China Reform Culture Holdings Co., Ltd. (SHSE:600636) shares have continued their recent momentum with a 28% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 8.5% isn't as impressive.

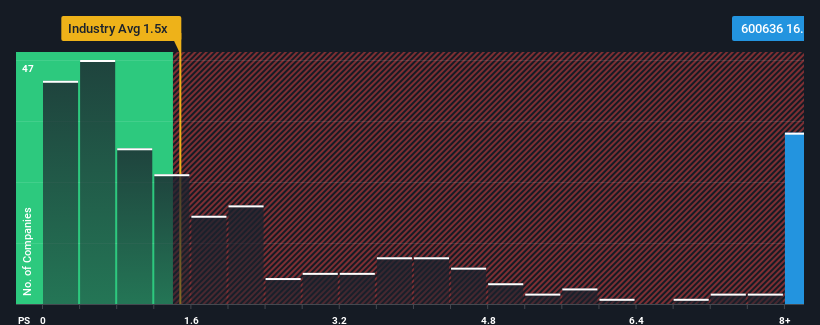

Following the firm bounce in price, China Reform Culture Holdings may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 16.4x, when you consider almost half of the companies in the Consumer Services industry in China have P/S ratios under 5x and even P/S lower than 2x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does China Reform Culture Holdings' P/S Mean For Shareholders?

With revenue that's retreating more than the industry's average of late, China Reform Culture Holdings has been very sluggish. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on China Reform Culture Holdings will help you uncover what's on the horizon.How Is China Reform Culture Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as China Reform Culture Holdings' is when the company's growth is on track to outshine the industry decidedly.

The only time you'd be truly comfortable seeing a P/S as steep as China Reform Culture Holdings' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 36%. The last three years don't look nice either as the company has shrunk revenue by 46% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue growth is heading into negative territory, declining 3.7% over the next year. That's not great when the rest of the industry is expected to grow by 40%.

In light of this, it's alarming that China Reform Culture Holdings' P/S sits above the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Key Takeaway

Shares in China Reform Culture Holdings have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of China Reform Culture Holdings' analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. Unless these conditions improve markedly, it'll be a challenging time for shareholders.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for China Reform Culture Holdings with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.