估計的未來盈利能力的互動圖表。

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. CCCC Design & Consulting Group expanded the number of shares on issue by 196% over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out CCCC Design & Consulting Group's historical EPS growth by clicking on this link.

要了解一家公司盈利增長的價值,必須考慮股東權益的任何稀釋。CCCC設計與諮詢集團過去一年已經將發行股份數量擴大了196%。這意味着其盈利將分配給更多的股份。談論淨利潤,而不注意每股收益,就是被大數字分心,而忽略表明每股價值的小數字。點擊這個鏈接查看CCCC設計與諮詢集團的歷史每股收益成長。

A Look At The Impact Of CCCC Design & Consulting Group's Dilution On Its Earnings Per Share (EPS)

探究CCCC設計與諮詢集團股份稀釋對其每股收益(EPS)的影響

As you can see above, CCCC Design & Consulting Group has been growing its net income over the last few years, with an annualized gain of 110% over three years. But on the other hand, earnings per share actually fell by 21% per year. And the 22% profit boost in the last year certainly seems impressive at first glance. But earnings per share are actually down 9.0%, over the last twelve months. And so, you can see quite clearly that dilution is having a rather significant impact on shareholders.

正如您在上面所看到的,CCCC設計與諮詢集團過去幾年一直在增長其淨利潤,年化增長率爲3年110%。但另一方面,每股收益實際上每年下降了21%。而過去一年的22%利潤增長看起來確實令人印象深刻。但每股收益實際上在過去12個月下降了9.0%。因此,您可以清楚地看到稀釋對股東造成了相當大的影響。

If CCCC Design & Consulting Group's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

如果CCCC設計與諮詢集團的每股收益能隨時間增長,那就極大地提高了股價朝着同一方向運動的可能性。但另一方面,要知道利潤(但不包括每股收益)正在改善,我們不會那麼興奮。因此,可以說在長期看來,每股收益比淨利潤更爲重要,假設目標是評估一家公司的股價可能增長。

Our Take On CCCC Design & Consulting Group's Profit Performance

我們對CCCC設計與諮詢集團的盈利表現看法

In conclusion, CCCC Design & Consulting Group has weak cashflow relative to earnings, which indicates lower quality earnings, and the dilution means that shareholders now own a smaller proportion of the company (assuming they maintained the same number of shares). On reflection, the above-mentioned factors give us the strong impression that CCCC Design & Consulting Group'sunderlying earnings power is not as good as it might seem, based on the statutory profit numbers. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. Case in point: We've spotted 3 warning signs for CCCC Design & Consulting Group you should be mindful of and 2 of these bad boys are potentially serious.

總的來說,相對於盈利能力,CCCC設計與諮詢集團的現金流相對較弱,這表明盈利質量較低,並且稀釋意味着股東現在擁有的公司比例較小(假定他們保持相同數量的股份)。在反思中,上述因素讓我們強烈感覺到,基於法定利潤數字,CCCC設計與諮詢集團的基礎盈利能力並不像表面上看起來那麼好。考慮到這一點,除非我們充分了解風險,否則不考慮投資股票。例如:我們已經發現了CCCC設計與諮詢集團的3個警示信號,您應該注意其中的2個問題可能嚴重。

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

在本文中,我們已經看到了可以損害利潤數字實用性的許多因素,而且我們已經變得謹慎。但是,如果您能夠將注意力集中在細節上,則總有更多發現。有些人認爲高淨資產回報率是高質量企業的一個好標誌。因此,您可能希望查看這個高淨資產回報率的免費公司收集,或這個高內部所有權的股票清單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

CCCC Design & Consulting Group has an accrual ratio of 0.45 for the year to September 2024. Statistically speaking, that's a real negative for future earnings. To wit, the company did not generate one whit of free cashflow in that time. Even though it reported a profit of CN¥1.98b, a look at free cash flow indicates it actually burnt through CN¥1.9b in the last year. We saw that FCF was CN¥113m a year ago though, so CCCC Design & Consulting Group has at least been able to generate positive FCF in the past. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

CCCC Design & Consulting Group has an accrual ratio of 0.45 for the year to September 2024. Statistically speaking, that's a real negative for future earnings. To wit, the company did not generate one whit of free cashflow in that time. Even though it reported a profit of CN¥1.98b, a look at free cash flow indicates it actually burnt through CN¥1.9b in the last year. We saw that FCF was CN¥113m a year ago though, so CCCC Design & Consulting Group has at least been able to generate positive FCF in the past. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.