Whales with a lot of money to spend have taken a noticeably bearish stance on Energy Transfer.

Looking at options history for Energy Transfer (NYSE:ET) we detected 21 trades.

If we consider the specifics of each trade, it is accurate to state that 19% of the investors opened trades with bullish expectations and 42% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $122,400 and 18, calls, for a total amount of $2,008,251.

From the overall spotted trades, 3 are puts, for a total amount of $122,400 and 18, calls, for a total amount of $2,008,251.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $1.0 to $17.0 for Energy Transfer over the last 3 months.

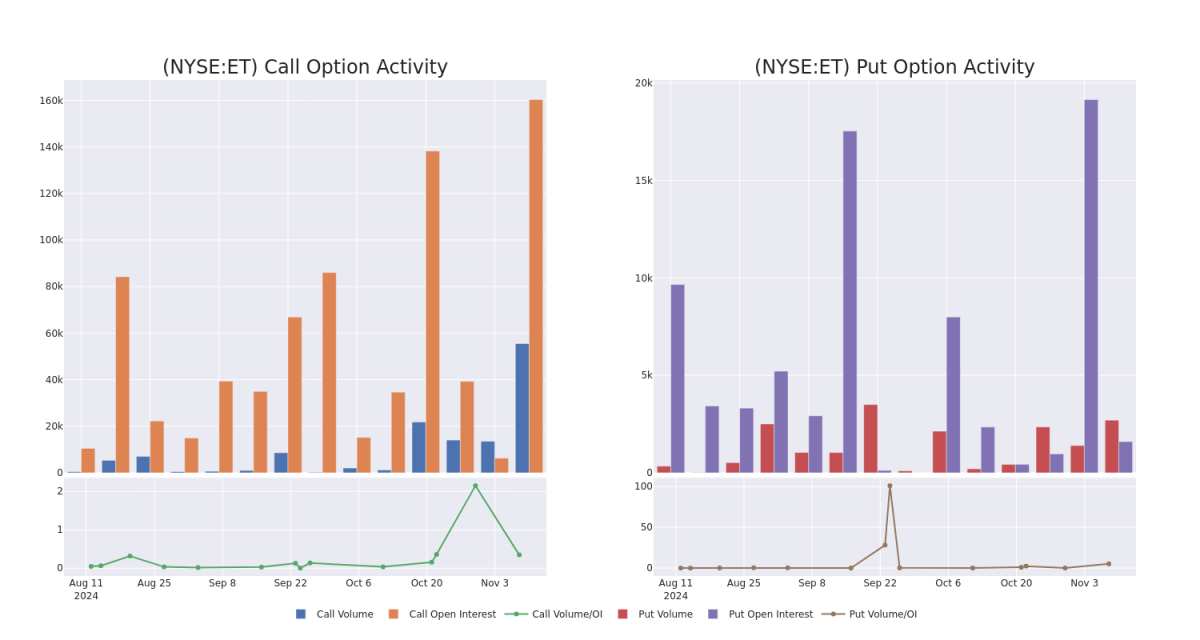

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Energy Transfer's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Energy Transfer's whale activity within a strike price range from $1.0 to $17.0 in the last 30 days.

Energy Transfer Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ET | CALL | TRADE | NEUTRAL | 01/17/25 | $16.1 | $15.95 | $16.03 | $1.00 | $961.8K | 0 | 602 |

| ET | CALL | SWEEP | BULLISH | 01/17/25 | $0.74 | $0.71 | $0.74 | $17.00 | $188.7K | 88.8K | 11.7K |

| ET | CALL | SWEEP | BULLISH | 01/17/25 | $0.72 | $0.7 | $0.71 | $17.00 | $88.2K | 88.8K | 6.6K |

| ET | CALL | TRADE | BULLISH | 01/17/25 | $12.05 | $11.9 | $12.05 | $5.00 | $68.6K | 301 | 57 |

| ET | CALL | TRADE | NEUTRAL | 01/17/25 | $2.6 | $2.56 | $2.58 | $15.00 | $64.5K | 51.3K | 8.3K |

About Energy Transfer

Energy Transfer owns one of the largest portfolios of crude oil, natural gas, and natural gas liquid assets in the US, primarily in Texas and the US midcontinent region. Its pipeline network totals 130,000 miles. It also owns gathering and processing facilities, one of the largest fractionation facilities in the US, fuel distribution assets, and the Lake Charles gas liquefaction facility. It combined its publicly traded limited and general partnerships in October 2018.

Energy Transfer's Current Market Status

- Trading volume stands at 18,793,942, with ET's price up by 0.01%, positioned at $17.09.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 96 days.

What The Experts Say On Energy Transfer

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $20.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for Energy Transfer, targeting a price of $20. * In a cautious move, an analyst from B of A Securities downgraded its rating to Buy, setting a price target of $20.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Energy Transfer options trades with real-time alerts from Benzinga Pro.