Despite an already strong run, TG Therapeutics, Inc. (NASDAQ:TGTX) shares have been powering on, with a gain of 27% in the last thirty days. The last month tops off a massive increase of 152% in the last year.

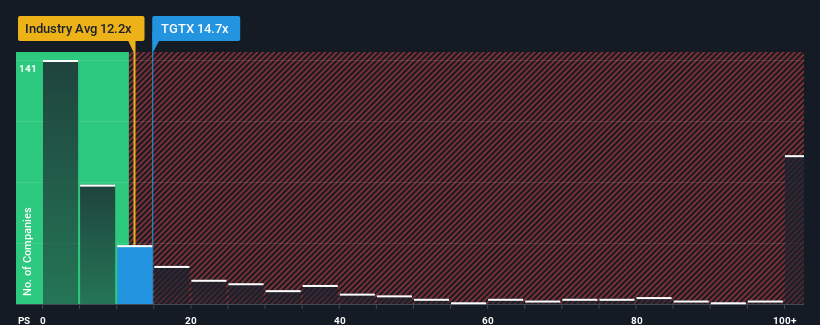

Following the firm bounce in price, TG Therapeutics' price-to-sales (or "P/S") ratio of 14.7x might make it look like a sell right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios below 12.2x and even P/S below 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

What Does TG Therapeutics' Recent Performance Look Like?

Recent times haven't been great for TG Therapeutics as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on TG Therapeutics.What Are Revenue Growth Metrics Telling Us About The High P/S?

TG Therapeutics' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

TG Therapeutics' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 40% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 56% per year as estimated by the nine analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 129% per annum, which is noticeably more attractive.

With this information, we find it concerning that TG Therapeutics is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From TG Therapeutics' P/S?

TG Therapeutics shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for TG Therapeutics, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for TG Therapeutics with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.