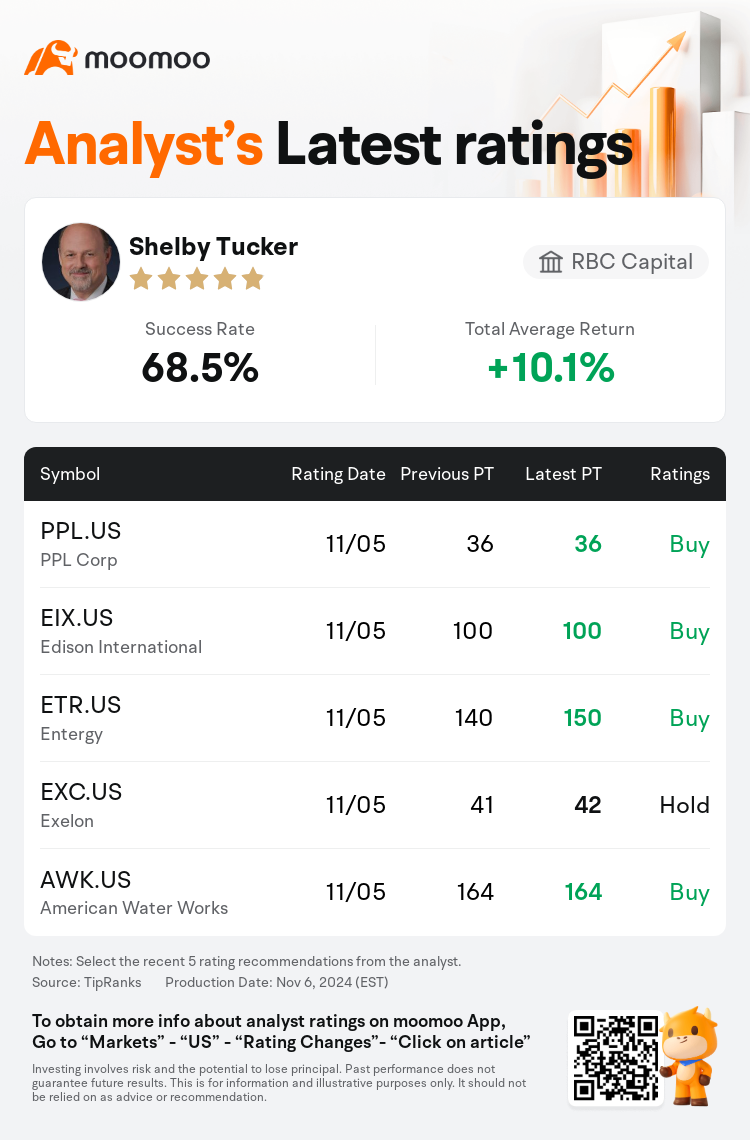

RBC Capital analyst Shelby Tucker maintains $Entergy (ETR.US)$ with a buy rating, and adjusts the target price from $140 to $150.

According to TipRanks data, the analyst has a success rate of 68.5% and a total average return of 10.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Entergy (ETR.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Entergy (ETR.US)$'s main analysts recently are as follows:

In light of its Q3 earnings disclosure, Entergy has revised its strategic business plan, indicating an uptick in capital expenditure projections, increased forecasts for sales growth, and an enhanced guidance for EPS along with a higher growth rate for EPS. Additionally, the company has made known that it has committed to a service agreement with a major customer in Louisiana, necessitating the construction of three new combined cycle units, and has expressed its intentions to pursue the development of nuclear units. While the updated strategy signifies value creation, it also introduces execution risks, which alongside the prevailing market valuation, affects the overall assessment of the company's outlook.

The company now presents an enhanced growth and risk profile, with industrial sales driving earnings to expand above its peers at a rate of 8%-9%. Additionally, regulatory issues in Louisiana have reached a resolution that is more constructive than initially anticipated. Although hurricane risk remains a structural concern, the current valuation of the shares presents a more balanced risk/reward scenario.

The robust quarter for Entergy was recognized, with discussions highlighting the potential incorporation of carbon capture and nuclear technology within its fleet to address the significant load growth in its service area.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

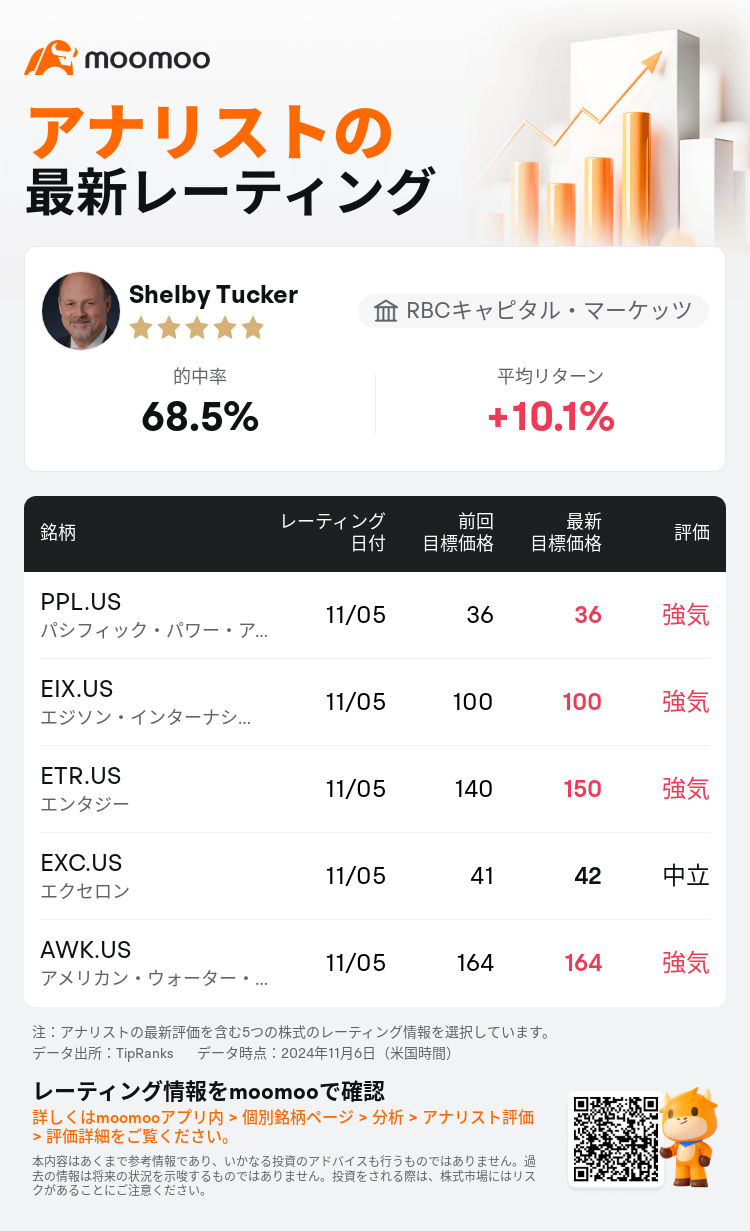

RBCキャピタル・マーケッツのアナリストShelby Tuckerは$エンタジー (ETR.US)$のレーティングを強気に据え置き、目標株価を140ドルから150ドルに引き上げた。

TipRanksのデータによると、このアナリストの最近1年間の的中率は68.5%、平均リターンは10.1%である。

また、$エンタジー (ETR.US)$の最近の主なアナリストの観点は以下の通りである:

また、$エンタジー (ETR.US)$の最近の主なアナリストの観点は以下の通りである:

エンタージは、第3四半期の収益開示を受けて、戦略的ビジネス計画を見直し、資本支出の予測の上昇、売上成長の予測の増加、EPSに対する向上したガイダンス、およびより高いEPS成長率を示しています。さらに、同社はルイジアナ州の主要顧客との契約に合意し、3つの新しいコンバインドサイクルユニットの建設が必要となりました。また、同社は原子力ユニットの開発を追求する意向を表明しました。更新された戦略は価値創出を示していますが、実行リスクを導入し、現在の市場評価と併せて、会社の見通し全体に影響を与えています。

現在、会社は強化された成長とリスクプロファイルを提示し、産業売上が、収益を同業他社よりも8〜9%の割合で拡大させているという。さらに、ルイジアナ州における規制上の問題は、当初予想よりも建設的な解決に至りました。ハリケーンリスクは構造的な懸念であり続けていますが、株式の現在の評価はよりバランスの取れたリスクとリターンのシナリオを提示しています。

エンタージにとって力強い四半期が認識され、議論では、カーボンキャプチャや原子力テクノロジーをフリートに組み込む可能性が、サービスエリアの大きな需要成長に対処するために取り上げられています。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

また、$エンタジー (ETR.US)$の最近の主なアナリストの観点は以下の通りである:

また、$エンタジー (ETR.US)$の最近の主なアナリストの観点は以下の通りである:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of