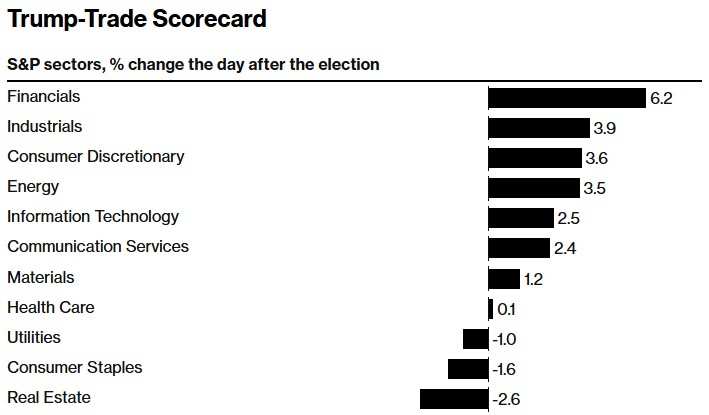

Trump's victory boosts the large cap US stocks, as investors search for sector winners.

For investors, following Trump's decisive victory, the initial rebound in risk appetite in the US stock market has now faced challenging times. The Republican President-elect made many promises during his campaign: to increase tariffs, reduce taxes, relax regulation for business-friendly policies, and stricter immigration laws, among others. For investors who entered the market last week speculating on Trump's policies lifting the economy, the challenge lies in determining which industries will receive sustained boosts.

For example, tariffs could trigger inflation, damaging large multinational companies, while potentially benefiting small cap stocks in the US. However, cracking down on immigration could raise labor costs, potentially squeezing small businesses. At the same time, a friendly stance towards increasing production of traditional energy may push down oil prices, while overturning Biden's efforts to help the clean energy and electric car industries through policy could face challenges in Congress.

Eric Clark, portfolio manager at Accuvest Global Advisors, said: 'I expect active investors to start carefully selecting industries to see which companies and sectors might benefit now. Over time, we will gain more insights into the actual implementation and effectiveness of policies.'

Eric Clark, portfolio manager at Accuvest Global Advisors, said: 'I expect active investors to start carefully selecting industries to see which companies and sectors might benefit now. Over time, we will gain more insights into the actual implementation and effectiveness of policies.'

Clark has seized some opportunities. As banks, industrials, energy, and large tech stocks boosted the market last Wednesday, he sold some technology and financial stocks. He also bought luxury goods retail and basic consumer stocks, which were in a loss position during the market surge.

More Obvious Winners

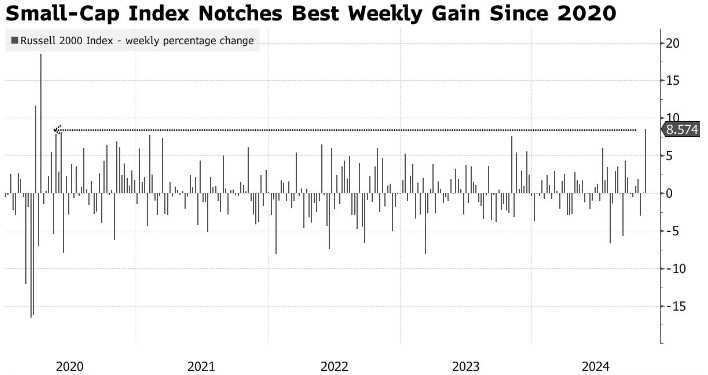

Small cap stocks rebounded last week, seemingly in a favorable position as traders assess the potential policy backdrop in the future. Most of these companies generate a majority of their revenue domestically in the US, positioning them to benefit from protectionist trends. Possible corporate tax cuts could also provide assistance.

Trump proposed comprehensive tariffs of 10% to 20% on imported goods, with tariffs of up to 60% on goods made in China. The prospect of at least partial tariffs being implemented has driven the small-cap benchmark Russell 2000 index up by 8.6% last week. The digital payment company Sezzle (SEZL.US) is one of the biggest gainers in this index, doubling its stock price during this period.

Financial stocks are also seen as being in a strong position, as Trump promises to reform regulatory agencies implementing stricter banking rules under Biden's leadership. As banking industry analyst Mike Mayo of Wells Fargo stated, a new era of deregulation could enhance the profitability of Wall Street banks. The stock prices of Citigroup (C.US), Goldman Sachs (GS.US), and JPMorgan (JPM.US) surged after Trump's victory.

Barclays US stock strategist Venu Krishna stated, "The market is eager to digest Trump's domestic growth policies through small-cap stocks, and is looking to relax regulations by betting on financial and large technology stocks."

Industrial and machinery companies like Caterpillar (CAT.US) are expected to benefit from domestic production of energy and mining commodities. Jefferies analyst Stephen Volkmann reiterated Caterpillar as his top pick in the industry, partly due to the company's limited exposure in China. He also mentioned that industrial distributors like Fastenal (FAST.US) and W.W. Grainger (GWW.US) have a good track record in passing on cost increases such as tariff hikes.

The prospect of cracking down on immigration is a potential downside that investors are closely watching. However, some companies may benefit from it, such as private prison operators like CXW Corp (CXW.US) and The GEO Group Inc (GEO.US).

More complex situation.

Meanwhile, some on Wall Street express doubts about certain market trends after the election. Given Trump's pro-oil stance, traditional energy stocks including oil & gas companies saw significant gains after Trump's election win. However, industry observers caution that efforts to relax regulations and allow more fossil fuel extraction on public lands could lead to oversupply and lower prices.

Considering that retailers have significant exposure to China through their supply chains, they suffered sharp declines last week. With tariff negotiations escalating, they are likely to be in investors' crosshairs. Barclays analyst Seth Sigman mentioned that discount chains and housewares companies could face the largest impact. He specifically named Five Below (FIVE.US), Dollar Tree (DLTR.US), and electronics retailer Best Buy (BBY.US) among others.

However, in Clark's view, some consumer companies appear attractive because any tariff hikes may not affect all companies equally. He said: "I'm not too worried about imposing high tariffs on European luxury brands such as LVMH (LVMHF.US), Hermes International, L'Oreal, Ferrari (RACE.US), etc."

For another industry that suffered heavy losses last week - clean energy and renewable energy - the situation is equally complicated. The iShares Global Clean Energy ETF had its worst week since March. However, the outlook may not be as terrible. Trump has indicated his intention to repeal the Clean Energy Incentive Act aimed at promoting clean energy use, including electric vehicles, but analysts believe the likelihood of a complete repeal is low. One key reason is that the act triggered a wave of investments in Republican districts.

Royal Bank of Canada capital markets analyst Christopher Dendrinos said that the specter of this shift poses a threat to the industry as investors await clarity. He said: "On the other hand, people expect policy changes to take a long time to pass, or even longer to implement, weakening the overall impact and potentially changing again after the next administration takes office."

Dendrinos pointed out that other factors in Trump's policies may even help some stocks. This analyst expects that, given the protectionist agenda and strong domestic demand, the performance of First Solar (FSLR.US) and Fluence Energy (FLNC.US) will outperform their peers.

Accuvest Global Advisors的投资组合经理Eric Clark表示:“我预计活跃的投资者将开始仔细在行业层面进行筛选,看看哪些公司和行业现在可能受益。随着时间的推移,我们将获得更多关于实际实施的内容以及如何发挥作用的数据点。”

Accuvest Global Advisors的投资组合经理Eric Clark表示:“我预计活跃的投资者将开始仔细在行业层面进行筛选,看看哪些公司和行业现在可能受益。随着时间的推移,我们将获得更多关于实际实施的内容以及如何发挥作用的数据点。”