The S&P International Holding Limited (HKG:1695) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 10%.

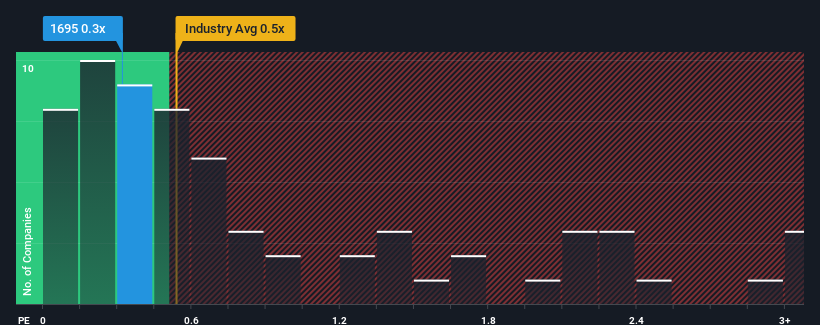

Even after such a large drop in price, it's still not a stretch to say that S&P International Holding's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Food industry in Hong Kong, where the median P/S ratio is around 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

How Has S&P International Holding Performed Recently?

The revenue growth achieved at S&P International Holding over the last year would be more than acceptable for most companies. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. Those who are bullish on S&P International Holding will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on S&P International Holding's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For S&P International Holding?

The only time you'd be comfortable seeing a P/S like S&P International Holding's is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like S&P International Holding's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. As a result, it also grew revenue by 13% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 6.1% shows it's about the same on an annualised basis.

In light of this, it's understandable that S&P International Holding's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

What Does S&P International Holding's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for S&P International Holding looks to be in line with the rest of the Food industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we've seen, S&P International Holding's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for S&P International Holding (1 is potentially serious) you should be aware of.

If you're unsure about the strength of S&P International Holding's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.