Key Insights

- Axos Financial will host its Annual General Meeting on 14th of November

- Total pay for CEO Greg Garrabrants includes US$700.0k salary

- The overall pay is 294% above the industry average

- Over the past three years, Axos Financial's EPS grew by 31% and over the past three years, the total shareholder return was 33%

CEO Greg Garrabrants has done a decent job of delivering relatively good performance at Axos Financial, Inc. (NYSE:AX) recently. As shareholders go into the upcoming AGM on 14th of November, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

How Does Total Compensation For Greg Garrabrants Compare With Other Companies In The Industry?

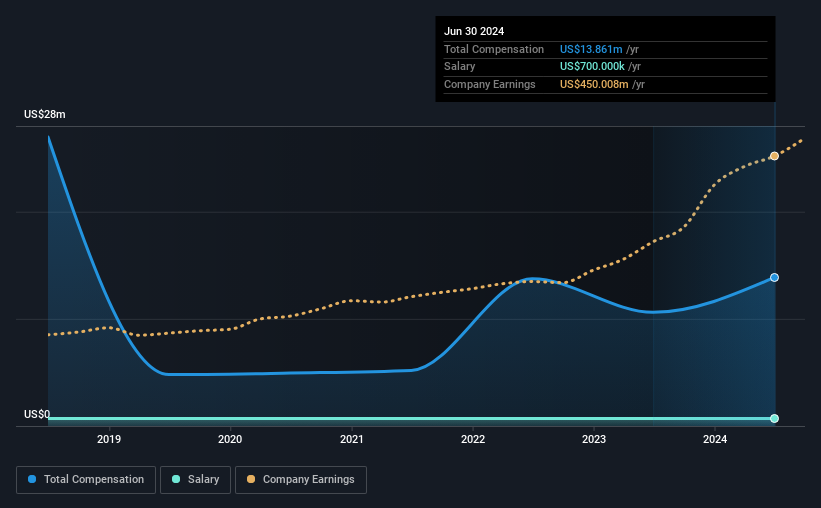

According to our data, Axos Financial, Inc. has a market capitalization of US$4.7b, and paid its CEO total annual compensation worth US$14m over the year to June 2024. Notably, that's an increase of 31% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at US$700k.

On examining similar-sized companies in the American Banks industry with market capitalizations between US$2.0b and US$6.4b, we discovered that the median CEO total compensation of that group was US$3.5m. This suggests that Greg Garrabrants is paid more than the median for the industry. Moreover, Greg Garrabrants also holds US$130m worth of Axos Financial stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$700k | US$700k | 5% |

| Other | US$13m | US$9.9m | 95% |

| Total Compensation | US$14m | US$11m | 100% |

On an industry level, around 45% of total compensation represents salary and 55% is other remuneration. In Axos Financial's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

On an industry level, around 45% of total compensation represents salary and 55% is other remuneration. In Axos Financial's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Axos Financial, Inc.'s Growth

Over the past three years, Axos Financial, Inc. has seen its earnings per share (EPS) grow by 31% per year. In the last year, its revenue is up 23%.

This demonstrates that the company has been improving recently and is good news for the shareholders. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Axos Financial, Inc. Been A Good Investment?

Most shareholders would probably be pleased with Axos Financial, Inc. for providing a total return of 33% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 2 warning signs for Axos Financial (of which 1 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Important note: Axos Financial is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.