① Solid-state batteries are heating up, how to benefit the lithium battery sector? ② Hong Kong lithium battery stocks have taken advantage of the momentum to rebound. Which individual stocks are receiving financial attention?

Finance Association, November 11 (Editor Feng Yi) Today, Hong Kong lithium battery stocks followed the trend, and A-share solid-state battery popularity rebounded against the market.

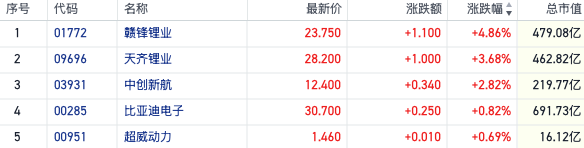

As of press release, Ganfeng Lithium (01772.HK) rose nearly 5%, Tianqi Lithium (09696.HK) rose more than 3%, China Airlines (03931.HK) rose more than 2%, and BYD Electronics (00285.HK) followed suit.

According to the news, CITIC Securities released a report saying that the global lithium oversupply is gradually narrowing, and short-term supply and demand have improved. The report points out that the drop in lithium prices has caused major lithium production regions around the world to fall into losses and reduce production, and the pace of commissioning of projects under construction has also slowed sharply.

CITIC Securities predicts that the lithium industry's oversupply will narrow from 0.094 million tons in 2024 to 0.025 million tons in 2026. Domestic lithium salt production and lithium concentrate imports both declined month-on-month in September. Demand for lithium salt increased for three consecutive months. In September, domestic lithium carbonate supply changed from excess to a shortage of 0.011 million tons. Domestic demand for lithium batteries and cathode materials is expected to increase sequentially in the fourth quarter, and the fundamentals of the lithium industry will continue to improve.

On the other hand, since November, the A-share solid-state battery concept has been gaining popularity, which has also led the market to continue to pay attention to the lithium battery sector.

On the afternoon of November 7, Changan Automobile and Tailan New Energy officially released non-diaphragm-free solid-state lithium battery technology, achieving many key technological breakthroughs for all-solid-state lithium batteries.

According to earlier reports, the Ningde Era increased its R&D investment in all-solid-state batteries this year, and has expanded the all-solid-state battery R&D team to over 1,000 people.

In addition, industry leaders such as Changan Automobile, Guangzhou Automobile Group, and Chery all have a trend of continuing to enhance solid-state battery technology, which has also boosted the enthusiasm for short-term capital hype.

The power equipment team of Zhongtai Securities said in a November 10 report that Huawei has also deployed solid-state battery technology, which can enable lithium batteries to have a long service life.

Zhongtai Securities also said that the performance of some companies in the lithium battery industry chain improved month-on-month in the third quarter, and it is expected that there will be an inflection point between supply and demand in '25. The industry has entered a 2-3 year upward cycle. Looking ahead to the next two years, there is a possibility that performance and valuation will improve significantly, and it is a sector with a good midline layout.

However, CITIC Securities also emphasized in the report that large-scale reduction in production at the Australian mine was one of the important reasons why lithium prices stopped in the previous round. The rapid decline in lithium prices in this round led to the active reduction of production in high-cost lithium mines in Australia, China, Africa and Canada. If lithium prices continue to fall, it will begin to affect the main mines in Australia with lower costs, which in turn will have a great impact on the global supply of lithium resources.

Taken together, the short-term rebound in lithium battery stocks was mainly driven by events, but the sustainability of the market still depends on the global lithium supply's follow-up attitude to production cuts.

消息面上,中信证券发布报告称,全球锂供应过剩量逐步收窄,短期供需已经改善。报告指出,锂价下跌导致全球主要锂产区陷入亏损并减停产,在建项目的投产节奏也大幅放缓。

消息面上,中信证券发布报告称,全球锂供应过剩量逐步收窄,短期供需已经改善。报告指出,锂价下跌导致全球主要锂产区陷入亏损并减停产,在建项目的投产节奏也大幅放缓。