The red rocket is coming.

In October, the A-share market experienced a magnificent roller coaster ride, completing a thrilling bull-bear switch.

As the sharpest spear in this round of market, domestic and foreign funds alike choose to use ETFs to allocate to the Chinese stock market.

In October, ETF funds continued to net inflow 64.586 billion yuan. During the same period, global funds gobbled up A-shares by 170 billion yuan, with overseas passive funds net inflowing for 5 consecutive weeks.

In October, ETF funds continued to net inflow 64.586 billion yuan. During the same period, global funds gobbled up A-shares by 170 billion yuan, with overseas passive funds net inflowing for 5 consecutive weeks.

In its 20th year of establishment this year, ETFs have created multiple milestone historical moments, rightfully earning the title of the 'Gold Absorber', with net inflows exceeding 1 trillion yuan for the year.

On October 8, the scale of stock ETFs broke through the 3 trillion yuan mark for the first time, taking only 9 months. The ETF scale broke through the first 0.01 million yuan mark after 16 years, and reached 2 trillion yuan after 3 years.

What is the confidence behind the unstoppable momentum of ETFs?

01

Index funds, one of the greatest innovations.

Going back to 20 years ago, since Huaxia Fund launched the first domestic ETF - ChinaAMC Shanghai A50 Exchange Traded Fund (chinaamc shanghai a50 exchange traded fund) in 2004, ETFs in China have experienced a leap from nothing to something, from small to large.

Over the past twenty years, ETFs have blossomed all the way with their unique advantages, becoming an important way for investors to participate in the market and share the benefits of economic growth.

On November 7th, Huaxia Fund held the annual Index Conference in Beijing. Li Yimei, the general manager of Huaxia Fund, attended the event and delivered a speech.

Li Yimei stated in her opening speech:

"Over the past twenty years, ETFs have evolved from an innovative product category to the 'main battlefield' for capital inflows in the capital markets today. They have become the focus of discussion among investors on the streets, not an easy road but the result of the concerted efforts and gradual accumulation of regulators, exchanges, industry practitioners, media, and industry partners."

In fact, index funds are undoubtedly one of the greatest innovations in financial history, saving investors trillions of dollars in transaction fees over the past 20 years due to their low costs.

"This money stayed in the pockets of investors, rather than going to so-called high-paid investment experts." This is how the famous FT journalist Weigswort in 'Trillions in Index Funds' put it.

Meanwhile, index funds have subtly changed the ecology of the financial system. During various financial crises, ETFs have always been a stabilizing force in the market.

Whether it is the USA increasing ETF holdings through retirement plans or the Bank of Japan directly holding ETFs, both play a critical role in stabilizing the stock market.

In 2008, the financial crisis broke out, causing a severe blow to the global financial market. That year, global mutual funds (excluding ETFs) experienced a net sales of -256.7 billion US dollars, while ETFs defied the trend with a net inflow of 187.5 billion US dollars, being the only fund asset category to achieve a net capital inflow.

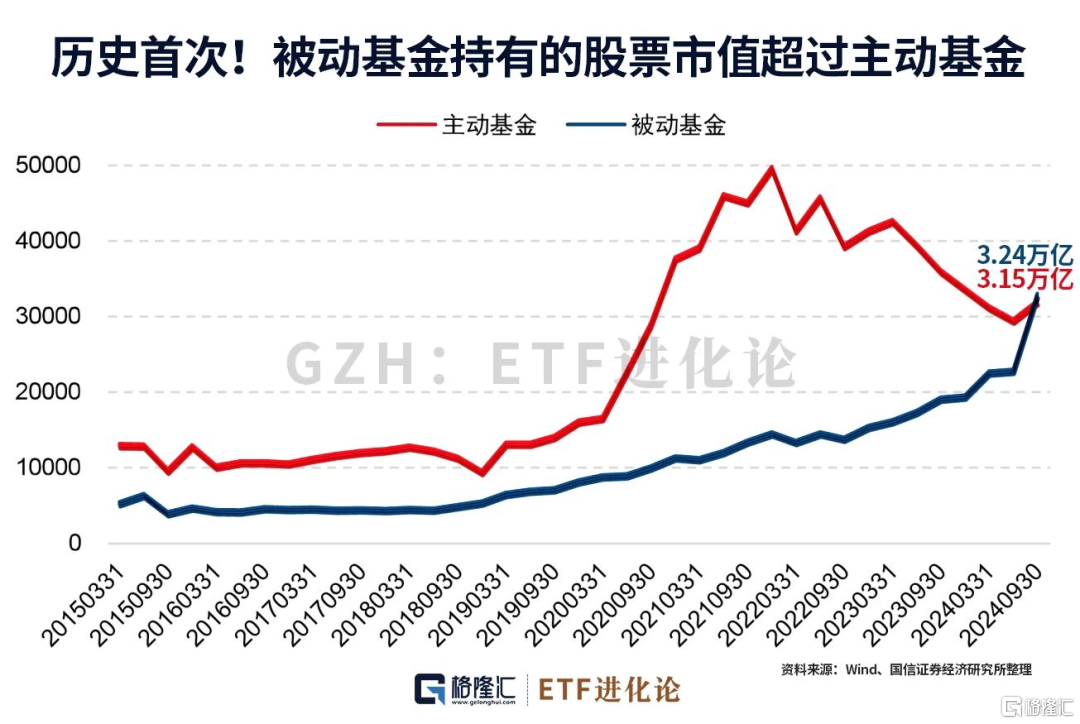

By 2023, the global passive fund scale officially exceeded that of active funds, adding a significant touch to index investment.

02

The first ETF, a difficult birth

By 2024, the domestic ETF market will celebrate its twentieth anniversary, marking a milestone moment.

In the third quarter of this year, passive funds held a market value of A-shares surpassing that of active funds for the first time in history.

Twenty years ago, the first ETF in China, the Huaxia ChinaAMC Shanghai A50 Exchange Traded Fund, was officially born.

Looking back at the birth process of the Huaxia ChinaAMC Shanghai A50 Exchange Traded Fund, it can be described as full of twists and turns.

In the early 1990s, the Chinese capital markets, under the dividend of reform and opening up, grew rapidly, with various financial innovative products emerging endlessly.

In 2001, the Strategic Development Committee of the Shanghai Stock Exchange proposed the idea of designing ETFs. Huaxia Fund keenly seized this opportunity and began to research ETFs.

Li Yimei, the general manager of Huaxia Fund who personally experienced the birth process of the ChinaAMC Shanghai A50 Exchange Traded Fund, recalled:

"During the development of the ETF, hundreds of various problems were encountered, involving product establishment, subscription and redemption, component stock trading, arbitrage, and so on."

As an innovative product, the development of ETFs faced many obstacles in terms of legal systems and practical operations. At that time, the Securities Law did not cover it, and the Fund Law did not have clear provisions.

ETF development has been stuck in the first step: there is no legal basis for the launch of ETFs.

What to do?

In order to develop the ChinaAMC Shanghai A50 Exchange Traded Fund, Huaxia Fund spent more than three years, learning from overseas institutions on one hand, and repeatedly studying how to establish a framework system for physical subscription and redemption within the legal framework at that time.

It was not until nearly three years after the issuance and operation details of the ChinaAMC Shanghai A50 ETF had been nearly perfected that the State Council formally approved ETFs as a "specially regulated" fund type, and ETF development finally obtained a legal basis.

In June 2004, the China Securities Regulatory Commission officially approved the launch of ETFs by the Shanghai Stock Exchange. In July of that year, Huaxia Fund was approved as the first ETF product, the Fund Manager of the Huaxia ChinaAMC Shanghai A50 ETF.

After all the hardships, the Huaxia ChinaAMC Shanghai A50 ETF can finally start fundraising.

A new problem has arisen.

Unlike today when everyone knows the benefits of ETFs, at that time investors barely understood even mutual funds, let alone this disruptive and innovative type of ETF.

The general manager responsible for the sales of ChinaAMC Shanghai A50 Exchange Traded Fund, Li Yimei, still vividly remembers the year in which many things happened:

"At that time, I had no idea. Everyone said that fund products with numbers or letters in their names are difficult to sell, and ChinaAMC Shanghai A50 ETF, which has both numbers and letters, is even more challenging. No one knew what ETF was."

In difficult situations, the most fearful thing is to have someone who is determined.

"We could only go to each brokerage firm and promote tirelessly. Often, we would speak for over two hours in one session. It was common for us to finish one session, then hurriedly take a green leather train for several hours to the next branch to continue speaking," Li Yimei recalled.

After strenuous efforts, on December 30, 2004, Huaxia ChinaAMC Shanghai A50 ETF announced that it had raised 5.4 billion yuan. In February 2005, Huaxia ChinaAMC Shanghai A50 ETF officially began trading, and its latest scale now exceeds 160 billion yuan.

03

Deeply cultivating index investments for twenty years.

After that, at every key moment in the development of ETFs, you can see the presence of Huaxia Fund.

In May 2012, the Huaxia300 ETF officially launched as a cross-market ETF, ushering in a new era of domestic ETF cross-market trading. Huaxia300 ETF, as one of the first batch of Huaxia300 ETFs, is now listed with a latest scale of up to 170 billion yuan.

On August 9, 2012, Huaxia Hengsheng ETF was established, investing in the Hong Kong market through the QDII channel, being one of the first cross-border ETF products.

In 2015, the first domestic ETF option - Huaxia SSE 50 ETF options started trading, further expanding the onshore equity derivatives product system.

From the first ETF product breaking ground, to gradual investor recognition, to the rapid growth in ETF scale, in the flourishing 20 years of ETF development, Huaxia Fund's development has never stopped.

Starting from scratch, the ETF was unknown and unnoticed for 16 years.

Li Yimei sighed: "We are like walking in a long corridor, at the beginning there was only a faint light, and only we bravely moved forward."

It is because 20 years ago, the seed of ETF was planted, and with consistent cultivation, when the opportunity arose, Huaxia Fund was able to quickly seize the opportunity of ETF.

Therefore, in this group of elites, in the competitive ETF ecosystem, it is no coincidence that Huaxia Fund can be known as the "Index King", with its equity ETF ranking TOP1 in scale for 19 consecutive years, and the number of serviced customers growing from tens of thousands to 0.215 billion.

In the third quarter of this year, the scale of Huaxia Fund equity index products reached 765.7 billion, ranking first in the industry.

04

Red rocket, index investment is effortless.

Li Yimei deeply understands that wealth management must truly gain the recognition of investors, all aspects go through the test of time. Only when investors win, can the industry win.

As vividly displayed on the Huaxia Fund official website, the slogan "Dedicate Returns for Trust."

"For twenty years, from ChinaAMC Shanghai A50 Exchange Traded Fund to the current A500ETF, the core principle of Huaxia Fund's ETF business has always remained unchanged, which is 'keep the complexity to ourselves and give the simplicity to investors', making every effort to make investing effortless for investors." Li Yimei said so.

Standing at a new milestone in the ETF, the domestic market is entering the 'q&m dental index investment era,' but new problems are emerging one after another.

ETF names are confusing, different ETFs tracking the same index have different performances, and the differences between similar index names such as CSI new energy vehicles index? Electric vehicles index? Every detail is puzzling.

Huaxia fund keenly observes the various pain points in index investment. Since 2021, they have been thinking about how to pass on a vast amount of data, experience, and information to index investors without any compromise in an accessible way.

In order to build the best index investment tool, Huaxia Fund has assembled an elite project team, conducted in-depth research on over 450 investors, spent over 0.12 million hours on development and debugging, forged for more than 1000 days and nights, and refined over 90 official versions.

After three years of careful preparation, on November 7th, Li Yimei officially announced the launch of an all-in-one index investment tool called the 'Red Rocket' at the annual index conference of Huaxia Fund, aiming to make index investment clear, efficient, and easy.

In order to effectively help investors uncover the 'marketing information' veil and quickly understand the essence of index investment, the foundation of all services of the Red Rocket is 'index,' including 'Index Browser,' 'Index Comparison,' 'Hot Stocks Select Index,' and 'Index Wind Vane' on the home page.

The 'Index Browser' solves the quick understanding of an index through three dimensions. By searching for the Guozheng Semiconductor Index in the 'Index Browser Search,' you can quickly understand the recent trend, valuation level, profit situation, industry policies, and all fund products tracking this index.

05

Summary

Looking at the development process in the USA, Japan, and Europe, as the ETF scale expands, the market fund structure gradually optimizes, further driving the entry of medium and long-term funds into the market, which is a stabilizing factor for the stock market.

At the current point in time, with real estate returning to its housing attributes, the new asset management regulations breaking the net redemption constraint, ETFs will play an important role in the process of long-term fund entry and serving residents' wealth management.

Policies also have high expectations for the development of ETFs. The new 'Nine Articles of the State' explicitly proposes to 'establish a fast approval channel for exchange-traded open-end index funds (ETF), promote the development of index investment.'

For Huaxia Fund, looking back at the 20 years that ETFs have gone through, it has never been an easy path, but rather a process of breakthroughs after breakthroughs, accumulating strength through time, steadfast in values. Every step taken on the journey matters.

20 years ago, the first ETF was launched despite difficulties and obstacles; 20 years later, it has brought a soaring success. Huaxia Fund firmly believes that index funds are the next Alipay Yu'e Bao, simple, transparent, sustainable, and can be the first choice for every investor.

Looking back, the light boat has passed through thousands of mountains. Looking ahead, the road is long and bright.

Scroll up and down to view the full risk warning:

The above content only reflects the current market situation, which may change in the future and does not represent any investment advice or recommendation. Past performance of an index does not guarantee its future performance, nor does it constitute a guarantee of fund investment returns or any investment advice. The short operating time of an index may not reflect all stages of market development. Index funds have tracking errors, and past performance does not guarantee future results. Before purchasing any fund products, please read legal documents such as the Fund Contract and Prospectus and choose products suitable for yourself based on your risk tolerance and investment goals. The market is risky, so investment should be made cautiously.

10月,ETF资金继续净流入645.86亿元。同期,全球资金爆买A股1700亿,海外被动资金已经连续5周净流入。

10月,ETF资金继续净流入645.86亿元。同期,全球资金爆买A股1700亿,海外被动资金已经连续5周净流入。