Since the beginning of this year, under the background of strict supervision, the number of companies that have terminated their IPO is increasing.

Glory Harvest learned that recently, the GEM IPO of Ririshun Supply Chain Technology Co., Ltd. (referred to as "Ririshun") was terminated due to voluntary withdrawal.

As a logistics unicorn under the Haier Group, Ririshun has already achieved an annual revenue of over 10 billion, and has also made the Hurun Global Unicorn List in 2023, ranking 374th with a valuation as high as 18.5 billion yuan.

Ririshun submitted its prospectus in May 2021, went through inquiries, and passed the meeting in May 2023, but still returned empty-handed in the end.

Ririshun submitted its prospectus in May 2021, went through inquiries, and passed the meeting in May 2023, but still returned empty-handed in the end.

Ririshun originally planned to raise 2.771 billion yuan for projects including the Smart Logistics Center Project, Intelligentization of Warehousing Equipment Project, Digitization and Intelligentization of Logistics Information System Project, Last Mile Network Contact Point Construction Project, and Self-operated Capacity Enhancement Project. Now, everything comes to a sudden stop.

It is worth noting that on the same day Ririshun withdrew the IPO, Haier Group's listed company Haier Smarthome issued an announcement stating that it planned to control Ririshun through entrusted voting rights and include Ririshun in the Haier Smarthome consolidated financial statements.

Founded in 1984, Haier Group has diversified into smart home, health, and industrial internet sectors. Its founder, Zhang Ruimin, is a legendary figure who has led Haier from a collective small factory on the verge of bankruptcy to a world-renowned household appliance brand over more than 30 years of entrepreneurship.

In addition to Haier Smarthome, Haier Group also owns multiple listed companies such as Haier Electric Appliances, Qingdao Haier Biomedical, and Zhongmiao Holdings. Among them, when Zhongmiao Holdings went public in August this year, Zhang Ge also wrote about it, see details in "Making Over a Billion in Insurance Agency Business, Another Listed Company Added to Haier Group" (click on the article title to view details), today let's introduce Rishun.

01

Logistics unicorn under Haier Group cancels IPO and "returns" to Haier Smarthome.

The development history of Rishun can be traced back to 2000, when Haier Group and Haier International Trade jointly invested in setting up the predecessor of Rishun, Qingdao Haier Logistics Storage and Transportation.

As of the end of 2022, Rishun Shanghai holds 56.4009% of Rishun's shares, making it the controlling shareholder; Haier Group indirectly controls Rishun Shanghai, being the actual controller of Rishun. At the same time, Partner Century (Chengda Holdings Limited) and Taobao Holdings respectively hold 16.68% and 12.37% of Rishun's shares.

According to the announcement made by Haier Smarthome on October 29, 2024, a wholly-owned subsidiary of Haier Smarthome, Guanmei (Shanghai) Enterprise Management Co., Ltd., signed a "Voting Rights Entrustment Agreement" with affiliated company Bingji (Shanghai) Enterprise Management Co., Ltd., entrusting Bingji to irrevocably exercise the voting rights corresponding to the 55% equity of Youjin (Shanghai) Enterprise Management Co., Ltd. held by Bingji. After the completion of the matter, Guanmei will control 100% of Youjin's voting rights, and Youjin and its controlled entities Rishun Shanghai, Rishun, and its subsidiary will be included in the consolidated financial statements of Haier Smarthome.

Established in 1984, Haier Smarthome is headquartered in Qingdao, Shandong. Its main products include refrigerators, washing machines, air conditioners, and kitchen appliances. Haier Smarthome was listed on the Shanghai main board in 1993 and later landed on the Hong Kong Stock Exchange in 2020.

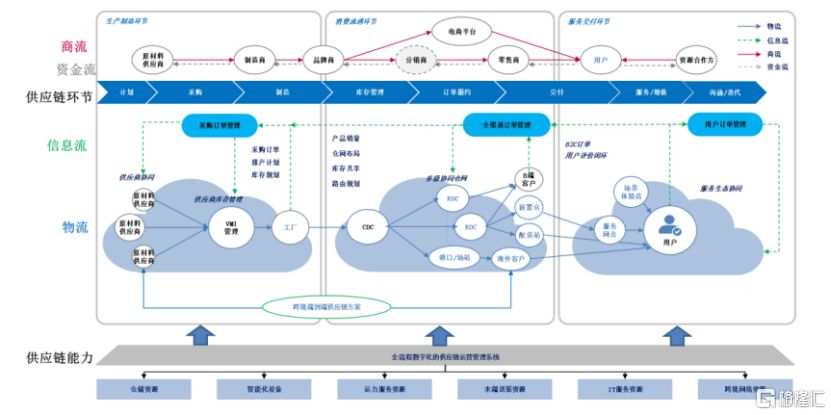

Rishun is a provider of supply chain management solutions and scenario logistics services for various industries, offering customized supply chain solutions to clients to achieve efficient collaboration between various processes in the supply chain and precise delivery of products and services. This enhances overall inventory and capital turnover efficiency, meeting clients' planning and optimization goals for logistics, information flow, business flow, and fund flow.

According to the report by Roland Berger, as of 2020 revenue, RRD ranks as the third largest end-to-end supply chain management service provider in China.

The company's main business, image source: RRD prospectus

RRD has built and managed a nationwide, synchronized delivery and installation, last-mile logistics service network through digital operational capabilities, providing supply chain management services including consumer supply chain services and manufacturing supply chain services around customers' needs in procurement, production, consumption, and distribution.

Based on this, RRD has also developed logistics service capabilities including air transportation, marine transportation, railroads, and multimodal transport to address customers' demands for cross-border supply chain management and transportation services during their global business expansion.

From 2020 to 2022, supply chain management services accounted for over 70% of RRD's revenue, with consumer supply chain services contributing over 60%, serving as a significant income source.

Composition of the company's revenue, image source: prospectus

In terms of performance, in 2020, 2021, and 2022 (referred to as the "reporting period"), Ririshun's revenue was approximately 14.036 billion yuan, 1.7163 million yuan, and 16.847 billion yuan respectively, with corresponding net profits of approximately 0.431 billion yuan, 0.579 billion yuan, and 0.575 billion yuan, showing some fluctuations.

During the reporting period, Ririshun's overall gross margin was 8.38%, 7.78%, and 7.85%, which was lower than the average gross margin of comparable companies. However, the gross margins from Haier and Alibaba customer business were significantly higher than the company's overall gross margin.

Changes in gross margins of Haier and Alibaba customers, as well as comparisons with industry gross margins, image source: prospectus

During the review meeting in 2023, Ririshun's related party transaction issues were questioned.

In fact, Ririshun's high proportion of related party transactions and high customer concentration have long been criticized.

The prospectus shows that from 2020 to 2022, Ririshun's revenue from the top five customers accounted for over 50% of the company's annual revenue, with revenue from related party Haier customers accounting for over 30%, which is quite significant.

Furthermore, due to Ririshun's mainly adopting a light-asset operational model, its capacity and service resources are mainly obtained through third-party procurement. However, under the third-party procurement model, there might be instances where delays, damages, or losses in services provided by third-party suppliers result in customer claims, affecting the company's reputation.

In the first three quarters of 2024, Haier SmartHome achieved revenue of 202.971 billion yuan, a year-on-year increase of 2.17%; the net profit attributable to the shareholders of the listed company was approximately 15.154 billion yuan, an increase of 15.27% year-on-year. After the consolidated statement, the performance of Haier SmartHome is worth looking forward to.

02

This year, more than 400 A-share companies have terminated their IPOs.

As a unicorn company that has been filing for more than three years and has been approved, the termination of Dailywin's IPO is regrettable. However, under the current strict regulatory environment, many companies have terminated their IPOs.

The number of A-share companies terminating their IPOs this year has exceeded 400, far surpassing the total of 286 for the whole year of 2023.

According to the Shanghai Stock Exchange's listing service, as of November 10, 2024, a total of 414 companies have publicly announced the termination of their reviews (including withdrawal of materials, veto, termination of registration). Among them, there are 78 on the main board of Shanghai, 71 on the STAR Market, 53 on the main board of Shenzhen, 140 on the gem board, and 72 on the Beijing Stock Exchange.

While a large number of companies have terminated their IPOs, the number of newly declared A-share companies this year is very small, with only 37 as of November 10 (including 34 aiming for the Beijing Stock Exchange), far less than the lively scene in 2023 (with 313 new A-share IPO application companies).

Against this background, the number of companies queuing for IPOs in the A-share market this year has rapidly declined.

As of November 10, the number of companies under review in various sectors of the A-share market has decreased to 261. Among them, there are 50 companies in the Shanghai main board, 24 in the Science and Technology Innovation Board, 35 in the Shenzhen main board, 67 in the GEM, and 85 in the Beijing Stock Exchange.

In the current environment of slowing down the IPO pace and tightening regulations, the difficulty for companies to go public on the A-share market has significantly increased.

The opinions released on April 12 regarding strengthening supervision, preventing risks, and promoting the high-quality development of the capital markets pointed out the need to raise the listing standards for the main board and the GEM, improve the evaluation criteria for the innovative attributes of the Science and Technology Innovation Board, enhance the quality and effectiveness of listing counseling, expand on-site inspections of companies under review and related intermediary institutions. It also requires disclosure of dividend policies at the time of listing, and inclusion of instances such as rush dividend distributions before listing in the negative list for IPOs. Strict supervision of spin-off listings and rigorous scrutiny on refinancing.

In this context, many companies, due to declining performance not meeting the listing requirements under the registration-based system, or facing increased thresholds for sector listing applications, rush dividend distributions before listing, penalties on intermediary institutions, etc., have withdrawn their A-share IPO applications.

For companies, after strict scrutiny for listing admission, the difficulty of A-share market financing has increased. However, this also helps to improve the quality of listed companies by selecting those with true development potential and innovative capabilities through rigorous review and supervision. This provides investors with higher-quality investment choices, reduces overall market risks.

日日顺在2021年5月递交招股书,经历过问询,并在2023年5月过会了,但最终依然铩羽而归。

日日顺在2021年5月递交招股书,经历过问询,并在2023年5月过会了,但最终依然铩羽而归。