The average increase of A-share IPOs on the first day was 225%

Tomorrow (November 8), the A-share market will welcome 3 new shares to be purchased, namely Jintian Titanium (688750.SH) of the Science and Technology Innovation Board, Yilian Technology (301631.SZ) of the GEM Stock Exchange, and Wan Yuantong (920060.BJ) of the Beijing Stock Exchange. Since this year's money-making effect is quite good, you can actively participate in the subscription.

According to Gelonghui statistics, as of November 7, a total of 82 A-share companies were newly listed this year. Only 1 Shanghai Hejing broke off on the first day of listing, Haisheng Pharmaceutical closed on the first day, and the remaining 80 companies all closed higher on the first day of listing.

The 82 newly listed A-share companies had an average increase of 225% on the first day. Among them, the highest increase was Qiangbang New Materials, which closed up 1738.95% on the first day; the tenth place on the increase list was Qiangda Circuit, with an increase of 387.93%.

The 82 newly listed A-share companies had an average increase of 225% on the first day. Among them, the highest increase was Qiangbang New Materials, which closed up 1738.95% on the first day; the tenth place on the increase list was Qiangda Circuit, with an increase of 387.93%.

01

Jintian Titanium Industry: Focus on the field of titanium materials in the aerospace industry

Hunan Xiangtou Jintian Titanium Technology Co., Ltd. (“Jintian Titanium” for short) launched an IPO on November 7, 2024. Zhongtai Securities Co., Ltd. and China Aviation Securities Co., Ltd. are co-sponsors, and the stock code is 688750.SH.

The current issue price of Jintian Titanium Industry is 7.16 yuan/share, making it the 15th new A-share offering price of less than 10 yuan/share this year.

The company's issuance price-earnings ratio is 24.72 times. The industry it belongs to is the non-ferrous metal smelting and rolling processing industry (C32). As of November 5, 2024 (T-3), the average static average static price-earnings ratio for the industry in the last month announced by China Securities Index Co., Ltd. was 17.54 times.

The arithmetic average static price-earnings ratio of listed companies selected in the prospectus after dilution of net profit due to mother before or after deduction in 2023 was 36.9 times (as of November 5, 2024).

The price-earnings ratio of Jintian Titanium's current offering is higher than the average static price-earnings ratio of the industry in the last month published by China Securities Index Co., Ltd., and lower than the static price-earnings ratio of comparable companies in the same industry before and after deduction in 2023.

The number of shares issued this time was 92.5 million shares, accounting for 20% of the company's total share capital after issuance. All of them were publicly issued new shares, and the total share capital after the public offering was 0.4625 billion shares. Each subscription unit is 500 shares, and the number of shares to be purchased shall be 500 shares or an integer multiple thereof, but the maximum shall not exceed one-thousandth of the number of shares initially issued online, or 0.0165 million shares.

Investors who opened a securities account with China Settlement Shanghai Branch before November 8, 2024 (T-day) and held unrestricted A-share shares and unrestricted depository certificates in the Shanghai market with an average daily market value of 0.01 million yuan or more for 20 trading days (including T-2) before November 6, 2024 (T-2) can participate in the online subscription.

The company is a high-tech enterprise mainly engaged in R&D, production and sales of high-end titanium and titanium alloy materials. Its main products are titanium and titanium alloy bars, forgings and parts, which are mainly used in high-end equipment fields such as aviation, aerospace, ships and weapons.

The downstream users of Jintian Titanium products are mainly forging manufacturers, which are ultimately used by aircraft and aero engine manufacturers. During the reporting period, the company's important customers included aviation industry subsidiaries, Triangle Defense (300775.SZ), Parker New Materials (605123.SH), Aerospace Technology (688239.SH), China Second Heavy Machinery Group Deyang Wanhang Die Forging Co., Ltd., China Aviation Development subsidiary, and Chinese shipping subsidiaries.

These customers are all important participants in the defense and military industry chain. They have strict technical requirements for products. Because of their high conversion costs, especially customers in the aerospace field, are generally not easily replaced after selecting suppliers through certification. Stable customer relationships provide important support for the company's continuous development.

From 2021 to the first half of 2024 (reporting period), benefiting from the continuous development of the domestic high-end titanium alloy material market and the acceleration of the upgrading process of national defense and military equipment, the company achieved operating income of 0.573 billion yuan, 0.7 billion yuan, 0.8 billion yuan and 409 million yuan. Net profit attributable to the company's shareholders after deduction was 87.973 million yuan, 0.109 billion yuan, 0.134 billion yuan and 716.625 million yuan, respectively.

From January to September 2024, Jintian Titanium expects to achieve operating income of 0.61 billion yuan to 0.64 billion yuan, an increase of about 8.18% to 13.50% year on year; net profit to mother 0.11 billion yuan to 0.125 billion yuan, an increase of about 16.03% to 31.86% year on year.

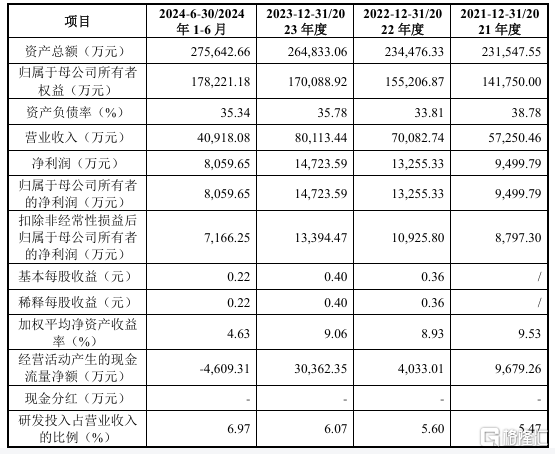

Key financial indicators of Jintian Titanium Industry, Source: Prospectus

Key financial indicators of Jintian Titanium Industry, Source: ProspectusCurrently, in the military aviation market, in addition to Jintian Titanium, which can mass-produce related titanium alloy products, there are mainly Baotai Co., Ltd. and Western Superconductor. In 2023, the market share of Jintian Titanium's titanium alloy products in the domestic aerospace sector was about 7.90%, while Western Superconductor's market share in the aforementioned market in 2020 was about 23.75%.

The company's main customers are units under the Military Industry Group and its supporting forging manufacturers. Affected by the overall arrangement of industrial chain projects and payment progress for end customers, etc., the company's accounts receivable amount is large and the accounts receivable recovery cycle is long. On June 30, 2024, the company's total accounts receivable accounted for 38.20% of total assets at the end of each period.

02

Yilian Technology: Focus on the field of electrical connection components

Shenzhen Yilian Technology Co., Ltd. (“Yilian Technology” for short) will begin online subscription on November 8. The stock code is 301631.SZ, and the sponsor is China Merchants Securities Co., Ltd.

Yilian Technology's current issuance price is 72.99 yuan/share. The corresponding price-earnings ratio of the diluted net profit attributable to shareholders of the parent company before and after deduction in 2023 was 19.06 times, lower than the static average price-earnings ratio of the same industry for the most recent month announced by China Securities Index Co., Ltd. on November 5 (T-3), 2024 (T-3). It is also 44.77 times lower than the arithmetic average of comparable listed companies in the same industry as the static price-earnings ratio attributable to the parent company's shareholders after deducting non-recurring profit and loss in 2023.

Source: Yilian Technology listing release announcement

Source: Yilian Technology listing release announcementThe number of new shares issued this time was 16.33 million shares, accounting for 25.01% of the company's total share capital after issuance, all of which were publicly issued new shares.

Investors determine their online subscription amount based on the market value of their unrestricted A-share shares and unrestricted depository certificates in the Shenzhen market (hereinafter referred to as “market value”). Based on the average daily market value held by investors for 20 trading days (including T-2) before November 6, 2024 (T-2), the average daily market value held for less than 20 trading days is calculated based on 20 trading days.

Only investors with a market capitalization of 0.01 million yuan or more can participate in the IPO. For every 5,000 yuan market capitalization, they can purchase one subscription unit, and the portion less than 5,000 yuan is not included in the subscription amount. Each subscription unit is 500 shares, and the number of shares to be purchased shall be 500 shares or an integer multiple thereof, but the maximum purchase amount shall not exceed one-thousandth of the number of shares issued online, that is, no more than 3,500 shares, and shall not exceed its maximum subscription amount calculated by market value.

Yilian Technology is a product and solution provider integrating R&D, design, production, sales and service of electrical connection components. The company is deeply involved in the field of electrical connection components. Currently, it has production bases in Shenzhen, Guangdong, Ningde, Fujian, Liyang, Jiangsu, Yibin, Sichuan, Yueqing, Zhejiang, and Zhaoqing, Guangdong.

The company's main products cover various types of electrical connection components such as battery cell connection components, power transmission components, and low voltage signal transmission components, forming an industrial development pattern with new energy vehicles as the main development axis and various application fields such as energy storage systems, industrial equipment, medical equipment, and consumer electronics.

Revenue composition of Yilian Technology's main business, source: prospectus

Revenue composition of Yilian Technology's main business, source: prospectusFrom 2021 to June 2024, the company's revenue was 1.434 billion yuan, 2.758 billion yuan, 3.075 billion yuan, and 1,692 billion yuan, respectively; net profit attributable to the company's common shareholders after deduction was 0.139 billion yuan, 0.22 billion yuan, 0.25 billion yuan, and 0.108 billion yuan.

The company's main financial data, image source: Yilian Technology's prospectus

The company's main financial data, image source: Yilian Technology's prospectusThe company expects revenue of 3.663 billion yuan to 4.033 billion yuan in 2024, with a year-on-year change of 19.14% to 31.17%; net profit attributable to shareholders of the parent company in 2024 is expected to be 0.262 billion yuan to 0.289 billion yuan, with a year-on-year change of 0.89% to 11.09%. The increase in customer order demand has led to a steady increase in the company's sales scale and profitability in 2024. The net profit growth rate is expected to be relatively slow in the face of increased market competition and rising labor costs.

During the reporting period, the company's comprehensive gross margin was 21.69%, 19.54%, 18.94% and 16.17%, respectively. In the future, with cyclical fluctuations in the industry and product upgrades, there is pressure to negotiate price reductions for the company's products.

Yilian Technology relied more on major customers in the Ningde era. From January to June 2024, revenue from the Ningde era accounted for 70.87%.

03

Wan Yuantong: Focus on the printed circuit board industry

Wan Yuantong (920060.BJ) launched the subscription on November 8. The subscription price is 11.16 yuan per share, the maximum purchase amount is 1.4725 million shares, and the maximum amount is 16.4331 million yuan. The subscription funds must be fully deposited into the account in advance.

The total number of shares issued this time was 35.65 million, and 29.45 million shares were issued online. The lead underwriter was Societe Generale Securities Co., Ltd., and the subscription payment date was November 8, 2024.

Wanyuantong's business is the “C39 computer, communication and other electronic equipment manufacturing industry” in the manufacturing industry. As of November 5, 2024, China Securities Index Co., Ltd. announced that the average static price-earnings ratio of the industry in the last month was 39.33 times.

When the corresponding over-allotment option was not exercised, Wan Yuantong's corresponding price-earnings ratio of the net profit attributable to shareholders of the parent company after deducting non-recurring profit and loss in 2023 was 14.93 times; assuming that the full amount of the over-allotment option was exercised, the issuer's corresponding price-earnings ratio of the net profit attributable to shareholders of the parent company after deducting non-recurring profit and loss in 2023 after being diluted was 15.40 times, all lower than the industry's average static price-earnings ratio for the most recent month.

The company is a high-tech enterprise specializing in the R&D, production and sales of printed circuit boards (PCBs). The products cover single panel, double panel, multi-layer board and metal substrate (copper substrate, aluminum substrate, etc.), and are widely used in consumer electronics, automotive electronics, industrial control, household appliances, communication equipment, 5G, new energy and medical devices.

During the reporting period, the company's revenue was 1.012 billion yuan, 0.969 billion yuan, 0.984 billion yuan, and 464 million yuan, respectively, and net profit to mother was 19.35 million yuan, 52.53 million yuan, 0.118 billion yuan, and 60.22 million yuan, respectively.

Wanyuantong's main financial data, source: prospectus

Wanyuantong's main financial data, source: prospectus

82家A股新上市企业首日平均涨幅为225%,其中涨幅最高的是强邦新材,首日收涨1738.95%;涨幅榜第十名是强达电路,涨幅达387.93%。

82家A股新上市企业首日平均涨幅为225%,其中涨幅最高的是强邦新材,首日收涨1738.95%;涨幅榜第十名是强达电路,涨幅达387.93%。