Despite an already strong run, Wangli Security & Surveillance Product Co., Ltd (SHSE:605268) shares have been powering on, with a gain of 38% in the last thirty days. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

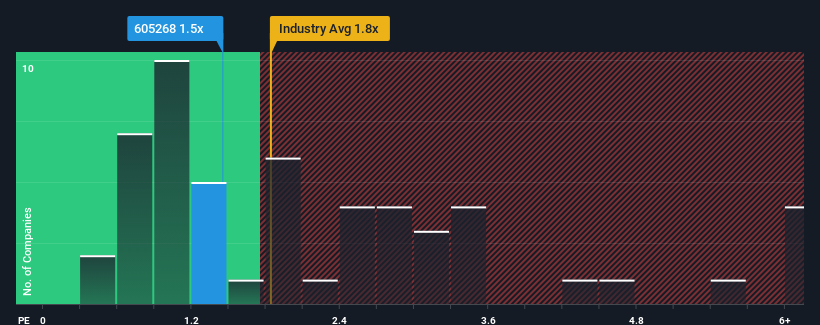

Although its price has surged higher, there still wouldn't be many who think Wangli Security & Surveillance Product's price-to-sales (or "P/S") ratio of 1.5x is worth a mention when the median P/S in China's Building industry is similar at about 1.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

What Does Wangli Security & Surveillance Product's P/S Mean For Shareholders?

Recent times have been advantageous for Wangli Security & Surveillance Product as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Wangli Security & Surveillance Product.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Wangli Security & Surveillance Product would need to produce growth that's similar to the industry.

In order to justify its P/S ratio, Wangli Security & Surveillance Product would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 28% last year. As a result, it also grew revenue by 27% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Turning to the outlook, the next year should generate growth of 34% as estimated by the dual analysts watching the company. With the industry only predicted to deliver 22%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Wangli Security & Surveillance Product's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Wangli Security & Surveillance Product appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at Wangli Security & Surveillance Product's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Wangli Security & Surveillance Product (at least 1 which is concerning), and understanding them should be part of your investment process.

If you're unsure about the strength of Wangli Security & Surveillance Product's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.