Market Whales and Their Recent Bets on LLY Options

Market Whales and Their Recent Bets on LLY Options

Financial giants have made a conspicuous bullish move on Eli Lilly. Our analysis of options history for Eli Lilly (NYSE:LLY) revealed 13 unusual trades.

金融巨头在Eli Lilly上做出引人注目的看好举动。我们对Eli Lilly(纽约证券交易所:LLY)的期权历史进行分析,发现了13笔异常交易。

Delving into the details, we found 53% of traders were bullish, while 15% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $190,238, and 11 were calls, valued at $638,091.

深入细节,我们发现53%的交易员持有看好态度,而15%表现出看淡的倾向。在我们发现的所有交易中,有2笔看跌交易,价值190,238美元,有11笔看涨交易,价值638,091美元。

Predicted Price Range

预测价格区间

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $500.0 to $1440.0 for Eli Lilly over the recent three months.

根据交易活动,显然一些重要投资者正瞄准Eli Lilly在最近三个月的价格区间从$500.0到$1440.0。

Insights into Volume & Open Interest

成交量和持仓量分析

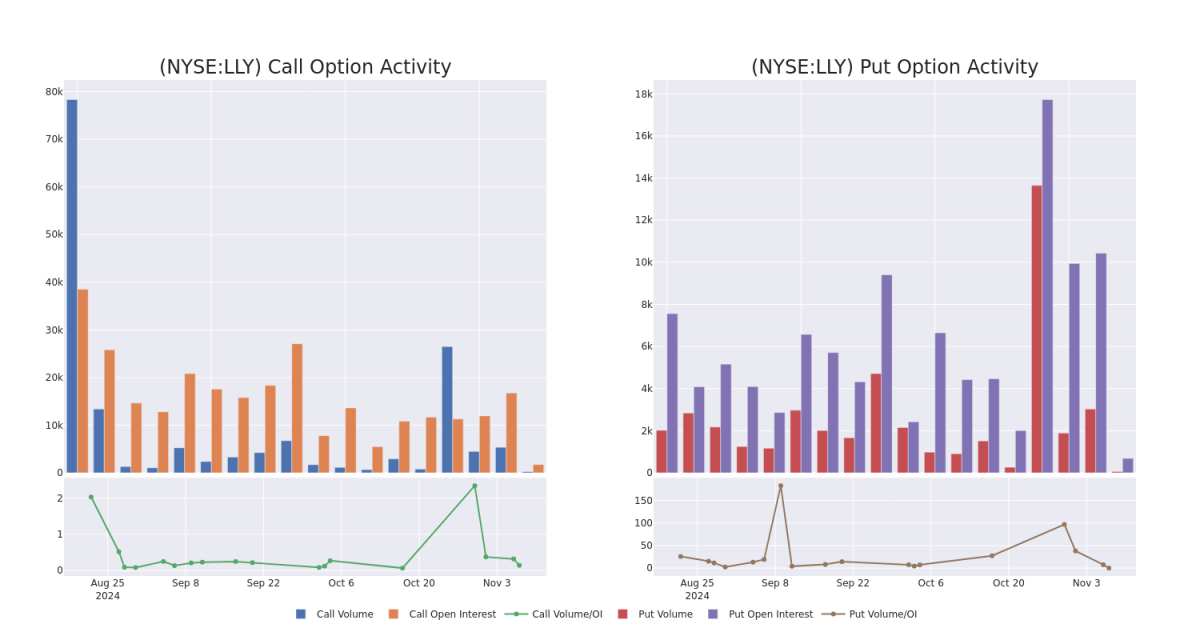

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Eli Lilly's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Eli Lilly's substantial trades, within a strike price spectrum from $500.0 to $1440.0 over the preceding 30 days.

评估成交量和未平仓合约是期权交易中的一项战略步骤。这些指标揭示了Eli Lilly期权在指定行权价上的流动性和投资者兴趣。即将到来的数据将可视化呈现出过去30天内与Eli Lilly的重要交易相关的看涌量和未平仓合约的波动,这些交易均在$500.0至$1440.0的行权价范围内。

Eli Lilly Option Volume And Open Interest Over Last 30 Days

Eli Lilly过去30天的期权成交量和未平仓合约量

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LLY | CALL | SWEEP | BULLISH | 02/21/25 | $22.9 | $21.6 | $22.9 | $880.00 | $160.3K | 189 | 105 |

| LLY | PUT | TRADE | NEUTRAL | 11/08/24 | $26.2 | $24.3 | $25.31 | $810.00 | $146.7K | 636 | 61 |

| LLY | CALL | TRADE | BULLISH | 02/21/25 | $59.5 | $59.5 | $59.5 | $780.00 | $119.0K | 131 | 43 |

| LLY | CALL | TRADE | BEARISH | 12/18/26 | $22.85 | $21.6 | $21.6 | $1440.00 | $62.6K | 44 | 30 |

| LLY | CALL | TRADE | BULLISH | 06/20/25 | $300.5 | $296.1 | $300.5 | $500.00 | $60.1K | 4 | 2 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LLY | 看涨 | SWEEP | 看好 | 02/21/25 | $22.9 | $21.6 | $22.9 | $880.00 | $160.3K | $ | 105 |

| LLY | 看跌 | 交易 | 中立 | 11/08/24 | $26.2 | $24.3 | $25.31 | 810.00美元 | $146.7K | 636 | 61 |

| LLY | 看涨 | 交易 | 看好 | 02/21/25 | $59.5 | $59.5 | $59.5 | $780.00 | $119.0K | 131 | 43 |

| LLY | 看涨 | 交易 | 看淡 | 12/18/26 | $22.85 | $21.6 | $21.6 | $1440.00 | $62.6K | 44 | 30 |

| LLY | 看涨 | 交易 | 看好 | 06/20/25 | $300.5 | $296.1 | $300.5 | $500.00 | $60.1K | 4 | 2 |

About Eli Lilly

关于Eli Lilly

Eli Lilly is a drug firm with a focus on neuroscience, cardiometabolic, cancer, and immunology. Lilly's key products include Verzenio for cancer; Mounjaro, Zepbound, Jardiance, Trulicity, Humalog, and Humulin for cardiometabolic; and Taltz and Olumiant for immunology.

Eli Lilly是一家专注于神经科学,心脏代谢,癌症和免疫学的药物公司。Lilly的主要产品包括用于治疗癌症的Verzenio;用于心脏代谢的Mounjaro,Zepbound,Jardiance,Trulicity,Humalog和Humulin;以及用于免疫学的Taltz和Olumiant。

After a thorough review of the options trading surrounding Eli Lilly, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

经过对以往与Eli Lilly有关的期权交易的彻底审查,我们转而更详细地研究这家公司。这包括对其当前市场地位和表现的评估。

Current Position of Eli Lilly

Eli Lilly的当前位置

- With a volume of 648,226, the price of LLY is up 1.08% at $784.78.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 89 days.

- 以648,226的成交量,LLY的价格上涨1.08%,报784.78美元。

- RSI指标表明该基础股票可能被超卖。

- 下一次财报预计在89天后发布。

What Analysts Are Saying About Eli Lilly

分析师对Eli Lilly的看法

5 market experts have recently issued ratings for this stock, with a consensus target price of $1074.6.

最近有5位市场专家为这支股票发布了评级,一致的目标价是1074.6美元。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Consistent in their evaluation, an analyst from Truist Securities keeps a Buy rating on Eli Lilly with a target price of $1033. * An analyst from Citigroup persists with their Buy rating on Eli Lilly, maintaining a target price of $1250. * An analyst from Deutsche Bank has decided to maintain their Buy rating on Eli Lilly, which currently sits at a price target of $1015. * An analyst from Barclays persists with their Overweight rating on Eli Lilly, maintaining a target price of $975. * An analyst from B of A Securities has decided to maintain their Buy rating on Eli Lilly, which currently sits at a price target of $1100.

20年期权交易专家透露了他的一线图表技术,显示何时买入和卖出。复制他的交易,平均每20天获利27%。点击这里获取访问。* Truist Securities的一位分析师坚持给Eli Lilly股票买入评级,目标价为1033美元。* Citigroup的一位分析师坚持给Eli Lilly股票买入评级,目标价为1250美元。* 德意志银行的一位分析师决定维持给Eli Lilly股票买入评级,目前的目标价为1015美元。* 巴克莱银行的一位分析师坚持给Eli Lilly股票超配评级,目标价为975美元。* b of A Securities的一位分析师决定维持给Eli Lilly股票买入评级,目前的目标价为1100美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Eli Lilly with Benzinga Pro for real-time alerts.

期权交易涉及更大的风险,但也提供更高利润的潜力。精明的交易员通过持续教育、战略交易调整、利用各种因子,并保持对市场动态的敏感,来减轻这些风险。通过Benzinga Pro及时了解Eli Lilly的最新期权交易,获取实时警报。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Eli Lilly's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Eli Lilly's substantial trades, within a strike price spectrum from $500.0 to $1440.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Eli Lilly's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Eli Lilly's substantial trades, within a strike price spectrum from $500.0 to $1440.0 over the preceding 30 days.