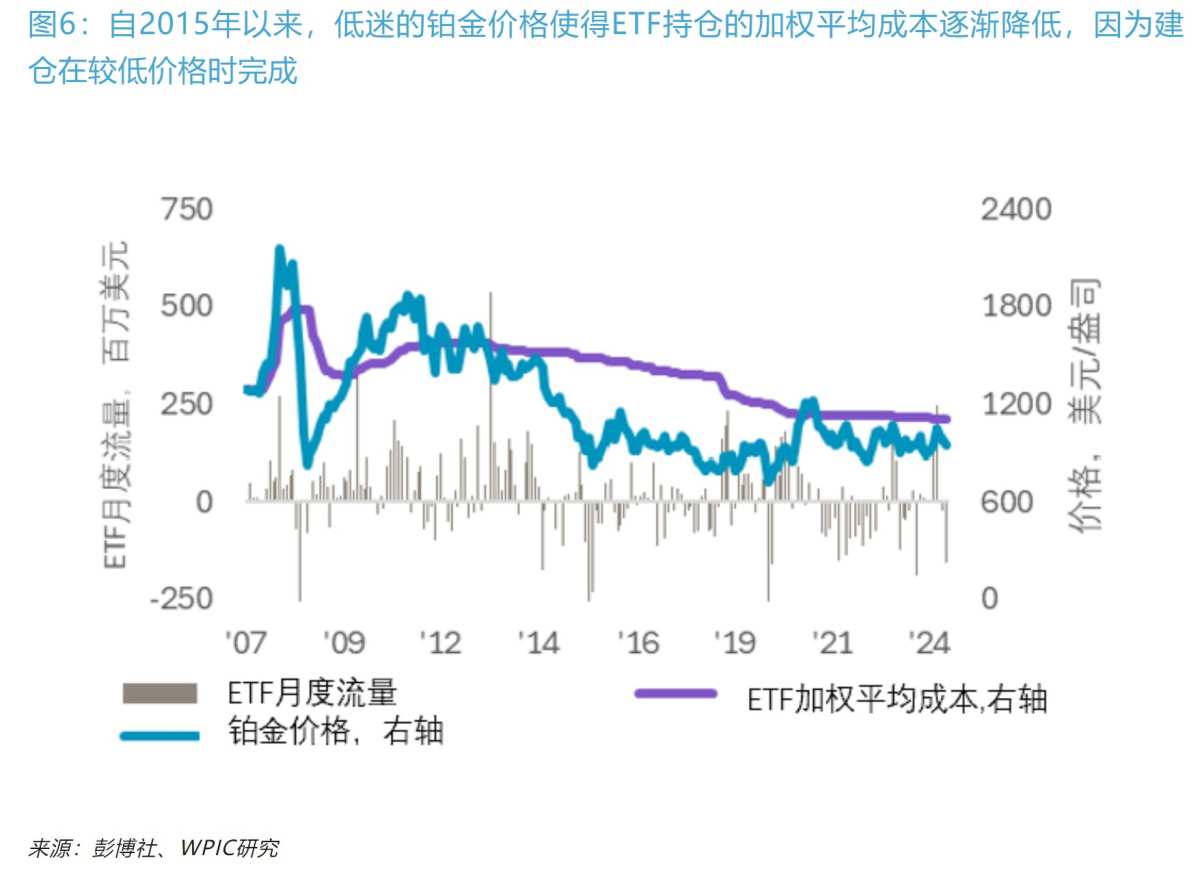

The selling of platinum ETF may occur when the price is above the weighted average cost of $1,100 per ounce, but a higher price is needed to achieve large-scale selling.

Zhitong Finance APP has learned that the World Platinum Investment Council (WPIC) stated in a document that in the latest outlook on the platinum market from 2025 to 2028, the average supply gap for the platinum market is predicted to be 0.769 million ounces during this period. The market will need to extract platinum from above-ground stocks (AGS) to meet demand, however, these stocks are expected to be depleted by 2028 (forecasted). A common view is that even if above-ground stocks are exhausted, the price of platinum will not rise due to years of consecutive market supply gaps, as the selling of platinum ETFs will fill the market shortage.

Although ETFs can serve as a source of supply, it is incorrect to assume that holders are indifferent to prices. The example of palladium shows that most ETF selling only occurs when spot prices rise significantly and exceed the weighted average cost of holding positions. Therefore, the selling of platinum ETF may occur when the price is above the weighted average cost of $1,100 per ounce, but a higher price is needed to achieve large-scale selling.

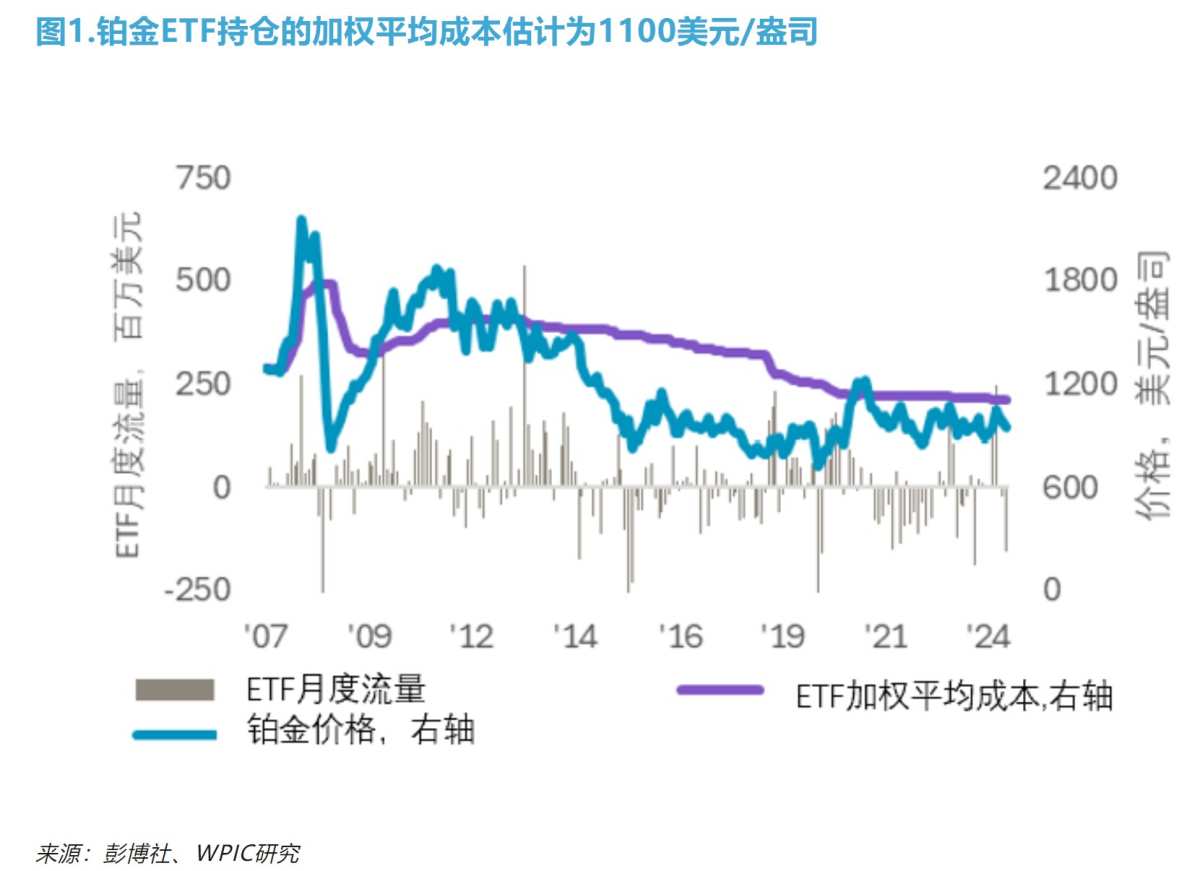

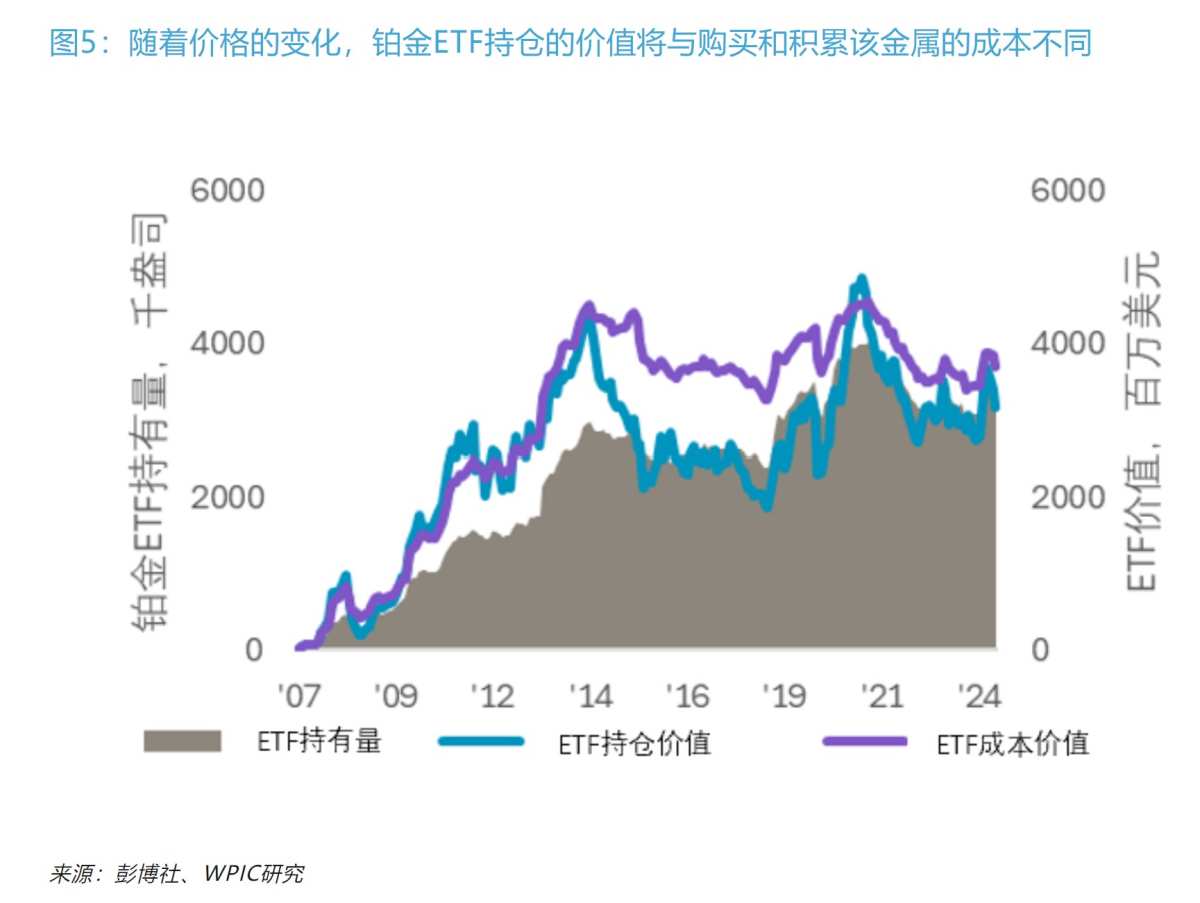

Platinum ETF was launched in 2007 and has accumulated approximately 3.2 million ounces of physical holdings. This has to some extent driven platinum demand, but conversely, selling will make ETFs a source of platinum supply. However, what is often overlooked is that the demand for platinum ETFs comes from investors hoping to achieve capital returns through rising platinum prices. Therefore, ETF selling is not indifferent to prices. By calculating the weighted average cost of ETF holdings in metal, the price threshold at which investors sell platinum ETFs can be estimated. Historical cost calculations of ETF holdings can be obtained by adding up the cumulative metal quantity each month at the average price. Dividing this value by the total ounces yields the weighted average cost per ounce, currently estimated at $1,100 per ounce for platinum ETF.

Platinum ETF was launched in 2007 and has accumulated approximately 3.2 million ounces of physical holdings. This has to some extent driven platinum demand, but conversely, selling will make ETFs a source of platinum supply. However, what is often overlooked is that the demand for platinum ETFs comes from investors hoping to achieve capital returns through rising platinum prices. Therefore, ETF selling is not indifferent to prices. By calculating the weighted average cost of ETF holdings in metal, the price threshold at which investors sell platinum ETFs can be estimated. Historical cost calculations of ETF holdings can be obtained by adding up the cumulative metal quantity each month at the average price. Dividing this value by the total ounces yields the weighted average cost per ounce, currently estimated at $1,100 per ounce for platinum ETF.

The example of palladium ETF shows that in markets expecting consecutive years of shortages, the weighted average cost of ETF holdings is roughly the threshold for ETF selling. From 2015 to 2020, the price of palladium tripled, and the ETF holdings decreased from 3 million ounces to 0.6 million ounces. However, most selling occurred after the spot price exceeded the weighted average cost of ETF holdings. Therefore, WPIC believes that unless the platinum price remains consistently above $1,100 per ounce, there will not be significant ETF selling, and the market shortage can only be met through consuming above-ground stocks. The current downtrend in interest rates may further enhance the competitiveness of commodity ETFs and other non-yielding assets.

Interestingly, when observing gold ETFs, the spot price is almost always higher than the weighted cost of ETF holdings. However, when the gold price enters a downward trend, outflows from ETFs accelerate; conversely, inflows accelerate when the price rises. In the Veblen scenario, the price increase of platinum may actually prompt investors to increase holdings of platinum ETFs, potentially exacerbating the market supply gap predicted by WPIC to persist at least until 2028.

Predictions suggest the continuous shortage in the platinum market will deplete above-ground platinum stocks by 2028.

Platinum held in aboveground stock or exchange-traded fund (ETF) positions is not indifferent to prices and may only help fill the market supply gap once it reaches a certain price threshold.

As an investment asset, platinum's attractiveness comes from the following:

WPIC research indicates that the platinum market entered a period of continuous supply shortage starting in 2023.

Platinum supply still faces challenges, primarily from primary mining and secondary recovery.

Due to platinum replacing palladium in gasoline cars, the anticipated growth in platinum demand in the automotive sector is expected to continue until 2024.

Platinum is a key mineral in the global energy transition and plays an important role in the hydrogen economy.

Platinum prices remain at historically low levels and are far below gold prices.

铂金ETF于2007年推出,目前已累积约了320万盎司的实物持仓。这在一定程度上推动了铂金需求,但反过来讲,抛售将使ETF成为铂金供应的来源。然而,常被忽视的是,铂金ETF需求来自希望通过铂金价格上涨实现资本回报的投资者。因此,ETF抛售并非对价格无动于衷。通过计算ETF持有金属的加权平均成本,可以估算出投资者出售铂金ETF的价格门槛。ETF持仓的历史成本计算可以通过将每月的金属累积量按平均价格相加得出的。将此值除以总盎司数,可得到每盎司的加权平均成本,目前估算铂金ETF的加权平均成本为每盎司1100美元。

铂金ETF于2007年推出,目前已累积约了320万盎司的实物持仓。这在一定程度上推动了铂金需求,但反过来讲,抛售将使ETF成为铂金供应的来源。然而,常被忽视的是,铂金ETF需求来自希望通过铂金价格上涨实现资本回报的投资者。因此,ETF抛售并非对价格无动于衷。通过计算ETF持有金属的加权平均成本,可以估算出投资者出售铂金ETF的价格门槛。ETF持仓的历史成本计算可以通过将每月的金属累积量按平均价格相加得出的。将此值除以总盎司数,可得到每盎司的加权平均成本,目前估算铂金ETF的加权平均成本为每盎司1100美元。