國際數據公司(IDC)於近日發佈了《中國數據備份與恢復系統市場(DR&P)季度跟蹤報告,2024上半年》。

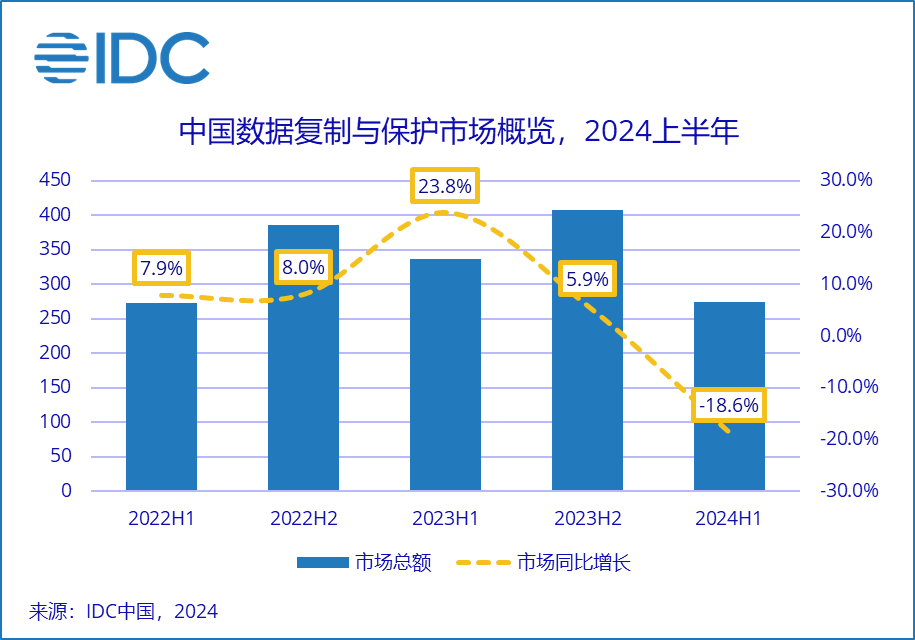

智通財經APP獲悉,國際數據公司(IDC)於近日發佈了《中國數據備份與恢復系統市場(DR&P)季度跟蹤報告,2024上半年》。報告顯示,中國DR&P市場收入在2024年上半年達到2.7億美元。受到市場數據資產化和產品化需求的推動,市場佔比保持穩定;備份與保護純軟件收入比重超過三成,由於能更快的適應新技術的發展,並進一步提升兼容性,成爲最終用戶採購的選購方向。IDC預測,未來五年,中國DR&P市場將以接近5%的年複合增長率(CAGR)增長,市場規模在2028年將超過10億美元。

經歷了2023年的高速增長,2024年上半年,數據備份與恢復市場的份額在整體企業級市場中保持平穩出貨量。

作爲生產資料,並逐漸提升價值成爲商品的——數據,安全方面的防護需求仍在進一步提升。繼「數據安全法」出臺後,2025年8月將實施剛由國務院通過的《網絡數據安全管理條例》,進一步規範數據處理活動,保障數據安全,以促進數據依法合理有效利用。企業與組織機構不僅對自有數據的內在安全需求提升,進一步的,隨着數據的產品化,對數據安全有效的複製與備份需求不斷提升。多重市場利好因素將在2024年繼續推動DR&P解決方案健康增長。

作爲生產資料,並逐漸提升價值成爲商品的——數據,安全方面的防護需求仍在進一步提升。繼「數據安全法」出臺後,2025年8月將實施剛由國務院通過的《網絡數據安全管理條例》,進一步規範數據處理活動,保障數據安全,以促進數據依法合理有效利用。企業與組織機構不僅對自有數據的內在安全需求提升,進一步的,隨着數據的產品化,對數據安全有效的複製與備份需求不斷提升。多重市場利好因素將在2024年繼續推動DR&P解決方案健康增長。

從子市場來看,2024年上半年,中國數據備份與恢復軟件市場(DR&P SW)出貨佔比超過3成。2024年中小企業恢復採購,數據備份與恢復軟件以其靈活定和成本效益成爲中小企業的首選,可以滿足他們迫切的數據備份與保護需求,同時也提供簡便的運維,尤其是在故障排查方面。

一體機市場(PBBA Appliance)同比增速遠高於數據備份與恢復整體市場情況。最終用戶對於數據丟失或損壞時的快速恢復功能越來越看重,備份一體機在保障業務連續性方面有較強優勢;加之技術供應商正在積極研發併爲一體機設備搭載智能化的管理功能,例如自動檢測數據變化、根據預設策略進行智能備份等,幫助降低人爲操作複雜性,提升數據備份效率和恢復速度。

市場格局

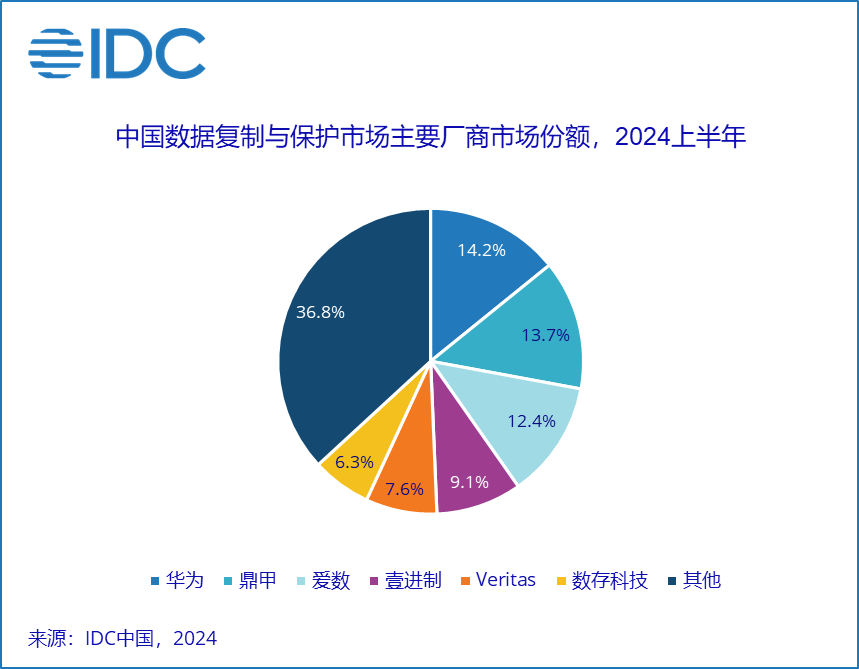

從整體市場來看,頭部技術供應商競爭態勢基本保持穩定,更多腰部技術供應商憑藉各自優勢獲得市場青睞。

從數據複製與保護整體市場來看,有兩家市場份額髮生了一定的變化 。其中,愛數的備份解決方案支撐豐富的操作系統、數據庫和應用系統備份,提供高效的數據壓縮技術與加密功能,在整體市場中份額上升近5%,獲得最終客戶青睞;數存科技在整體市場中佔比上升超過2%,通過集成智能化的數據保護與管理功能,包括自動定時保護、虛擬化無代理、自定義代理等,實現數據的實時監控和備份,其備份解決方案在醫療行業中獲得認可。

從備份軟件子市場來看,英方(688435.SH)以超過10%的市場佔比在軟件市場排名第二,支持用戶多種數據類型和環境的備份,並採用優化算法和傳輸機制提升備份性能;雲信達憑藉CDM技術爲客戶盤活暗數據,在軟件市場提升超過4%的份額,爲客戶提供簡單、快速、高效的數據恢復能力。

IDC中國研究經理楊昀煦表示,隨着AI等技術的落地,企業對數據備份、管理與數據恢復類解決方案的需求仍在不斷提升,這將繼續推動中國DR&P市場的健康增長。

作为生产资料,并逐渐提升价值成为商品的——数据,安全方面的防护需求仍在进一步提升。继“数据安全法”出台后,2025年8月将实施刚由国务院通过的《网络数据安全管理条例》,进一步规范数据处理活动,保障数据安全,以促进数据依法合理有效利用。企业与组织机构不仅对自有数据的内在安全需求提升,进一步的,随着数据的产品化,对数据安全有效的复制与备份需求不断提升。多重市场利好因素将在2024年继续推动DR&P解决方案健康增长。

作为生产资料,并逐渐提升价值成为商品的——数据,安全方面的防护需求仍在进一步提升。继“数据安全法”出台后,2025年8月将实施刚由国务院通过的《网络数据安全管理条例》,进一步规范数据处理活动,保障数据安全,以促进数据依法合理有效利用。企业与组织机构不仅对自有数据的内在安全需求提升,进一步的,随着数据的产品化,对数据安全有效的复制与备份需求不断提升。多重市场利好因素将在2024年继续推动DR&P解决方案健康增长。