- Attika Group is a Singapore-based full service commercial interior decoration and mechanical, electrical, and plumbing (MEP) engineering company. It offers a one-stop solution to customers from design, production, building and project management, to servicing and maintenance for their interior fit-out needs.

- Attika's current clients are mostly sourced from the public sector and commercial entities in the private sector such as banks and malls. It has an order book of S$33.9 million, and plans to expand the business through new investments, acquisitions of assets and businesses, and diversifying into the residential and hospitality sectors.

- The Group does not have a fixed dividend policy but intends to distribute dividends of at least 20% of the Group's profit attributable to equity holders of the company in respect of FY24 and FY25.

Attika Group is a Singapore-based full service commercial interior decoration and MEP engineering company offering solutions for customers' interior fit-out needs. The Group has its own in-house team but also works with third party contractors to provide services such as interior design, MEP services, and custom-built carpentry and metalwork services.

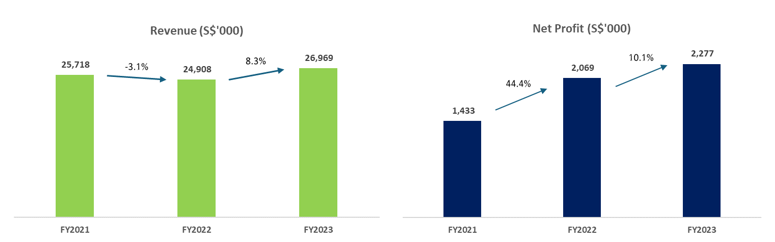

Over the last three years, Attika has been in the black, with net profit climbing from S$1.4 million in FY21 to S$2.3 million in FY23. The positive momentum has continued in the first three months of 2024, with Attika's net profit rising to S$1.3 million or 0.95 cent earnings per share (EPS), up from S$0.7 million or 0.55 cent EPS in the year-ago period, on a post-placement basis.

Interior Fit-Out Works Industry Outlook & Prospects from the Offer Document

- Growth Prospects in the Construction Pipeline: Public Sector, Commercial properties, and Institutions

- The Building and Construction Authority (BCA) projects for steady improvement in Singapore's overall construction demand in the medium term, reaching between S$31 billion to S$38 billion annually between 2025 and 2028. The public sector is expected to lead demand, contributing S$19 billion to S$23 billion. Private sector demand is expected to remain stable at between S$12 billion to S$15 billion per year.

- The market size of the Interior Fit-Out Works industry is linked to the demands of the Construction Sector and industry projections are for the sector to grow from a range of S$4.4 billion and S$5.8 billion in 2023 to between S$4.8 billion to S$7.4 billion in 2027.

- Redevelopment and repurpose of existing properties

- New opportunities for Interior Fit-Out contractors due to the trend of redefining space allocation, paving the way for more mixed-use developments.

Highlights from the Offer Document

Highlights from the Offer Document

Competitive Strengths

- Proven track record as a one-stop service provider covering all aspects from design, production, building and project management, to servicing and maintenance for interior fit-out projects of varying sizes in Singapore, including public sector projects. The Group does not need to compete purely on price for public sector projects that utilise a price-quality assessment.

- Established network of business relationships with other industry players and contractors allows for undertaking of projects in a timely and effective manner, producing savings on time and costs in day-to-day operations.

- In-house team of over 50 full-time carpenters, workers and tradesmen allows the Group to exercise greater control over quality and costs whilst ensuring sufficient expertise and capabilities to deliver projects on time.

- Experienced and dedicated management team with a strong understanding of prevailing market trends and customer demand.

Business Strategies & Future Plans

- Expanding the Group through new investment, acquisitions of assets and/or businesses

- Leverage existing experience and customer network to expand the business in Singapore and embark on new markets in neighbouring countries such as Malaysia.

- The Group has allocated S$1.3 million of gross proceeds from the Listing for this purpose.

- Acquisition and purchase of new equipment and machinery

- Expand the Group's manufacturing capacity to meet product demand for existing and future projects.

- New equipment to be purchased includes computer numerical control equipment and machinery to automate production processes

- Diversifying into the residential and hospitality sectors

- Leverage existing position in commercial market segment to expand the Group's portfolio into the residential and hospitality sectors, targeting residential housing developers, hotels, and integrated resorts.

Key Risk Factors

(Refer to page 42 of the Offer Document for a complete list of risk factors)

- The Group's business is non-recurring in nature, and thus there is no guarantee the Group will be able to secure new projects as projects are typically awarded on a project-by-project basis.

- Disputes and claims can adversely affect the Group's financial conditions due to among others, non-payment, defective workmanship, non-adherence to contract specifications, and flawed quality of materials supplied.

- The Group's reliance on Foreign Workers makes the Group susceptible to potential manpower shortages and high employment costs, where the former could result in the Group being forced to increase reliance on subcontractors and potentially be unable to maintain the quality of its services.

- The Group's business may be affected by any cancellation, suspension, revocation, downgrading, or non-renewal of any of the Group's licences, certifications, or registrations.

Financials

- The Group's revenue increased from FY21 to FY23, rising from S$25.7 million to S$27.0 million. The higher revenue in FY23 was mainly attributed to the completion of four projects secured and commenced work in FY22.

- Net profit attributable to equity holders of the Group increased by 44.4% from FY21 to FY22, and a further 10.1% from FY22 to FY23. This was mainly due to higher revenue growth that has exceeded cost of sales growth, leading to rising gross profits and net profits.

- EPS grew from 1.05 cents in FY21 to 1.67 cents in FY23, on a post-placement basis. Based on the issue price of 22.0 cents, and the audited earnings per share of the Group for FY23 of 1.67 cents, the price-to-earnings ratio is 13.2 times.

- The Group does not have a fixed dividend policy, however, its Directors intend to recommend and distribute a dividend payout ratio of at least 20% of the Group's profit attributable to equity holders of the company in respect of FY24 and FY25.

Construction & Engineering-related Plays on the SGX

After the listing of Attika, SGX now lists 44 Construction & Engineering-related plays with a total market capitalisation of approximately S$3.4 billion. Of these 44 companies, these 5 including Attika work mainly in the mechanical, electrical, and plumbing (MEP) space. Sorted by market cap, they are:

Name | Stock Code | Mkt Cap S$M | PE | ROE | Div Yield % |

ISOTeam | 5WF | 40.5 | 6.0 | 19.0 | 1.4 |

Lincotrade | BFT | 36.1 | N.A. | 23.9 | 1.6 |

Alphina Holdings | ZXY | 31.2 | N.A. | 1.4 | N.A. |

Attika Group | 53W | 29.9 | 13.2 | 65.9 | N.A. |

King Wan | 554 | 21.6 | 1.7 | 18.8 | N.A. |

Source: SGX, Refinitiv, Bloomberg (Data as of 7 November2024).

- ISOTeam is a building maintenance and estate upgrading company experienced in implementing eco-driven solutions through the provision of repairs & redecoration (R&R) and additions and alterations (A&A) services for the public and private sectors.

- Lincotrade is engaged in the provision of interior fitting-out services, A&A works and other building construction services primarily for commercial premises, residential premises and show flats and sales galleries.

- Alpina Holdings is an established Singapore-based contractor specialising in providing integrated building services, mechanical and electrical engineering services, and A&A works.

- Attika is a Singapore-based full service commercial interior decoration and mechanical, electrical, and plumbing (MEP) engineering company.

- King Wan is principally in the business of providing mechanical and electrical engineering services, but also supplies, delivers and services portable lavatories to various sites.

Additional Information from the Offer Document

Overview of Attika Group

Attika has been engaged in commercial interior decoration and MEP engineering since 2014. The group holds 9 workhead registrations with the BCA covering general building, interior decoration and finishing works, MEP works and other systems-related works. It also holds a GB1 licence allowing the group to carry out projects of any value as a main contractor. The Group has completed over 40 projects over the last 10 years, with the largest project awarded possessing a contract value exceeding S$40.0 million. The Group is currently working on 2 projects for data centre companies, with the projects slated for completion by 4Q2024 and 3Q2025, respectively.

Attika has issued 21 million placement shares at S$0.22 a piece to raise gross proceeds of around S$4.6 million. At the issue price, the group has a post-placement market capitalisation of S$29.9 million. Attika intends to use the proceeds from the placement for a) expansion through acquisitions, joint ventures strategic alliances, and/or investments into overseas ventures; b) acquisition of new equipment, plant, and other machinery; and c) general working capital purposes.

Shareholding Information

Post-placement Direct and/or Deemed Interest:

- 84.6% held by Managing Director and Executive Chairman Steven Tan

- 15.4% held by Public Shareholders

IPO Details

- Issue Price at S$0.22

- IPO Market Capitalization S$29.9 million

- Total of 21.0 million placement shares

- Use of IPO net proceeds of S$3.19 million:

- S$1.27 million – Expansion through acquisitions, joint ventures, and/or investments into overseas ventures

- S$0.96 million – Acquisition of new equipment, plant, and other machinery

- S$0.96 million – General working capital purposes

Did you know?

Attika SG, a subsidiary of Attika Group, obtained in 2020/2021 the highest grading of L6 for registration under the CR06 (Interior Decoration and Finishing Works) workhead, allowing the company to participate in tendering for and executing interior decoration projects in the public sector with no tendering limits and project value limits. This allowed Attika to secure its single largest project to date, with a contract value exceeding S$40.0 million.

Enjoying this read?

- Subscribe now to our SGX My Gateway newsletter for a compilation of latest market news, sector performances, new product release updates, and research reports on SGX-listed companies.

- Stay up-to-date with our SGX Invest Telegram channel.