Weaver Network Technology Co., Ltd. (SHSE:603039) shares have continued their recent momentum with a 33% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 13% in the last twelve months.

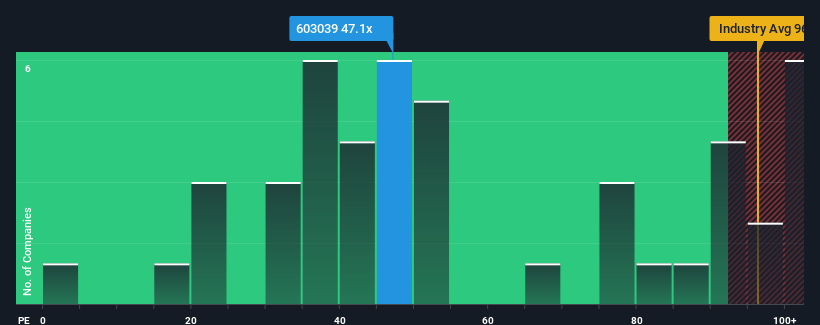

Following the firm bounce in price, Weaver Network Technology's price-to-earnings (or "P/E") ratio of 47.1x might make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 36x and even P/E's below 21x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Weaver Network Technology certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors' willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Weaver Network Technology's is when the company's growth is on track to outshine the market.

The only time you'd be truly comfortable seeing a P/E as high as Weaver Network Technology's is when the company's growth is on track to outshine the market.

If we review the last year of earnings growth, the company posted a terrific increase of 171%. However, this wasn't enough as the latest three year period has seen a very unpleasant 20% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 11% during the coming year according to the five analysts following the company. With the market predicted to deliver 41% growth , that's a disappointing outcome.

With this information, we find it concerning that Weaver Network Technology is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh heavily on the share price eventually.

The Key Takeaway

Weaver Network Technology's P/E is getting right up there since its shares have risen strongly. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Weaver Network Technology currently trades on a much higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Weaver Network Technology with six simple checks will allow you to discover any risks that could be an issue.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.