United States Cellular Corp (NYSE:USM) has agreed with AT&T Inc (NYSE:T) to sell a portion of its retained spectrum licenses for $1.018 billion.

The transaction aligns with UScellular's strategy, announced in May 2024, to capitalize on its remaining spectrum assets, which are not included in the proposed sale to T-Mobile US Inc (NASDAQ:TMUS).

This sale follows agreements made in October 2024 to sell other retained licenses to Verizon Communications Inc (NYSE:VZ) and two additional mobile network operators.

Also Read: Datadog Beats Q3 Estimates, Margins Show Mixed Results

Also Read: Datadog Beats Q3 Estimates, Margins Show Mixed Results

Laurent C. Therivel, President and CEO of UScellular, emphasized the value generated through recent deals, noting that AT&T's inclusion as a buyer expands the roster of networks set to benefit from UScellular's assets.

Therivel expressed confidence that AT&T will utilize the acquired licenses to support communities across the U.S.

With this transaction and previous agreements, UScellular has established deals to monetize around 55% of its spectrum holdings (excluding mmWave) on an MHz-Pops basis.

These deals collectively amount to approximately $2.02 billion. Once the proposed T-Mobile transaction is finalized, UScellular will have agreements to monetize approximately 70% of its overall spectrum assets.

Therivel added that UScellular would retain 1.86 billion MHz-Pops of low- and mid-band spectrum and 17.2 billion MHz-Pops of mmWave spectrum. He highlighted the strategic value of UScellular's C-band licenses, which offer competitive mid-band frequencies, strong support in the 5G ecosystem, and extended build-out timelines through 2029 and 2033.

This flexibility allows UScellular to leverage or sell these assets in the future, with plans to explore further monetization options for the C-band and other remaining spectrum.

The agreement involves selling 1,250 million MHz-Pops of 3.45 GHz licenses and 331 million MHz-Pops of 700 MHz B/C block licenses to AT&T for $1.018 billion, subject to potential adjustments outlined in the purchase agreement.

The transaction's completion hinges on closing the T-Mobile deal and obtaining regulatory approvals and customary closing conditions.

Some licenses to be transferred to AT&T are partially owned by a third party. Their sale will depend on UScellular's purchase of remaining equity in the third party, which is pending regulatory approval. These licenses account for around 15% of the MHz-Pops covered in this sale.

TDS, which holds an 83% stake in UScellular, has formally approved the transaction with AT&T.

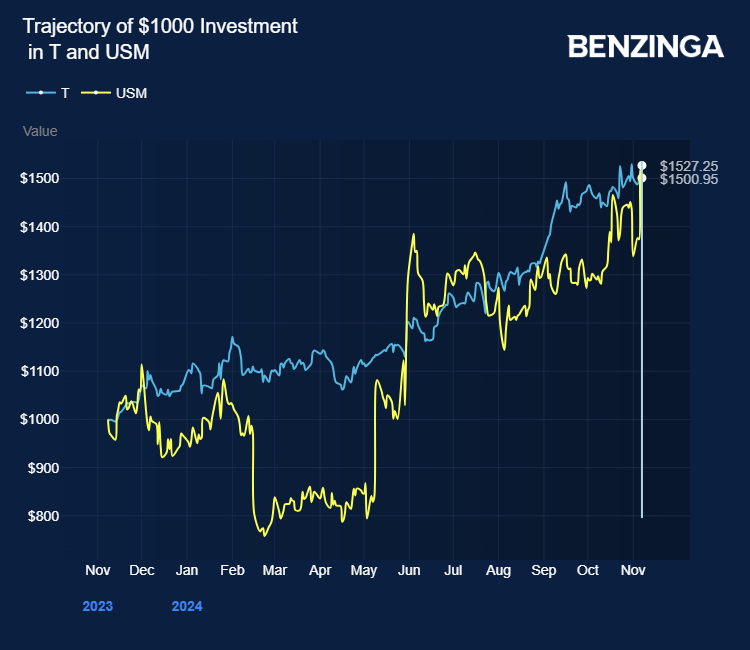

AT&T generated $10.24 billion in operating cash flow and $5.095 billion in free cash flow for the September 30, 2024 quarter. T is down 0.94%.

Price Action: USM stock is up 0.20% at $65.28 at the last check on Thursday.

Also Read:

- Appian Projects Positive Adjusted EBITDA, Boasts Strong Subscription Revenue In Q3

Photo by Tdorante10 via Wikimedia Commons