Market Whales and Their Recent Bets on LYFT Options

Market Whales and Their Recent Bets on LYFT Options

Investors with a lot of money to spend have taken a bullish stance on Lyft (NASDAQ:LYFT).

擁有大量資金的投資者對Lyft(納斯達克:LYFT)採取看好的立場。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我們在這裏追蹤的公開期權歷史記錄上看到交易時發現了這一點。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with LYFT, it often means somebody knows something is about to happen.

無論是機構還是富裕個人,我們不清楚。但當Lyft發生這麼大的事情時,通常意味着有人知道即將發生的事情。

So how do we know what these investors just did?

那麼我們如何知道這些投資者剛剛做了什麼呢?

Today, Benzinga's options scanner spotted 25 uncommon options trades for Lyft.

今天,Benzinga的期權掃描器發現Lyft有25筆不尋常的期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 52% bullish and 48%, bearish.

這些大手交易者的整體情緒在看好和看淡之間分爲52%和48%。

Out of all of the special options we uncovered, 6 are puts, for a total amount of $347,011, and 19 are calls, for a total amount of $1,852,255.

在我們發現的所有特殊期權中,有6個看跌期權,總金額爲347,011美元,有19個看漲期權,總金額爲1,852,255美元。

Predicted Price Range

預測價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $10.0 and $30.0 for Lyft, spanning the last three months.

經過評估交易量和未平倉合約後,可以清楚地看出,主要市場推動者正在專注於Lyft股價在10.0美元到30.0美元之間的價格區間,歷時過去三個月。

Insights into Volume & Open Interest

成交量和持倉量分析

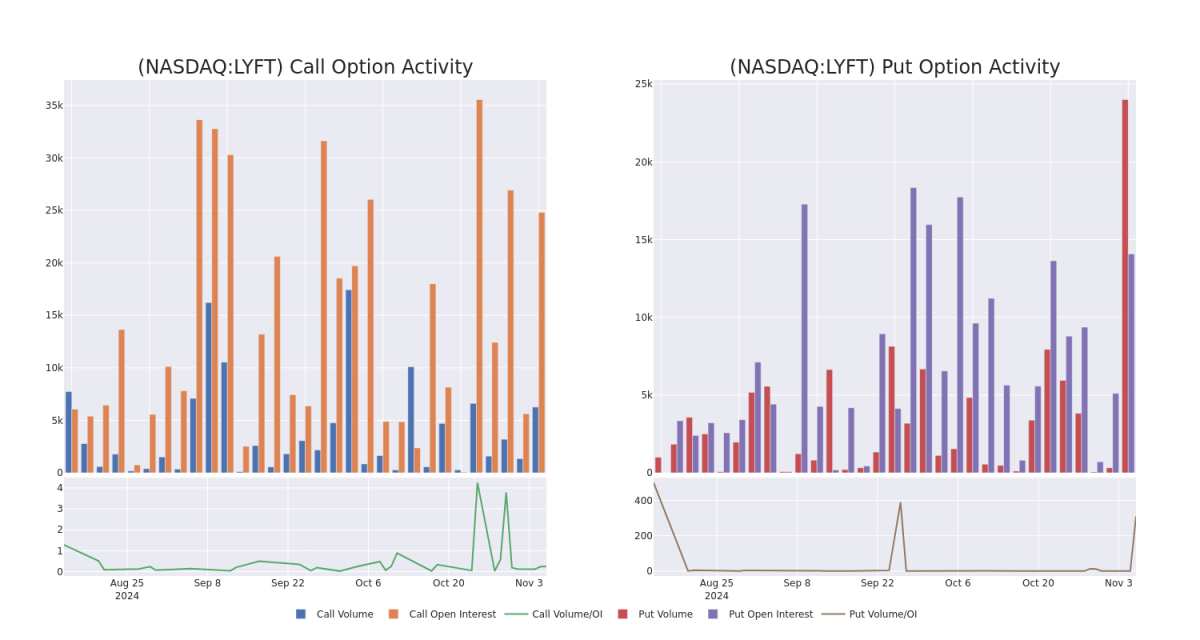

In today's trading context, the average open interest for options of Lyft stands at 3853.29, with a total volume reaching 39,771.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Lyft, situated within the strike price corridor from $10.0 to $30.0, throughout the last 30 days.

在今天的交易背景下,Lyft期權的平均未平倉合約爲3853.29,總成交量達到39,771.00。隨附的圖表描述了Lyft高價值交易的看漲和看跌期權成交量和未平倉合約的發展,這些交易位於Lyft的罷工價走廊範圍內,從10.0美元到30.0美元,歷時最近30天。

Lyft Option Activity Analysis: Last 30 Days

Lyft期權活動分析:最近30天

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LYFT | CALL | TRADE | BULLISH | 01/16/26 | $2.86 | $2.74 | $2.86 | $25.00 | $572.0K | 6.9K | 2.4K |

| LYFT | CALL | SWEEP | BEARISH | 01/17/25 | $1.6 | $1.59 | $1.6 | $19.00 | $184.3K | 3.0K | 1.2K |

| LYFT | CALL | SWEEP | BEARISH | 01/16/26 | $6.8 | $6.7 | $6.7 | $15.00 | $170.8K | 3.1K | 1.0K |

| LYFT | CALL | SWEEP | BEARISH | 11/08/24 | $3.2 | $3.0 | $3.0 | $14.50 | $150.6K | 4.8K | 541 |

| LYFT | CALL | SWEEP | BEARISH | 04/17/25 | $7.1 | $7.0 | $7.0 | $12.00 | $133.0K | 465 | 206 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LYFT | 看漲 | 交易 | 看好 | 01/16/26 | $2.86 | $2.74 | $2.86 | $25.00 | 572.0千美元 | 6.9K | 2.4K |

| LYFT | 看漲 | Sweep | 看淡 | 01/17/25 | $1.6 | $1.59 | $1.6 | $19.00 | 184.3千美元 | 3.0K | 1.2K |

| LYFT | 看漲 | SWEEP | 看淡 | 01/16/26 | $6.8 | $6.7 | $6.7 | $15.00 | $170.8K | 3.1K | 1.0千 |

| LYFT | 看漲 | SWEEP | 看淡 | 11/08/24 | $3.2 | $3.0 | $3.0 | $14.50 | 150.6千美元 | 4.8千 | 541 |

| LYFT | 看漲 | SWEEP | 看淡 | 04/17/25 | $7.1 | $7.0 | $7.0 | $12.00 | $133.0K | 465 | 206 |

About Lyft

關於Lyft

Lyft is the second-largest ride-sharing service provider in the us and Canada, connecting riders and drivers over the Lyft app. Incorporated in 2013, Lyft offers a variety of rides via private vehicles, including traditional private rides, shared rides, and luxury ones. Besides ride-share, Lyft also has entered the bike- and scooter-share market to bring multimodal transportation options to users.

Lyft是美國和加拿大第二大共乘服務提供商,通過Lyft應用程序連接乘客和司機。Lyft成立於2013年,提供多種私人車輛乘坐方式,包括傳統私人乘車、拼車和豪華乘車等。除了共乘,Lyft還進入了自行車和滑板車共享市場,爲用戶提供多種交通方式選擇。

After a thorough review of the options trading surrounding Lyft, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

經過對Lyft周邊期權交易的徹底審核,我們轉而更詳細地審查該公司。這包括對其當前市場地位和表現的評估。

Lyft's Current Market Status

Lyft的當前市場狀態

- Currently trading with a volume of 52,357,128, the LYFT's price is up by 23.37%, now at $17.77.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 96 days.

- 目前以成交量52,357,128的價格交易,LYFT的價格上漲了23.37%,現在爲$17.77。

- RSI讀數表明股票目前可能超買。

- 預期的盈利發佈將在96天內進行。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的專業期權交易員揭示了他的單線圖技巧,可以顯示何時買入和賣出。複製他的交易,每20天平均盈利27%。點擊這裏獲取更多信息。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Lyft with Benzinga Pro for real-time alerts.

交易期權涉及更大風險,但也可能獲得更高利潤。 精明的交易者通過持續的教育、戰略交易調整、利用各種因子以及保持對市場動態的敏感來減輕這些風險。 使用Benzinga Pro隨時了解Lyft的最新期權交易,以獲得實時警報。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with LYFT, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with LYFT, it often means somebody knows something is about to happen.