The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Shandong Hi-Speed Holdings Group Limited (HKG:412) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Shandong Hi-Speed Holdings Group's Net Debt?

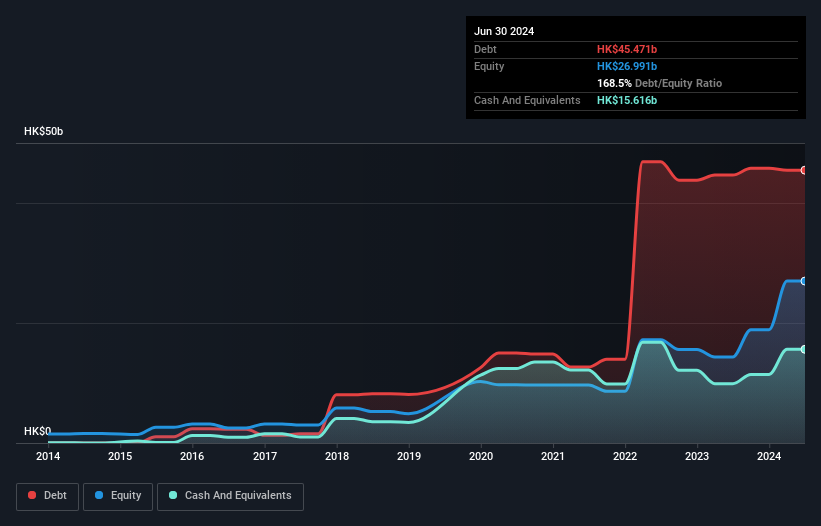

The chart below, which you can click on for greater detail, shows that Shandong Hi-Speed Holdings Group had HK$45.5b in debt in June 2024; about the same as the year before. On the flip side, it has HK$15.6b in cash leading to net debt of about HK$29.9b.

A Look At Shandong Hi-Speed Holdings Group's Liabilities

Zooming in on the latest balance sheet data, we can see that Shandong Hi-Speed Holdings Group had liabilities of HK$19.6b due within 12 months and liabilities of HK$32.2b due beyond that. On the other hand, it had cash of HK$15.6b and HK$17.1b worth of receivables due within a year. So it has liabilities totalling HK$19.1b more than its cash and near-term receivables, combined.

Zooming in on the latest balance sheet data, we can see that Shandong Hi-Speed Holdings Group had liabilities of HK$19.6b due within 12 months and liabilities of HK$32.2b due beyond that. On the other hand, it had cash of HK$15.6b and HK$17.1b worth of receivables due within a year. So it has liabilities totalling HK$19.1b more than its cash and near-term receivables, combined.

This deficit isn't so bad because Shandong Hi-Speed Holdings Group is worth HK$33.1b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Weak interest cover of 0.67 times and a disturbingly high net debt to EBITDA ratio of 9.2 hit our confidence in Shandong Hi-Speed Holdings Group like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. Worse, Shandong Hi-Speed Holdings Group's EBIT was down 52% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Shandong Hi-Speed Holdings Group will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Happily for any shareholders, Shandong Hi-Speed Holdings Group actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

On the face of it, Shandong Hi-Speed Holdings Group's interest cover left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Shandong Hi-Speed Holdings Group stock a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. While Shandong Hi-Speed Holdings Group didn't make a statutory profit in the last year, its positive EBIT suggests that profitability might not be far away. Click here to see if its earnings are heading in the right direction, over the medium term.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.