The top three daily net purchases in the Dragon Tiger list are Inspur Information, Bohai Leasing, and Dongfangtong

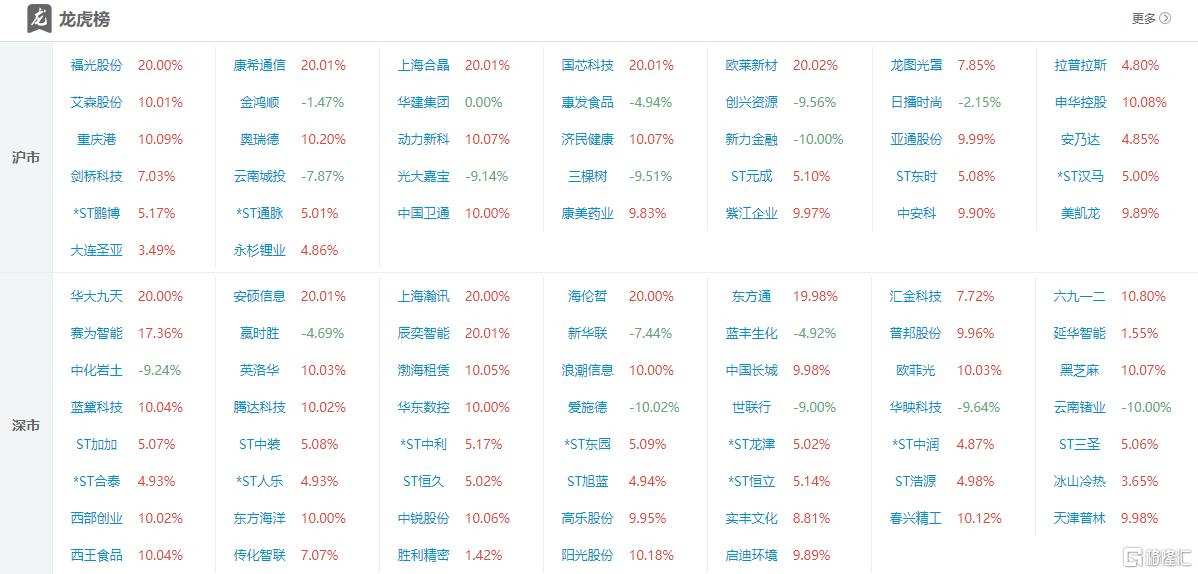

On November 8, the main A-share index fluctuated and declined after opening higher, and the entire market fell by more than 3,000 shares. In terms of sector topics, sectors such as semiconductors, Beidou navigation, BC batteries, 6G concepts, and Huawei Euler had the highest gains.

In terms of individual stocks, popular stocks such as Huaxia Happiness, HNA Holdings, and Hualin Securities were divided, and the market connection level dropped to 7. Among them, Hao Oubo's 20CM7 consecutive board led the way, Landai Technology, Inlova's 10cm7 board, and the Great Wall of China's 8-day 6 board.

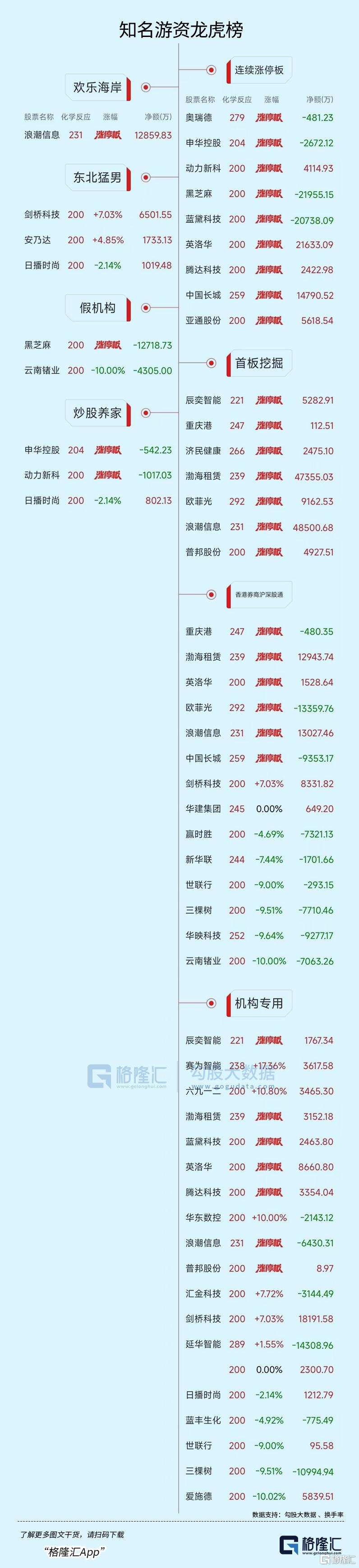

Let's take a look at the next Dragon Tiger list:

Let's take a look at the next Dragon Tiger list:

The top three daily net purchases in the Dragon Tiger list were Inspur Information, Bohai Leasing, and Dongfangtong, which were 0.485 billion yuan, 0.474 billion yuan, and 0.277 billion yuan, respectively.

The top three in the Dragon Tiger list in terms of net sales in a single day were Huada Jiutian, Black Sesame, and Landai Technology, which were 0.519 billion yuan, 0.22 billion yuan, and 0.207 billion yuan respectively.

Among the individual stocks involved in dedicated institutional seats in the Dragon Tiger list, the top three were Cambridge Technology, Inlova, and Axed, which were 0.182 billion yuan, 86.608 million yuan, and 58.3951 million yuan respectively.

Among the individual stocks involved in exclusive institutional seats in the Dragon Tiger list, the top three in single-day net sales were Yanhua Intelligence, Sankeshu, and Huada Jiutian, which were 0.143 billion yuan, 0.11 billion yuan, and 95.1379 million yuan respectively.

The subject of some of the individual stocks on the list:

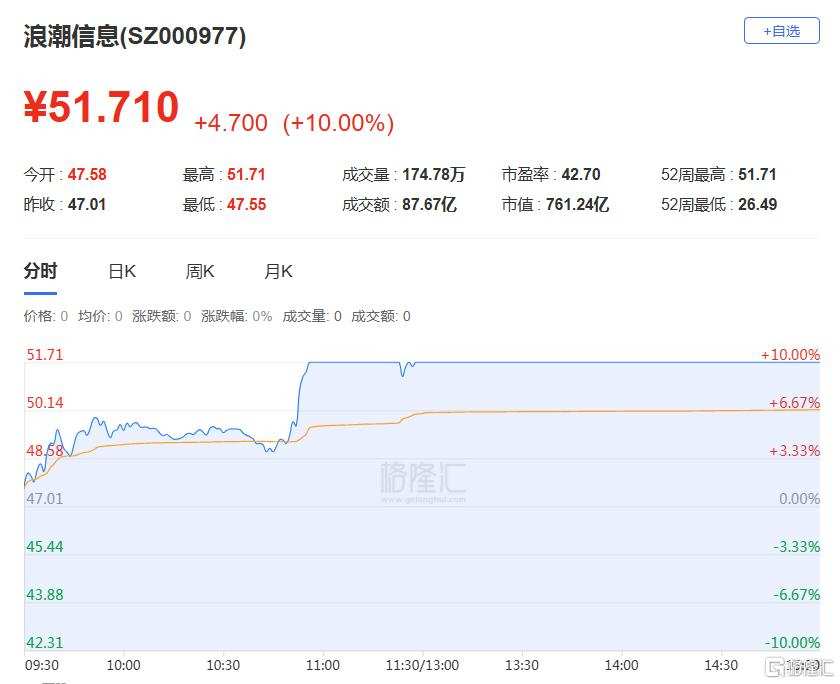

Wave information (AI server+data center+computing power)

It rose and stopped today. The full day turnover rate was 11.89%, and the turnover was 8.767 billion yuan, or 8.75%. According to Dragon Tiger Index data, the net sales of institutions were 64.3031 million yuan, the net purchase of Shenzhen Stock Connect was 0.13 billion yuan, and the total net purchase of sales department seats was 0.419 billion yuan.

1. According to the “China Semi-Annual Edge Server Market (First Half Year of 2024) Tracking Report” released by IDC, shipments in the Chinese edge computing server market increased by 40.6% year-on-year in the first half of 2024. Inspur Information continues to maintain its leading position in this market, ranking first in the Chinese market. The company's market share in the field of artificial intelligence servers ranks first in the global AI server market, and has maintained a market share of more than 50% in China for five consecutive years.

2. The company has led or participated in all national server standards, and is the only server supplier to join the world's top four open computing organizations at the same time.

3. At the level of system solutions, we provide overall solutions for the entire life cycle of liquid-cooled data centers; built the largest R&D and production base for liquid-cooled data centers in Asia, with an annual production capacity of over 0.1 million units, achieving the industry's first large-scale delivery of cold plate liquid cooling cabinets.

4. In the field of AI, Wave has the full-stack technical capabilities of the AI platform and has the most powerful AI server AGX-5.

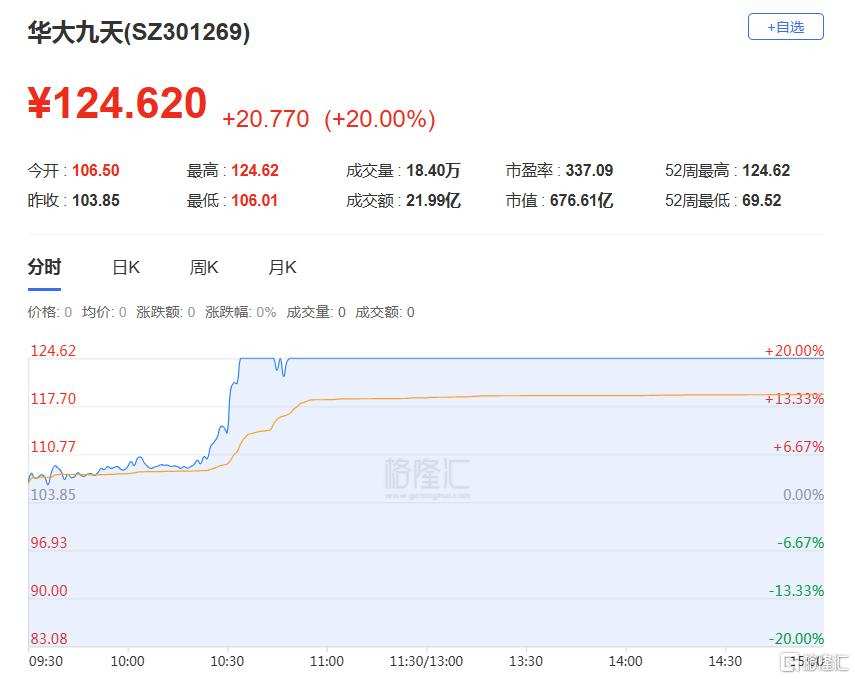

Huada Jiutian (China's largest EDA manufacturer)

It rose and stopped today. The turnover rate for the whole day was 7.02%, and the turnover was 2.199 billion yuan, an amplification of 17.55%. According to Dragon Tiger Index data, the net sales of institutions were 95.1379 million yuan, Shenzhen Stock Connect had net sales of 9.3243 million yuan, and the total net sales of sales department seats was 0.415 billion yuan.

1. The company is mainly engaged in EDA tool software development, sales and related services for integrated circuit design, manufacturing and packaging. In the first half of 2024, the market share steadily ranked first among local EDA companies.

2. The company's current EDA tool software products and services cover fields such as analog circuit design, storage circuit design, RF circuit design, digital circuit design, flat panel display circuit design, wafer manufacturing and advanced packaging design.

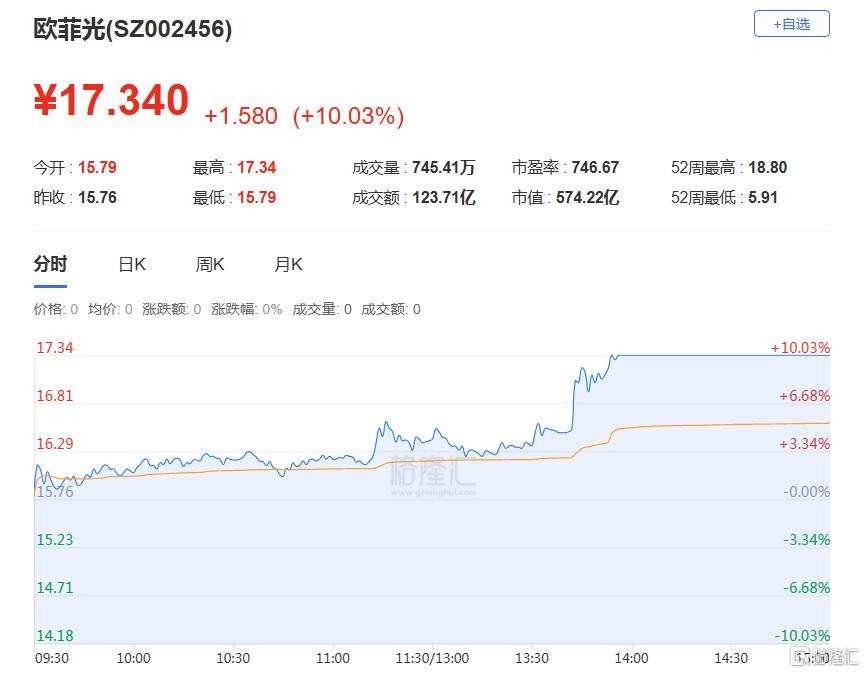

Ofik Light (Huawei phone+performance growth+VR/AR+folding screen+consumer electronics)

It rose and stopped today. The full-day turnover rate was 22.92%, and the turnover was 12.371 billion yuan, or 9.82%. According to Dragon Tiger Index data, Shenzhen Stock Connect's net sales were 0.134 billion yuan, and the total net purchase of sales department seats was 0.225 billion yuan.

1. The Internet Communications Company has obtained more than half of the share of the Huawei Mate 70 series mobile phone lens module. (unconfirmed). On the evening of October 30, 2024, it was announced that the company's revenue for the first three quarters was 14.472 billion yuan, up 33.76% year on year; net profit was 47.1192 million yuan, up 115.74% year on year.

2. In terms of optical lenses, the company can provide products such as VR/AR lens sets; in terms of image modules, expand VR eye tracking modules, etc.; in terms of VR/AR optical machines, lay out technical routes such as LCOS optical waveguide modules; the company also lays out complete assembly and manufacturing services for VR/AR glasses and head-mounted devices.

3. The company's flexible touch technology products based on MetalMesh and AGNW (nano silver wire) are at the leading level in the industry in terms of optoelectronic and mechanical properties, and can be the first to meet the needs of foldable screens in flagship models of many mobile phone brands.

4. The company's products are widely used in smart phones, smart cars, sweeping robots and other new fields of intelligent applications, mainly including optical camera modules, optical lenses, and fingerprint recognition modules.

Institutions focus on trading individual stocks:

Cambridge Technology today rose 7.03%, with a turnover of 4.096 billion yuan and a turnover rate of 29.46%. According to Dragon Tiger Index data, Shanghai Stock Connect bought 0.204 billion yuan and sold 0.121 billion yuan at the same time, with a net purchase of 83.32 million yuan; the two institutions ranked to buy 2 and 3 seats, with a net purchase of 0.182 billion yuan.

The Great Wall of China went up and down today, with a full-day turnover rate of 16.34% and a turnover of 11.286 billion yuan, an amplification of 6.99%. According to Dragon Tiger Index data, Shenzhen Stock Connect's net sales were 93.5317 million yuan, and the total net purchase of sales department seats was 0.241 billion yuan.

Asus Information went up and down today, with an all-day turnover rate of 34.38% and a turnover of 2.72 billion yuan, an increase of 8.83%. According to Dragon Tiger Index data, the net sales of the organization were 37.1171 million yuan, and the total net sales of sales department seats was 59.5691 million yuan.

Power Xinke went up and down today, with an all-day turnover rate of 4.31%, a turnover of 0.257 billion yuan, an amplification of 8.28%. According to data from the Dragon Tiger List, the total net purchase of sales department seats was 41.1493 million yuan.

Yanhua Smart rose 1.55% today, with a full-day turnover rate of 39.22%, and a turnover of 2.723 billion yuan, or 18.33%. According to Dragon Tiger Index data, the net sales of the organization were 0.143 billion yuan, and the total net purchase of sales department seats was 0.139 billion yuan.

Dongfangtong went up and down today. The full day turnover rate was 18.60%, and the turnover was 1.882 billion yuan, an increase of 16.48%. According to Dragon Tiger Index data, the net sales of institutions were 13.4645 million yuan, the net purchase of Shenzhen Stock Connect was 27.6518 million yuan, and the total net purchase of sales department seats was 0.262 billion yuan.

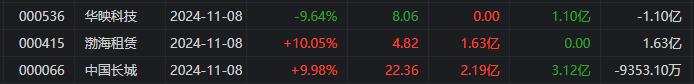

Bohai Leasing went up and down today, with a full day turnover rate of 17.99% and a turnover of 4.493 billion yuan, an increase of 15.59%. According to Dragon Tiger Index data, the net purchase of institutions was 31.5218 million yuan, the net purchase of Shenzhen Stock Connect was 0.129 billion yuan, and the total net purchase of sales department seats was 0.313 billion yuan.

In the Dragon Tiger list, there are 5 individual stocks involving the Shanghai Stock Connect exclusive seat. Cambridge Technology's Shanghai Stock Connect exclusive seat had the largest net purchase amount, with a net purchase of 83.318 million yuan.

In the Dragon Tiger list, there are 13 individual stocks involving Shenzhen Stock Connect exclusive seats. Bohai Leasing's Shenzhen Stock Connect exclusive seat had the largest net purchase amount, with a net purchase of 1.63 yuan.

Trends in volatile capital operations:

Happy Coast: net buying wave information 0.129 billion yuan

Chen Xiaoqun: Net purchase of the Great Wall of China 0.1275 billion yuan, Ou Fei Guang 0.1027 billion yuan

Fang Xinxia: Net purchase of China's Great Wall of 0.0.1488 billion yuan, Saiwei Smart 53.69 million yuan

Hujialou: Net Purchase Wave Information 0.1913 billion yuan, Dongfangtong 0.1443 billion yuan, Great Wall of China 14.18 million yuan

Leisure group: net purchase of OfiLight 0.2039 billion yuan, net sale of Asus information for 48.26 million yuan

Northeast Warriors: Net purchases of Cambridge Technology 65.0155 million yuan, Ananda 17.3313 million yuan, Nippon Broadcasting Fashion 10.1948 million yuan

Stock trading to support the family: net sales momentum Xinke 10.1703 million yuan

Liuyi Middle Road: Net purchase of Xinke Power 79.3 million yuan, Pubang shares 52.54 million yuan, Huadong CNC 33.02 million yuan, net sales of Shenhua Holdings 42.41 million yuan

Fuling Square Road: net purchase of Yanhua Smart 93.38 million yuan