Zhejiang Century Huatong Group Co.,Ltd's (SZSE:002602) Price Is Right But Growth Is Lacking After Shares Rocket 26%

Zhejiang Century Huatong Group Co.,Ltd's (SZSE:002602) Price Is Right But Growth Is Lacking After Shares Rocket 26%

Despite an already strong run, Zhejiang Century Huatong Group Co.,Ltd (SZSE:002602) shares have been powering on, with a gain of 26% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 19% over that time.

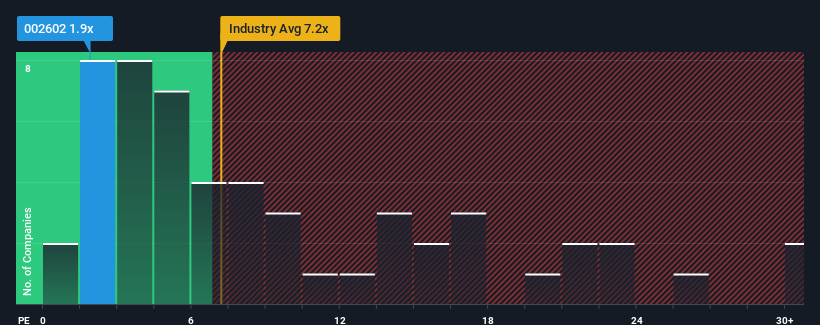

In spite of the firm bounce in price, Zhejiang Century Huatong GroupLtd's price-to-sales (or "P/S") ratio of 1.9x might still make it look like a strong buy right now compared to the wider Entertainment industry in China, where around half of the companies have P/S ratios above 7.2x and even P/S above 15x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

How Zhejiang Century Huatong GroupLtd Has Been Performing

Zhejiang Century Huatong GroupLtd certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zhejiang Century Huatong GroupLtd.Is There Any Revenue Growth Forecasted For Zhejiang Century Huatong GroupLtd?

The only time you'd be truly comfortable seeing a P/S as depressed as Zhejiang Century Huatong GroupLtd's is when the company's growth is on track to lag the industry decidedly.

The only time you'd be truly comfortable seeing a P/S as depressed as Zhejiang Century Huatong GroupLtd's is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 57%. The latest three year period has also seen an excellent 36% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 17% over the next year. Meanwhile, the rest of the industry is forecast to expand by 33%, which is noticeably more attractive.

In light of this, it's understandable that Zhejiang Century Huatong GroupLtd's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Shares in Zhejiang Century Huatong GroupLtd have risen appreciably however, its P/S is still subdued. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of Zhejiang Century Huatong GroupLtd's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 1 warning sign for Zhejiang Century Huatong GroupLtd that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.