从マーケットの動向を見ると、百徳メディカルは上場以来株価が一貫して下落し、10月以降株価が62%下落しており、明らかに市場投資家には強気ではないようだ。

最近、バイアード・メディカル投資ホールディングス・リミテッド(通称「百徳メディカル」)、傘下の百徳(スージョウ)メディカルリミテッドがSPAC(特別目的取得会社)のExcelFin Acquisition(XFIN)を介して米国ナスダックに上場した。

これまで、百徳メディカル(BDMD.US)の上場は波乱含みだった。同社は2022年9月に香港証券取引所で上場を予定していたが、規制政策や香港のバイオ医薬市場の低迷などの理由から、後に香港IPOを延期すると発表した。

2023年6月、会社は特殊目的収益会社(SPAC)であるExcelFin Acquisition Corp.(「ExcelFin」)と最終合併契約を結び、取引完了後はBaird Medical Investment Holdings Limitedとして運営される予定です。合併契約に基づき、合併前の株式価値は3億米ドル、合併後の会社の暗黙の推定企業価値は約3.7億米ドルで、Bettersの株主はその保有するBetters株式100%をBaird Medicalの普通株に転換します。

2023年6月、会社は特殊目的収益会社(SPAC)であるExcelFin Acquisition Corp.(「ExcelFin」)と最終合併契約を結び、取引完了後はBaird Medical Investment Holdings Limitedとして運営される予定です。合併契約に基づき、合併前の株式価値は3億米ドル、合併後の会社の暗黙の推定企業価値は約3.7億米ドルで、Bettersの株主はその保有するBetters株式100%をBaird Medicalの普通株に転換します。

従来のIPOと比較して、SPAC上場には短い時間が必要であり、またナスダックはバイオテクノロジーカンパニーに対する投資熱と評価水準が相対的に高いため、バイオ医薬企業により柔軟な上場選択肢を提供している。しかし、市場の動向を見ると、百徳メディカルは上市以来株価が一貫して下落し、10月以降株価が62%下落しており、明らかに市場投資家には強気ではないようだ。

製品の販売量の下落が業績に影響を与えています。

公開情報によると、百德医疗の歴史は2012年6月に遡り、中国で腫瘍の微創治療のための微波消融医療器械のリーディング開発者および提供者です。同社の専有する微波消融医療器械は良性腫瘍および悪性腫瘍(甲状腺結節、肝癌、肺癌および乳腺腫瘤を含む)の治療に使用されます。

微波消融は、微波エネルギーの熱を通じて細胞や組織を破壊する技術であり、甲状腺結節、乳腺結節、肝癌、肺癌などの病気に応用でき、安全性が高く、効果が良い特徴を持ち、人体の多くの免疫細胞の活性を高めることができます。

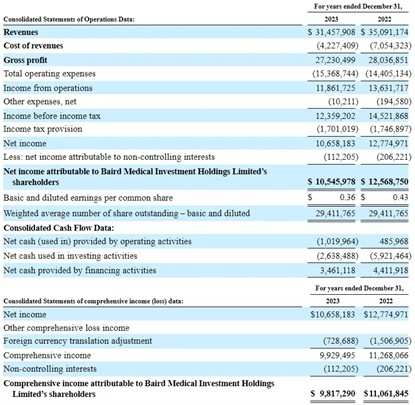

チャイナマネー・ファイナンスアプリによると、企業の2023年の売上高は3150万ドルで、前年比10.35%減少し、当期純利益は2723万ドルで、前年比2.86%減少しました。2024年の売上高は約4220万ドルで、調整後の税引前利益は2010万ドルになる見込みです。

会社側が発表したところによると、販売価格の変動により収入が約110万ドル減少し、製品の販売量の変動により収入が約400万ドル減少した。

株式公開書によると、Baider Medicalは合計8製品を所有し、そのうち3製品はすでに上市承認を取得しており、それぞれ肝臓癌および甲状腺結節のマイクロ波消融治療器およびマイクロ波消融針、長型マイクロ波消融針、精密型マイクロ波消融針です。

2023年11月末、百徳医療の子会社である百徳(蘇州)医療有限公司のマイクロ波消融システムと使い捨て製品のセット、マイクロ波消融針が正式に米国市場に投入され、II類規制機器として販売されました。

収入構造から見ると、2022年5月までの5か月間、Baider Medicalはマイクロ波消融針分野での収入が5452万ドルで、全売上高の割合が85.5%に達し、マイクロ波消融針事業への依存度が高くなっています。

2023年、企業の収益コストは前年比約280万ドル減少し、粗利益も2022会計年度の2800万ドルから80万ドル減少し、2023会計年度の2720万ドルになりました。企業側は、顧客の需要にさらに応えるために、マイクロ波消融(MWA)針の構成を2本増やしたことにより、コストが増加したと説明しています。今年のコスト構造は、前年と比べてより実際のコアビジネスの運営状況に近いと述べています。

営業およびマーケティング費用に関して、企業の戦略が徐々に直接販売顧客から販売代理店に移行することにより、内部販売とマーケティング部門の従業員数が79人から32人に減少し、2023年の営業およびマーケティング費用は100万ドル減少し、250万ドルになりました。2022会計年度と2023会計年度、企業の営業費用は売上高比率がそれぞれ10.2%と8.1%でした。企業側は、2024年に米国での販売業務が着実に進展することから、営業費用が増加する可能性があると述べています。

2023財年の会社の研究開発費は430万ドルで、2022財年の390万ドルと比べて40万ドル増加し、それぞれ2023財年と2022財年の総収入の13.6%と11.0%を占めています。研究開発費の増加は主にFDA認証費用、CE Marking費用、内視鏡超音波システム費用、AI焼灼システム及び設備の研究開発費用が増加したことによります。

招股書によると、フロストアンドサリバンの資料に基づき、2022年のマイクロ波焼灼針の販売収入及び販売数において、バイダ医療は中国において甲状腺結節及び乳房腫塊の治療用マイクロ波焼灼医療機器の供給者として第1位にランクされています。2022年の販売収入に基づけば、同社は中国の第3位のマイクロ波焼灼医療機器供給者です。

我国における癌症の発生は持続的に増加する傾向にあります。

公開資料によれば、焼灼技術は腫瘍の治療に一般的に用いられる方法であり、高温、低温または化学物質などの方法で癌細胞を破壊することができます。一般的な焼灼技術には、ラジオ波焼灼、レーザー焼灼、高強度焦点超音波焼灼、マイクロ波焼灼及び冷凍焼灼などがあります。

腫瘍の診断には、まず画像診断を通じて腫瘍の位置とサイズを特定し、病理組織サンプルを取得して更なる診断と分型を行う必要があります。マイクロ波焼灼とラジオ波焼灼は共に熱効果を利用して癌細胞を殺す方法ですが、原理、適応症、長所と短所、安全性などの面で一定の違いがあります。

適応症に関して見れば、マイクロ波焼灼は肝臓、腎臓、肺などの実質臓器の腫瘍治療に適しており、特に大きな腫瘍や多発性腫瘍の治療効果が優れています。一方、ラジオ波焼灼は肝癌、腎癌、肺癌などの悪性腫瘍の治療に適しており、特に小さな腫瘍や単発性腫瘍の治療効果が優れています。

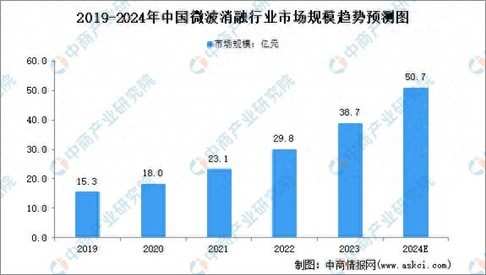

中国産業研究院の報告によると、2022-2027年の中国の腫瘍治療業界の市場展望と将来の発展動向に関する報告では、微創手術の普及、マイクロ波消融療法の各医療機関での普及および適応症の拡大に伴い、中国のマイクロ波消融市場が急速に成長していることが示されています。2023年の中国のマイクロ波消融市場規模は387億元で、前年比29.87%増加しています。中国産業研究院のアナリストは、2024年に中国のマイクロ波消融市場規模が507億元に達すると予測しています。

今年の上半期、国立癌症センターは全国の腫瘍登録および追跡監視の最新データに基づき、最先端のジャーナルである『JNCC』において2022年の中国の悪性腫瘍の疾病負担状況を発表し、2000年から2018年までの中国の癌の発症率と死亡率の傾向を更新しました。データによると、2022年の中国の新規癌症患者数は482万人であり、2015年から新規に53万人以上の癌患者が増加し、それは12%以上増加しています。新規癌症死亡例数は約257万人であり、肺癌は依然として中国で最も多い癌であり、発症率と死亡率はいずれもトップに位置しています。

データによると、新規症例の中で、上位5つのがんのタイプは肺がん、大腸がん、甲状腺がん、肝臓がん、胃がんで、がんの新規症例の57.42%を占めています。 0-74歳の中国人集団では、がんの罹患率は21.42%であり、人生で5人に1人ががんにかかることに相当します。

データによると、市場環境と一連の政策の利好の影響を受け、今年以降、米国への上場への関心が明らかに高まっています。2024年1-10月、50社の中概股がIPOを通じて米国市場に上場し、累計約24.2億ドルを調達し、さらに2社の中概股がSPACを通じて10月に上場しました。

資金調達環境が緩和されつつあり、中概股全体が評価の修復を迎えることが期待されている。ファンダメンタルズの観点から見ると、百德医療は収入規模と市場シェアにおいて明確な優位性はなく、決算発表のデータも良好ではないため、株価は継続的に圧迫されている。市場の投資家の信頼を復活させるためには、百德医療は今後多くの課題に直面するだろう。

2023年6月,公司与特殊目的收购公司(SPAC)ExcelFin Acquisition Corp.(“ExcelFin”)达成最终合并协议,拟交易完成后作为Baird Medical Investment Holdings Limited运营。根据合并协议,此次合并前的股权价值在3亿美金,合并后公司的隐含预估企业价值约为3.7亿美元,Betters股东将把其现有Betters股权100%转为Baird Medical的普通股。

2023年6月,公司与特殊目的收购公司(SPAC)ExcelFin Acquisition Corp.(“ExcelFin”)达成最终合并协议,拟交易完成后作为Baird Medical Investment Holdings Limited运营。根据合并协议,此次合并前的股权价值在3亿美金,合并后公司的隐含预估企业价值约为3.7亿美元,Betters股东将把其现有Betters股权100%转为Baird Medical的普通股。