Zhongxing Shenyang Commercial Building Group Co.,Ltd (SZSE:000715) shares have continued their recent momentum with a 30% gain in the last month alone. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 6.6% over the last year.

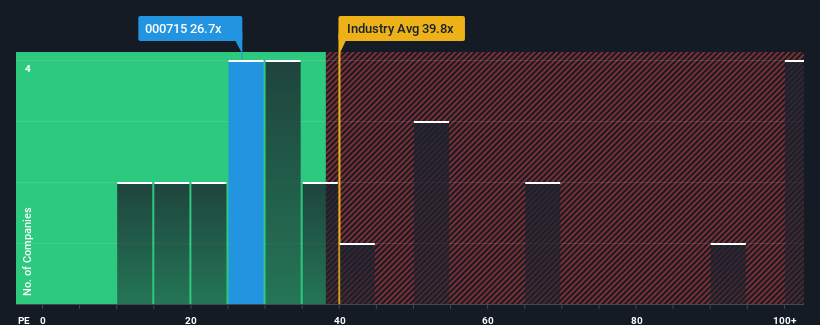

Although its price has surged higher, Zhongxing Shenyang Commercial Building GroupLtd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 26.7x, since almost half of all companies in China have P/E ratios greater than 37x and even P/E's higher than 72x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Zhongxing Shenyang Commercial Building GroupLtd has been struggling lately as its earnings have declined faster than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

How Is Zhongxing Shenyang Commercial Building GroupLtd's Growth Trending?

In order to justify its P/E ratio, Zhongxing Shenyang Commercial Building GroupLtd would need to produce sluggish growth that's trailing the market.

In order to justify its P/E ratio, Zhongxing Shenyang Commercial Building GroupLtd would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 9.3% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 32% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 28% during the coming year according to the sole analyst following the company. Meanwhile, the broader market is forecast to expand by 41%, which paints a poor picture.

With this information, we are not surprised that Zhongxing Shenyang Commercial Building GroupLtd is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Zhongxing Shenyang Commercial Building GroupLtd's P/E

The latest share price surge wasn't enough to lift Zhongxing Shenyang Commercial Building GroupLtd's P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Zhongxing Shenyang Commercial Building GroupLtd maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware Zhongxing Shenyang Commercial Building GroupLtd is showing 2 warning signs in our investment analysis, and 1 of those is significant.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.