Smart Money Is Betting Big In MRNA Options

Smart Money Is Betting Big In MRNA Options

Deep-pocketed investors have adopted a bearish approach towards Moderna (NASDAQ:MRNA), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MRNA usually suggests something big is about to happen.

富有的投资者们对Moderna(纳斯达克股票代码:MRNA)持看淡态度,市场参与者们不应该忽视这一点。我们在Benzinga跟踪的公开期权记录中发现了这一重大举动。这些投资者的身份还未知,但MRNA这样的重要举措通常意味着即将发生一些重大的事情。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 48 extraordinary options activities for Moderna. This level of activity is out of the ordinary.

我们从观察中获得了这些信息,当彭博社的期权扫描器突出显示Moderna的48项非同寻常的期权活动时。这种活跃程度超出寻常。

The general mood among these heavyweight investors is divided, with 35% leaning bullish and 50% bearish. Among these notable options, 36 are puts, totaling $7,149,868, and 12 are calls, amounting to $827,264.

这些重量级投资者中的一般情绪分为两派,35%倾向于看好,50%倾向于看淡。在这些显著的期权中,有36项看跌期权,总额达7149868美元,有12项看涨期权,总额为827264美元。

What's The Price Target?

目标价是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $30.0 and $135.0 for Moderna, spanning the last three months.

经过评估交易量和未平仓头寸后,明显可见主要市场推动力集中在Moderna的30.0美元至135.0美元的价格区间,跨越过去三个月。

Volume & Open Interest Trends

成交量和未平仓量趋势

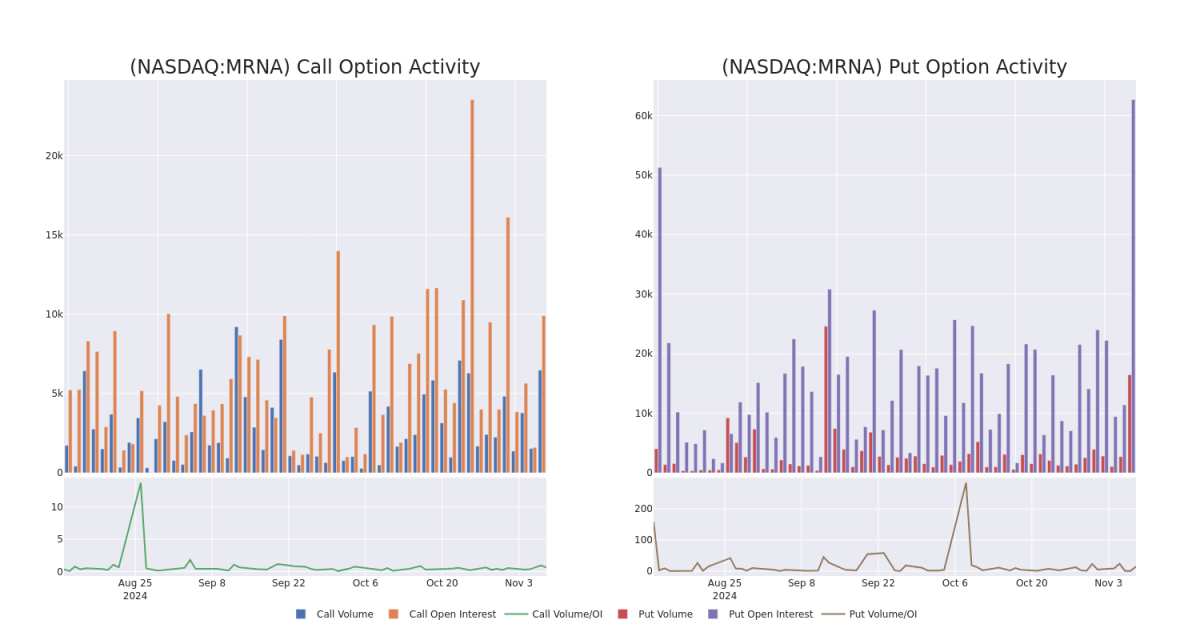

In today's trading context, the average open interest for options of Moderna stands at 2268.03, with a total volume reaching 22,831.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Moderna, situated within the strike price corridor from $30.0 to $135.0, throughout the last 30 days.

在今日的交易背景下,Moderna期权的平均未平仓头寸为2268.03,总成交量达到22831.00。附带图表详细描述了Moderna高价交易的看涨和看跌期权成交量和未平仓头寸的发展情况,位于30.0美元至135.0美元的行权价走廊内,贯穿过去30天。

Moderna Option Volume And Open Interest Over Last 30 Days

Moderna过去30天内的期权成交量和持仓量

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRNA | PUT | SWEEP | NEUTRAL | 01/16/26 | $70.45 | $70.45 | $70.45 | $120.00 | $2.4M | 980 | 346 |

| MRNA | PUT | SWEEP | BEARISH | 01/16/26 | $70.9 | $69.7 | $70.4 | $120.00 | $971.5K | 980 | 346 |

| MRNA | PUT | SWEEP | BULLISH | 12/18/26 | $42.15 | $41.0 | $41.12 | $85.00 | $479.4K | 1.1K | 517 |

| MRNA | PUT | SWEEP | BEARISH | 01/16/26 | $70.35 | $69.7 | $70.35 | $120.00 | $443.2K | 980 | 564 |

| MRNA | PUT | SWEEP | BEARISH | 12/18/26 | $82.85 | $81.3 | $82.85 | $130.00 | $314.8K | 620 | 290 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Moderna | 看跌 | SWEEP | 中立 | 01/16/26 | $70.45 | $70.45 | $70.45 | $120.00 | $2.4M | 980 | 346 |

| MRNA | PUT | SWEEP | BEARISH | 01/16/26 | $70.9 | 69.7美元 | $70.4 | $120.00 | 971.5K美元 | 980 | 346 |

| moderna | 看跌 | SWEEP | 看好 | 12/18/26 | $42.15 | $41.0 | $41.12 | $85.00 | $479.4K | 1.1千 | 517 |

| MRNA | PUT | SWEEP | BEARISH | 01/16/26 | $70.35 | $69.7 | $70.35 | $120.00 | $443.2K | 980 | 564 |

| moderna | 看跌 | SWEEP | BEARISH | 12/18/26 | $82.85 | $81.3 | $82.85 | $130.00 | $314.8K | 620 | 290 |

About Moderna

关于现代

Moderna is a commercial-stage biotech that was founded in 2010 and had its initial public offering in December 2018. The firm's mRNA technology was rapidly validated with its covid vaccine, which was authorized in the United States in December 2020. Moderna had 40 mRNA development candidates in clinical development as of September 2024. Programs span a wide range of therapeutic areas, including infectious disease, oncology, cardiovascular disease, and rare genetic diseases.

Moderna是一家创建于2010年的商业化生物科技公司,于2018年12月首次公开发行。该公司的mRNA技术通过其新冠疫苗得到快速验证,该疫苗于2020年12月获得美国授权。截至2024年9月,Moderna在临床开发中有40个mRNA开发候选项目,涵盖传染病、肿瘤学、心血管疾病和罕见遗传病等广泛疗法领域。

Moderna's Current Market Status

Moderna的当前市场地位

- With a volume of 7,492,117, the price of MRNA is down -6.64% at $46.94.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 104 days.

- 成交量为7,492,117,moderna的价格下跌了-6.64%,为46.94美元。

- RSI指标表明该基础股票可能被超卖。

- 下一季度盈利预计将在104天后发布。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的专业期权交易员揭示了他的单线图技巧,可以显示何时买入和卖出。复制他的交易,每20天平均盈利27%。点击这里获取更多信息。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $30.0 and $135.0 for Moderna, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $30.0 and $135.0 for Moderna, spanning the last three months.