How big is the impact?

On November 7, Beijing time, MSCI, an international index compiling company, announced the November stock index review results. Among them, 4 new Chinese stocks have been added to the MSCI China Index, excluding 20 stocks. All changes will take effect after closing on November 25, 2024.

At the same time, 22 new shares were added to the MSCI Global Standard Index, and 57 shares were excluded. Based on the company's market capitalization, the top three new shares will be Spotify Technology, Carvana A, and CVC Capital. The three biggest additions to the MSCI Emerging Markets Index will be International Games System Co, Kalyan Jewellers India, and Oberoi Realty.

Generally speaking, inclusion in the MSCI China Index also means being embedded in the MSCI Emerging Markets Index and entering the MSCI Global Standard Index series, thus receiving a large amount of passive capital tracking. Judging from historical experience, individual stocks newly included by MSCI may welcome purchases of overseas passive index funds at the end of the day.

Generally speaking, inclusion in the MSCI China Index also means being embedded in the MSCI Emerging Markets Index and entering the MSCI Global Standard Index series, thus receiving a large amount of passive capital tracking. Judging from historical experience, individual stocks newly included by MSCI may welcome purchases of overseas passive index funds at the end of the day.

Recent changes to the MSCI list

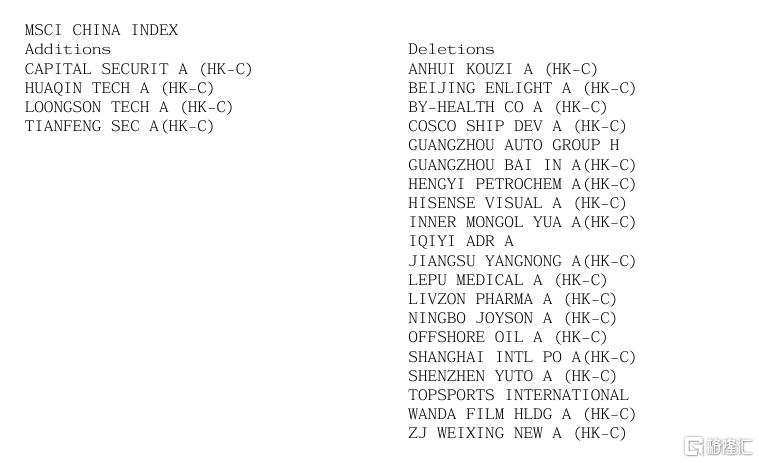

Specifically, the MSCI China Index now includes 4 new targets: Capital Securities, Huaqin Technology, Longxin Zhongke, and Tianfeng Securities.

Twenty stocks were excluded, including 17 A shares (Kouzijiao, Light Media, Tomson Beijian, COSCO Haifa, Baiyun Airport, Hengyi Petrochemical, Hisense Video, Yuanxing Energy, Yangnong Chemical, Lepu Medical, Lepu Medical, Lizhu Group, Junsheng Electronics, Offshore Oil Engineering, SIPG Group, Yutong Technology, Wanda Film, Weixing New Materials), and 2 H shares (Guangzhou Automobile Group, Taobo), and iQiyi—ADR.

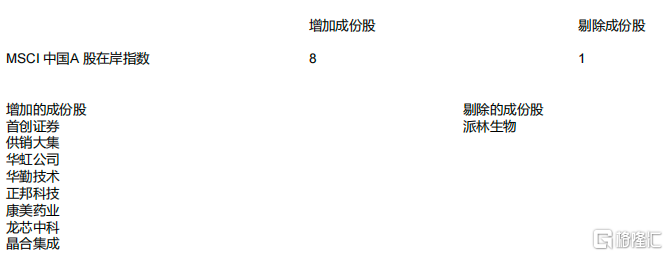

Eight new constituent stocks were included in the MSCI China A-share Onshore Index, including Pioneer Securities, Supply and Marketing, Huahong, Huaqin Technology, Zhengbang Technology, Kangmei Pharmaceutical, Longxin Zhongke, and Jinghe Integrated; Pailin Biotech was excluded.

How big is the impact?

In the global capital market, MSCI is one of the world's largest index providers, and the MSCI index it compiles is widely regarded as an important benchmark for measuring the performance of global investment portfolios.

MSCI divides different indices based on various dimensions such as market capitalization, region, industry, and theme. Among the many indices involving Chinese assets, what people are most concerned about is the MSCI China Index.

Among them, the MSCI China Index covers representatives of large and medium-sized stocks and overseas listings (such as ADR) of A shares, H shares, B shares, red chips, and P shares. The MSCI China Index is one of the important reference indicators for global investors. It is widely used to measure the performance of the Chinese stock market, compare markets, and build portfolios.

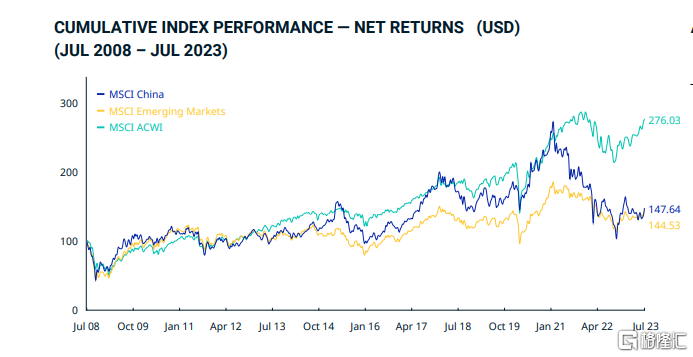

Since the US subprime mortgage crisis in December 2008, the MSCI China Index has shown an overall upward trend and recorded the highest increase of more than 300% in 2020. The Chinese stock index declined somewhat after 2020. By the end of 2023, the 15-year cumulative increase was 97.72%. The Emerging Markets Index and the MSCI Global Index rose 173% and 364% respectively during the same period.

As MSCI's multiple index constituent stocks are adjusted, related index funds will also adjust their positions. Newly included companies will receive more capital allocation, excluded companies will be passively sold by relevant index funds, and related individual stocks may experience an “abnormal” increase in trading volume and volatility, especially at the end of the session. In contrast, active funds do not have this restriction; they can take the opportunity to choose when to allocate them. CICC suggests focusing on the potential impact of some individual stocks with poor liquidity.

In terms of stock prices, after the results are announced until the official implementation date, some arbitrage funds will lay out corresponding individual stocks based on the official results, especially those unexpected results that were not fully predicted by the market before.

一般来说,纳入MSCI中国指数同时也意味着被嵌套进MSCI新兴市场指数,进入了MSCI全球标准指数系列,从而将获得大量被动资金跟踪。从历史经验来看,被MSCI新纳入个股或将在当天尾盘迎来海外被动指数资金的买入。

一般来说,纳入MSCI中国指数同时也意味着被嵌套进MSCI新兴市场指数,进入了MSCI全球标准指数系列,从而将获得大量被动资金跟踪。从历史经验来看,被MSCI新纳入个股或将在当天尾盘迎来海外被动指数资金的买入。